Technology powered by human expertise.

-

Automated investing

We manage all the trading, rebalancing, reinvesting, and tax management for you, moves that make a big difference over decades.

-

Personalized platform

We build an investing portfolio around what you want to accomplish, whether that’s retirement or simply building wealth.

-

Diversified portfolios

Your money is invested across global markets and asset classes, a better way to build wealth through market cycles.

-

Expert-managed

Our in-house Investing Team regularly monitors, analyzes, and updates portfolios to help strengthen your investments.

Since launch, our Core portfolio’s average annual return has been ~10% after fees.

Investing that fits your needs.

Accounts built for retirement and more.

Traditional IRA, Roth IRA, SEP IRA, 401(k) rollover, and Solo 401(k).

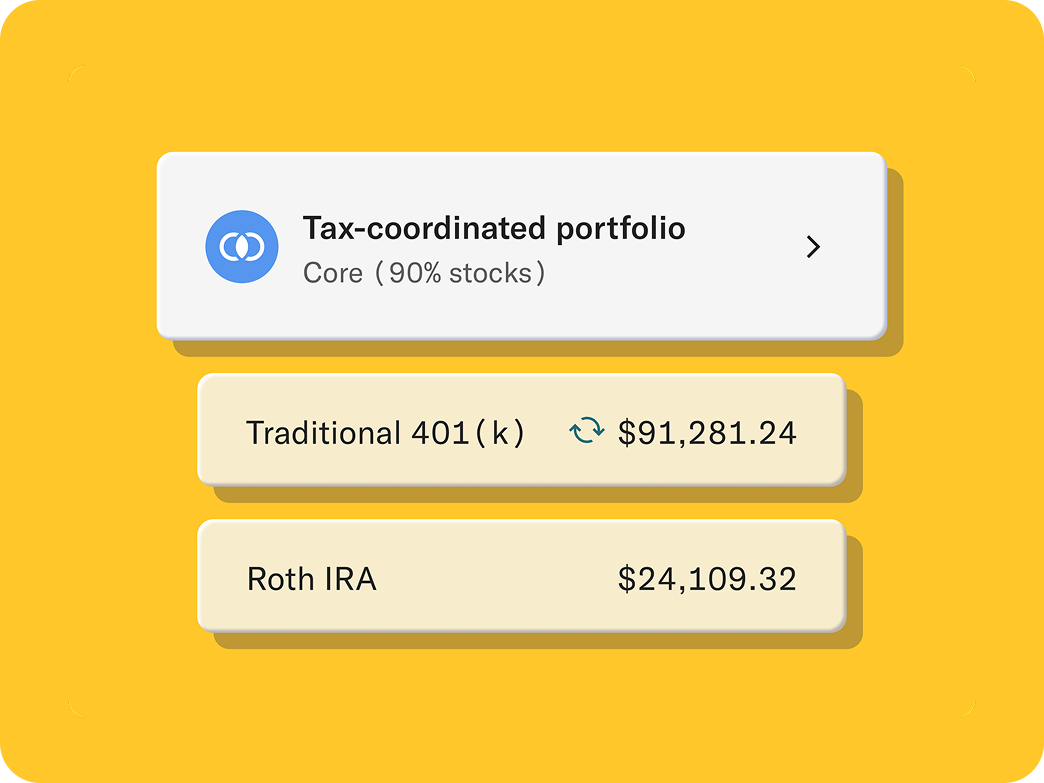

Make your retirement more tax-efficient.

Open both an IRA and a taxable investing account, and we’ll coordinate them to help minimize tax liabilities and better grow your retirement savings.

Enroll and earn

up to $1,500

Open any individual investing account

(including an IRA) and make a deposit to

earn up to $1,500 on us. The more you invest,

the more you can earn.

Claim offer

Investing that can help lower your taxes.

Nearly 70% of customers using tax-loss harvesting covered their taxable advisory fees through estimated tax savings.

-

Pay for a wedding

-

Save for education

-

Buy a home

-

Build wealth

Trusted to do what's right for your money.

As a fiduciary, we're legally bound to put your interests first when you invest.

-

1 Million+

Customers

-

$65 Billion+

Assets under management

-

4.8 rating

78.1K reviews on App Store and Google Play

-

$65 Billion+ in assets

-

1 Million+ customers

-

Member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at www.sipc.org.

Member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at www.sipc.org. -

4.8 rating

78.1K reviews