2025 stock market outlook: 3 insights from a financial expert

Our financial expert weighs in on investing amid market highs, AI optimism, and political uncertainty—and why diversification is key.

Investors are starting to feel a healthy dose of cognitive dissonance, otherwise known as that grating feeling when two beliefs you hold don't quite line up.

On one hand, the U.S. market is soaring on the back of AI optimism and potential tax cuts.

And on the other, companies’ stock prices, relative to their actual earnings, are starting to loosely resemble the run-up to the Dotcom bubble of the late 90s.

So which belief will win out in 2025: boom or bust? Let's parse this conflicted outlook by examining three questions in particular:

Are U.S. stocks overvalued?

Around this time last year, we said the booming market at the time might keep going if the Fed lowered interest rates in response to cooling inflation.

Interest rates did tick down, and boy, did markets take notice. Through the end of November 2024, stocks in our Betterment Core portfolio returned roughly 17.6% year-to-date.

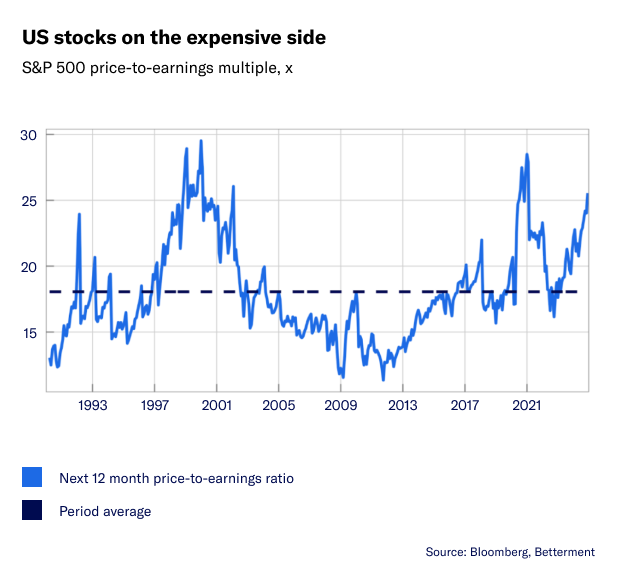

Such a run, however, begs speculation of yet another reversal, a swing of the pendulum toward less frothy valuations and a drawback in portfolio returns. The S&P 500 currently costs about 25 times more than what those companies are expected to bring in over the next 12 months. For comparison, this average “price-to-earnings” ratio over the last 35 years has been 18x.

While stocks in the US certainly appear flush in terms of the value assigned to them, perspective matters for the long-term investor. When companies go for more than their “intrinsic” worth, there’s more potential downside than when they don’t. So long as one invests for more than a few years, chances are the market as a whole may “grow” into its valuation.

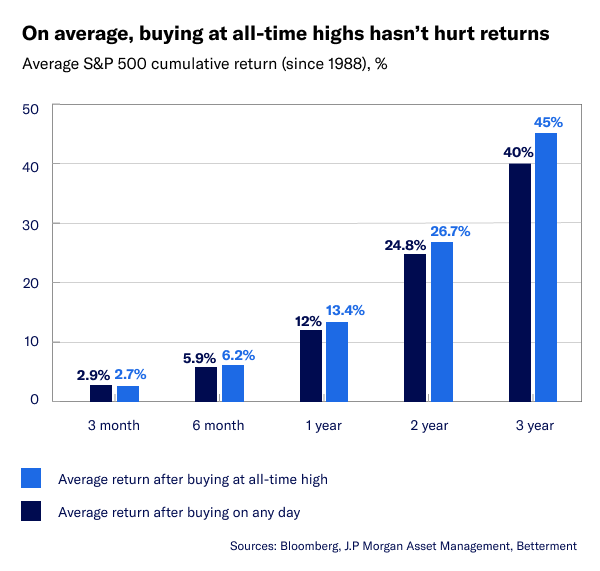

Remember in 2021, when a cohort of stocks were darlings of the pandemic period and shot to the moon? Analysts rightly called foul—those kinds of valuations shouldn’t be sustainable. But within a few years the market was setting fresh all-time highs. An investor who had sold or stayed on the sidelines would've missed out on all that growth.

If there’s a lesson to learn here, let it be this: Historically, Investing at all-time highs hasn’t resulted in lower future returns compared to investing on any given trading day. On the contrary, buying when the market has never been higher leads to slightly higher average returns in the long run. You can never be sure exactly when a growth cycle will end.

Will AI pan out?

Speaking of the stock market reaching previously uncharted heights, another reason for this bullish spell has been optimism surrounding the potential value of artificial intelligence, and the infrastructure that powers these underlying models. Large tech companies that provide cloud services—like Nvidia, which furnishes hardware that powers AI—have rallied strongly over the last 12 months. This clique of stocks, which overlaps with a group of mega-sized firms known as the Magnificent Seven (Google, Amazon, Microsoft, Meta, Apple, Tesla, and Nvidia), makes up an increasingly large share of the US and global stock market.

So, what does the Mag7’s outperformance, and the hoopla around AI mean for the future? Some say a bubble, some say the early innings of a fully-automated techno-utopic future. Analysts have argued that a good amount of corporate America’s investment in AI capabilities will not ultimately prove fruitful. Yet it remains difficult to use the technology, and to witness the pace with which it has evolved, and not foresee eventual significant boosts to the economy’s productivity and companies’ profitability.

There’s that grating feeling again—the potential of revolutionary upside sitting right next to worries that it’s mostly hype. In the face of uncertainty, all one can do to lower their risk is hedge their bets and diversify. Betterment’s Core portfolio, as well as our other portfolio options, invest globally, which means that while they maintain significant exposure to large US stocks including the Mag7, they also hold European, Japanese, and emerging market stocks that trade at less elevated valuations, providing a buffer in the event of a U-turn in the AI juggernaut.

There’s that grating feeling again—the potential of revolutionary upside sitting right next to worries that it’s mostly hype. In the face of uncertainty, all one can do to lower their risk is hedge their bets and diversify. Betterment’s Core portfolio, as well as our other portfolio options, invest globally, which means that while they maintain significant exposure to large US stocks including the Mag7, they also hold European, Japanese, and emerging market stocks that trade at less elevated valuations, providing a buffer in the event of a U-turn in the AI juggernaut.

Do markets care who’s in the White House?

Right now, markets aren’t sure exactly what to make of President-elect Trump’s proposed economic agenda. Promises of corporate tax cuts, while fueling the recent surge in stocks, could in practice increase inflation. Same goes for tariffs and mass deportation. Stricter immigration policies could simultaneously worsen labor shortages in certain industries, constraining economic growth and keeping inflationary pressures elevated. And, rising inflation could in turn pause or reverse the recent trend in interest rate cuts. But until more details emerge, or the policies themselves are actually put into practice, we won’t know their full effect.

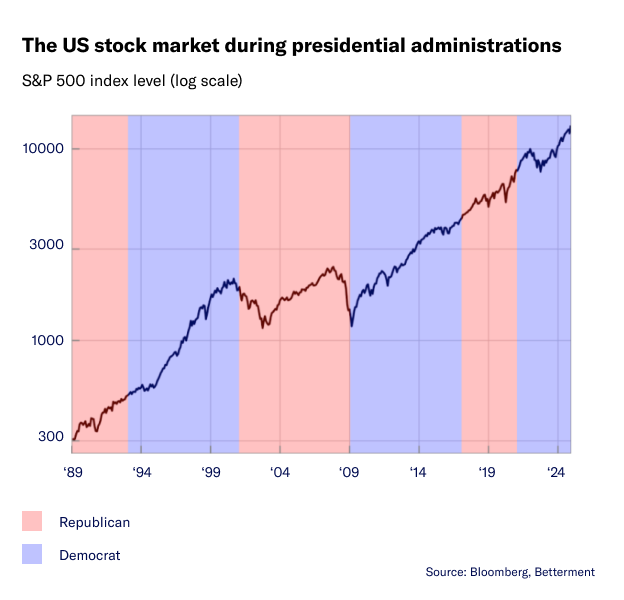

Despite the policy uncertainty and cognitive dissonance, keep in mind that markets tend to rise over time, regardless of which party holds the presidency. Maintaining a consistent, diversified investment approach is the best way to navigate political and economic cycles.

So what now?

As always, the risks associated with a down cycle exist alongside the opportunity of a growth cycle, so err on the side of staying invested. And, if you find your clients are sitting on too much cash, now might be the time to act and put it to work in the market. You can also recommend they invest it as a lump sum, which research shows may offer higher potential returns over time. Or, sprinkle it into a portfolio over time. (We make it easy to invest funds from Cash Reserve account, either way.) And however the market performs in 2025, you should remain confident that investing can help your clients reach their financial goals in the long-term.