-

Best Overall

Best Overall

Robo Advisor 2024 -

★★★★★

★★★★★ -

4.7 rating

4.7 rating

65,900 reviews§

The following entities provided the above to Betterment LLC: (1) Buy Side - on 1.12.2024 for 2024; (2) Nerdwallet - on 1.02.2024 for Aug - Oct 2023. The Betterment App store rating is as of 9.12.24 (based on reviews since 9.10.2010). No compensation was provided for this recognition. See full disclosures for award details.

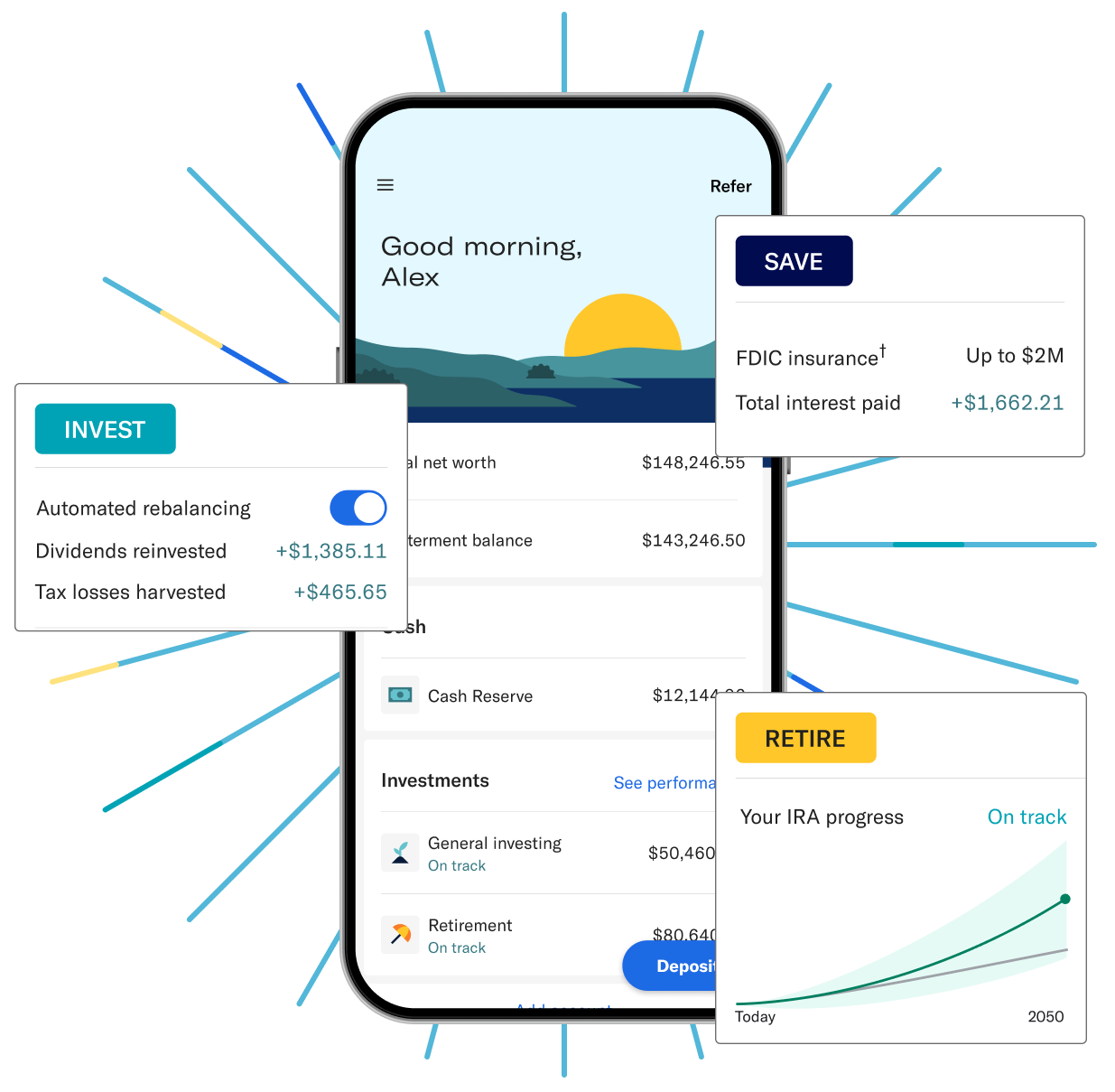

Take the stress out of investing with automation.

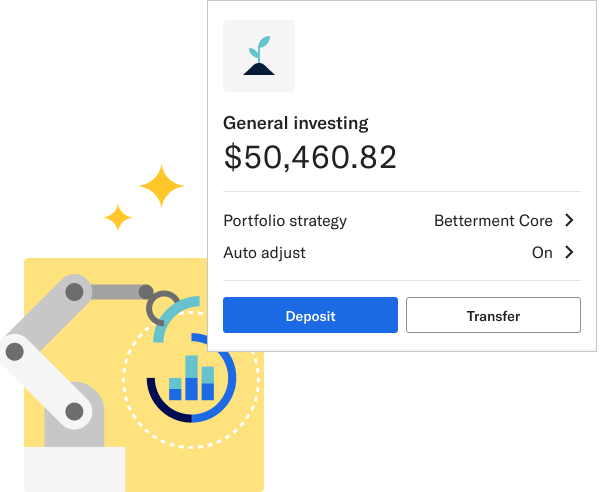

Get a diversified, expert-built portfolio to help you invest like a pro. We manage your money for you—helping minimize taxes and maximize returns—while you focus on living your life.

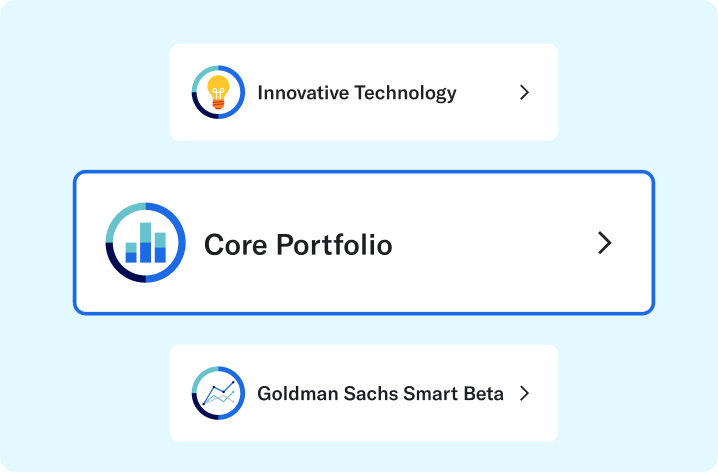

- Curated portfolios, including sustainability, tech, and crypto

- Automated rebalancing and dividend reinvestment

- Tax-efficient tools to help boost your after-tax returns

- Recurring deposits can help keep your money on track

How we help you get more from your money.

-

Tax savings can pay your fee.

69% of customers using our tax-loss harvesting features have their taxable advisory fee covered by likely tax savings.Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Fee coverage and estimated tax savings based on Betterment internal calculations. See more in disclosures. -

Recurring deposits can help you earn even more.

Customers with automated deposits earned 6% higher annual returns than those that did not.Based on Betterment's internal calculations for the Core portfolio. Users in the "auto-deposit on" groups earned an additional 1% annualized over 5 years and 6% over the last year. See more in disclosures.

Put more power behind your savings with 4.25% variable APY.*

Don’t let traditional savings accounts keep your money from growing. Our high-yield cash account earns interest at 9x the national average.**

- No fees or minimum balance, just $10 to get started

- Up to $2M FDIC insurance with our program banks †

- Unlimited withdrawals

- Transfer cash to investing accounts seamlessly

For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance.

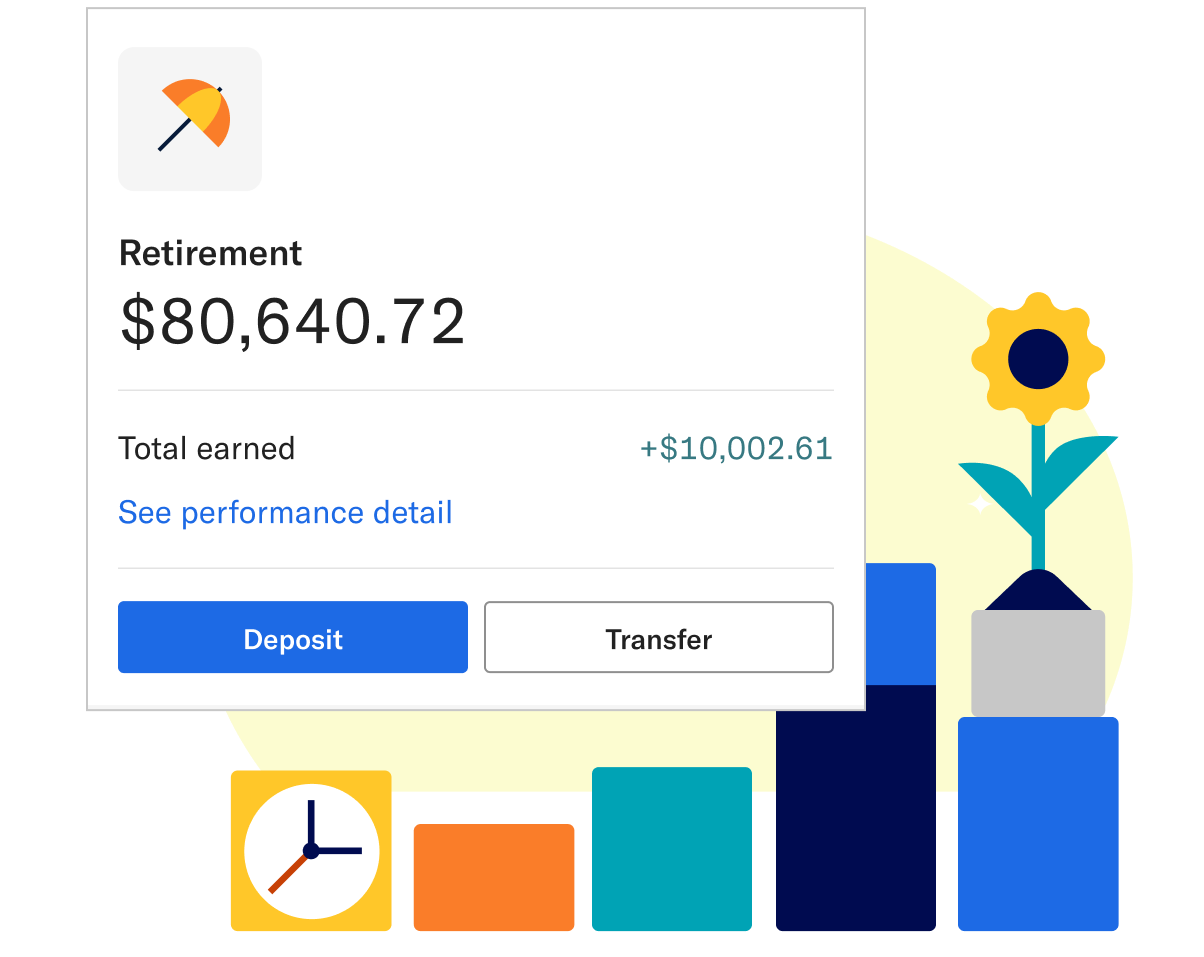

Make saving for retirement easy with an IRA.

Feel confident saving for retirement with one of our IRAs. Get tax benefits along with our automated technology and full suite of planning tools.

- Traditional, Roth, and SEP IRAs

- Rollovers could save you on high fees and hassle

- Planning tools to help you save for retirement

Give your retirement a boost

-

900,000+

Customers

-

$50+ Billion

Assets under management

-

14+ years

In business

Here's what our customers have to say about us

-

"It's a good "set-it-and-forget-it" investing tool for my family."

Casey M.

-

"Saves the stress and hassle of handling retirement savings myself."

David S.

-

"I like the different types of accounts offered, the high APY, and how easy it is to check my accounts on mobile."

Karen G.

-

"Set-it-and-forget-it investing. Low fees. Easy to see my financial status at a glance."

Andrew C.

-

"The climate change portfolio is great. I like being able to plan for retirement while knowing my savings are not supporting Big Oil!"

Julie O.

-

"It's easy to select stock and bond allocation for your risk type."

Michael M.

Ready to get started? Check out our most popular accounts.

For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance.

Want to know how you can make the most of your money? Take our quiz.

Still have questions?

-

Betterment helps you manage your money through cash management, guided investing, and retirement planning. We are a fiduciary, which means we act in your best interest.

We'll ask a bit about you when you sign up. We'll also gather information when you connect your outside accounts. Then, we'll help you set financial goals and set you up with investment portfolios for each goal.

For your long-term financial needs (like retirement, next year's vacation, or a down payment), our investment strategy utilizes low-cost ETFs (exchange-traded funds) and an adjustable risk profile based on your goal type and how long you plan to invest.

For your daily saving and spending, you can use our cash management products that include Checking (which is offered by nbkc bank, Member FDIC) and Cash Reserve, a high-yield cash account.

-

Customer support team members are available five days per week to answer questions about your account.

If you want in-depth financial advice, you can talk to a licensed advisor by phone for an additional cost. Our Premium plan provides you with unlimited access and costs an additional 0.40% on your invested balances (with a minimum account balance requirement of $100,000).

-

Betterment Securities is a Member of SIPC, which protects securities of its members up to $500K (including $250K for claims for cash). Explanatory brochure available upon request or at www.sipc.org. What you should remember is that the SIPC does not protect against market changes in your investing account.

Individual Cash Reserve accounts have FDIC insurance up to $2 million and joint Cash Reserve accounts offer up to $4 million in FDIC insurance once funds are deposited into our program banks†.

Funds deposited into Checking are FDIC-insured up to $250,000 for individual accounts and up to $250,000 per depositor for joint accounts, provided by nbkc bank, Member FDIC. Explore further details about FDIC insurance.

-

Our team of investing experts make decisions about our portfolio strategies and fund selection with the help of an external committee of economists, PhDs, and industry experts.

More than just a portfolio management team, our experts work to develop improvements to our Tax Smart technology, our cash analysis tools, and other advanced strategies.