Flexible investment options that grow with your firm.

-

Build your own portfolios.

Create personalized portfolios with any combination of 9,000+ mutual funds and ETFs from top global institutions. Complement your advice with tailored allocations to deliver better long-term growth. -

Leverage our model marketplace.

Utilize a marketplace of expert-built portfolios from our in-house team and third-party portfolios from leading asset managers. Access research, compare, and personalize models to streamline your process without compromising performance.

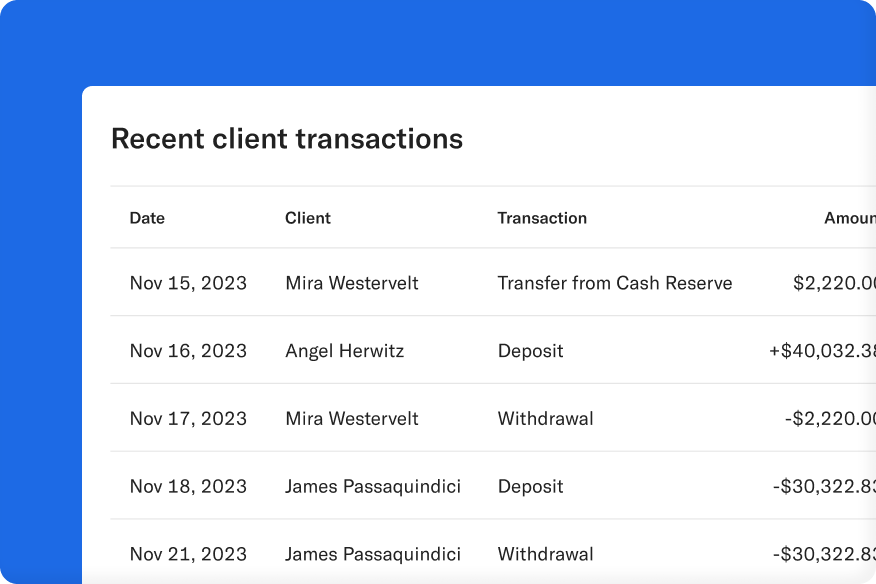

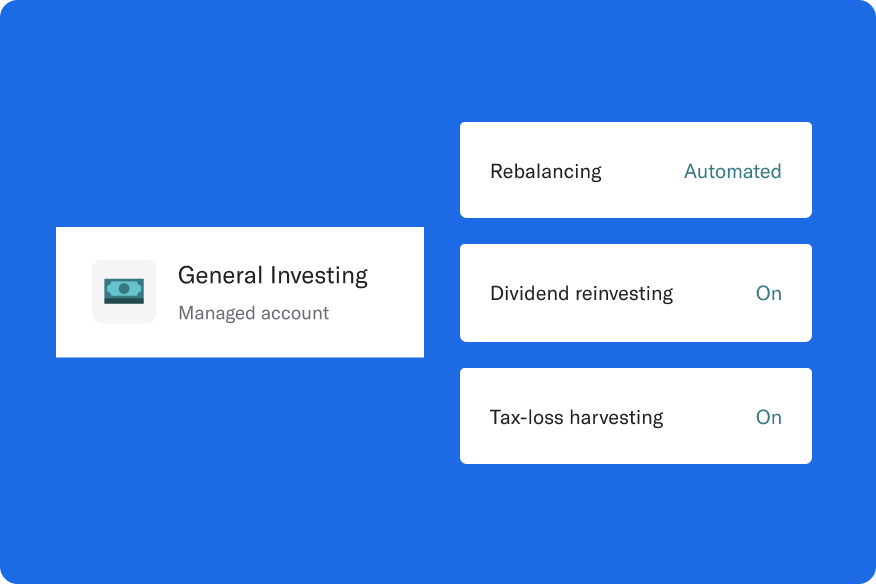

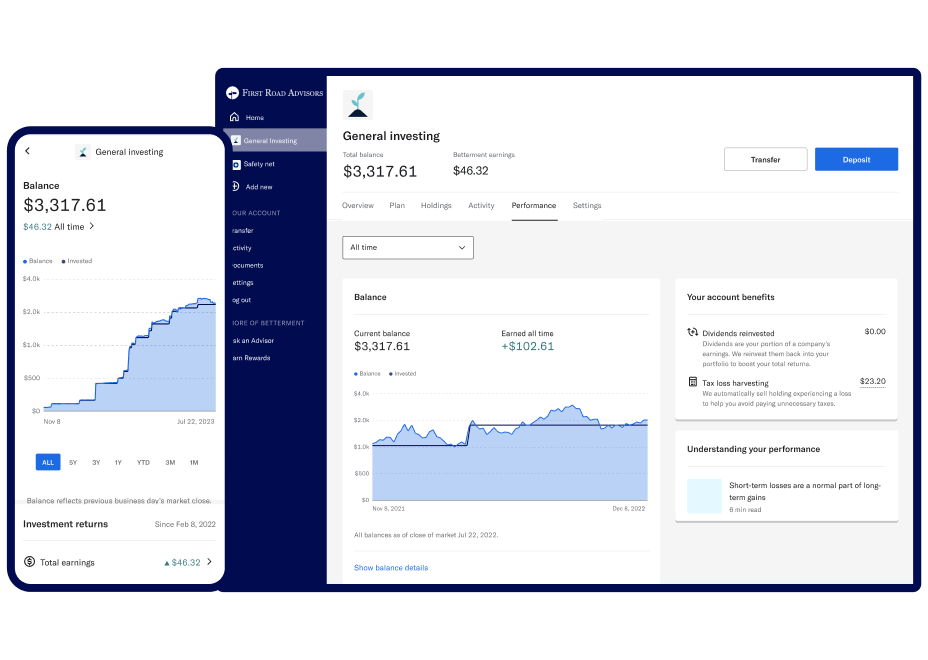

Get ahead of the curve with technology that automates portfolio management and boosts efficiency in your practice.

Image is hypothetical.

Image is hypothetical.

"The efficiency I get is second to none. I have been able to scale much faster and serve a more financially diverse client base than I could with a traditional custodian."

Keep It Simple Financial Planning

Explore our scalable, turnkey models.

Filter by:

Core

Well-diversified, low-cost, and built for long-term investing. Features a broad collection of exchange-traded funds (ETFs) made of thousands of stocks and bonds from around the world.

- Broad exposure to U.S. companies

Innovative Technology

A well-diversified portfolio focused on high-growth potential companies such as clean energy, semiconductors, robots, virtual reality, blockchain, and nanotechnology along with increased exposure to risk.

- Broad exposure to future-focused economies in one portfolio

Broad Impact

Invests in companies that rank highly on environmental, social, and corporate governance (ESG) criteria without compromising potential long-term performance.

- Diversified, relatively low-cost portfolio built for long-term investing

Climate Impact

Invests in companies with lower carbon emissions and the funding of green projects while still helping you achieve potential long-term growth.

- Diversified, relatively low-cost portfolio built for long-term investing

Social Impact

Provides broad diversified exposure with a greater focus on companies actively working toward minority empowerment and gender diversity as part of your long-term strategy.

- Diversified, relatively low-cost portfolio built for long-term investing

Goldman Sachs Smart Beta

Targets companies that have potential to outperform the broader market over the long term. Diverse and relatively low-cost, but with higher exposure to risk.

- Offers higher potential returns along with increased risk

BlackRock Target Income

A 100% bond portfolio with different income yields to help protect you against stock market volatility.

- Built to generate a stream of income while mitigating volatility

Vanguard portfolio (CRSP Series)

Total return model portfolios seeking to provide broad exposure to U.S. and international equities and U.S. and international investment-grade taxable bonds in an asset allocation framework.

- Broad global diversification with over 19,000 securities available

Value Tilt

Invest in a globally diverse portfolio that tilts toward undervalued U.S. companies, for investors who understand the potential benefits and risks of investing more heavily in value stocks.

- Stronger focus on potentially undervalued U.S. companies

Goldman Sachs Tax-Smart Bonds

Gives higher-income individuals a personalized bond portfolio to generate additional after-tax yield.

Crypto ETF

Tap the market moves of the two largest and widely traded cryptocurrencies, Bitcoin and Ethereum, with this fully automated ETF portfolio.

Dimensional Core Plus Wealth Models

Built with Dimensional ETFs, combining equity and fixed-income allocations designed to go beyond indexing by pursuing higher expected returns in a diversified, cost-effective manner using a research-driven, systematic, and transparent approach.