What's new from Betterment for Advisors

At Betterment for Advisors, our customers are our first priority. We’re constantly working to elevate the advisor-client experience, and building scalable technology with your goals in mind.

At Betterment for Advisors, our customers are our first priority. We’re constantly working to elevate the advisor-client experience, and building scalable technology with your goals in mind.

2024 is off to a great start: Read on to get a sense of what’s new.

Table of Contents

Portfolio and cash management

- Mutual funds and more added to custom model menu

- Simple account migration

- Bring cash into focus with 5.00%* APY (variable) and recurring transfers

Advisor dashboard

Advisor service

Additional improvements

- 401(k) matching on student loan payments

- Editable custom model portfolios

- Automated 401(k) force-outs

Mutual funds, Bitcoin ETFs, and more added to custom portfolio menu

This year, we’re increasing our investment choice to give advisors more control in meeting growing client demand for personalization. Take a look at the most recent updates to the custom portfolio menu:

Mutual funds: We added over 2,000 mutual funds to the custom portfolio menu, including Vanguard, PIMCO, T. Rowe Price, and Fidelity, in addition to the 1350+ existing ETFs. Stay tuned as we roll out thousands of additional funds in the coming months.

Bitcoin spot ETFs: Advisors who want to increase investor exposure to Crypto can now access 11 Bitcoin ETF tickers in custom model construction: GBTC, BITB, HODL, ARKB, EZBC, BTCW, BTCO, FBTC, DEFI, BRRR, and IBIT.

Dimensional funds: We offer access to Dimensional funds at a low cost. Now, you can create custom models combining Dimensional funds and other mutual fund families with ETFs, and set custom drift thresholds and capital market assumptions for Dimensional models.

Simplify firm-wide portfolio updates with bulk actions

Betterment for Advisors’ custom model portfolio builder helps RIAs construct personalized investing strategies at scale. Now, you can move all accounts from one portfolio strategy to another in a single, bulk action.

Betterment for Advisors’ custom model portfolio builder helps RIAs construct personalized investing strategies at scale. Now, you can move all accounts from one portfolio strategy to another in a single, bulk action.

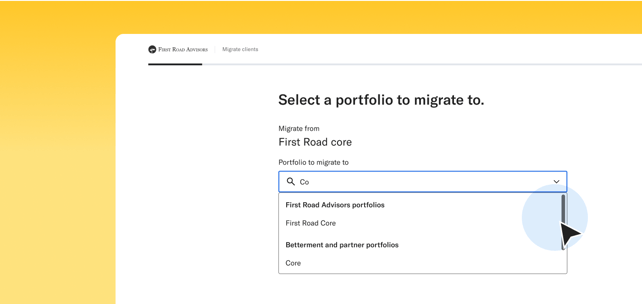

To move accounts, simply:

- Navigate to the current portfolio assigned to relevant client accounts

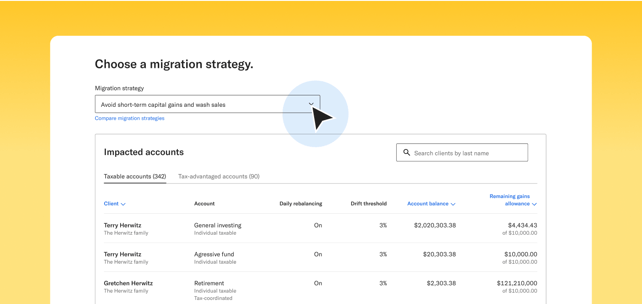

- Select your desired destination portfolio and configure your desired allocation using risk level mapping

- Choose a tax-aware migration strategy to transition accounts with greater precision and tax-efficiency. You’ll be able to review impacted accounts before submitting the bulk portfolio change request.

Bulk portfolio actions power you to make strategic decisions for your clients even faster.

Bulk portfolio actions power you to make strategic decisions for your clients even faster.

Bring cash into focus

Managed cash accounts bring more of your clients' assets into your overall orbit, helping you better advise on short and long-term goals, gauge the right amount of risk to take in your clients’ investing portfolios, and open up conversations on investing excess cash.

Managed cash accounts bring more of your clients' assets into your overall orbit, helping you better advise on short and long-term goals, gauge the right amount of risk to take in your clients’ investing portfolios, and open up conversations on investing excess cash.

Your clients can now set their own schedule for recurring transfers from Cash Reserve† to IRAs and investing goals—and rest easy knowing there are no overdraft fees. They’ll earn a high yield on cash up until the day it’s transferred (now at 5.00% APY* variable), and you can get the visibility you need to offer more holistic advice. Learn more about Cash Reserve.

Streamline client onboarding and the KYC process with Co-pilot

Streamline client onboarding and the KYC process with Co-pilot

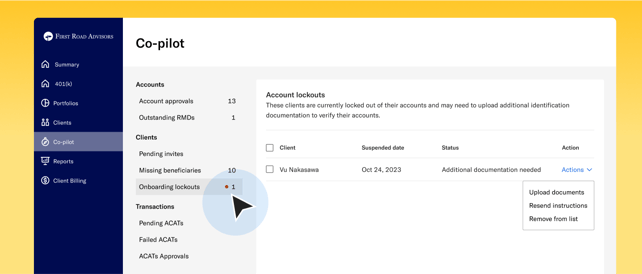

Co-pilot is designed to intelligently surface unresolved client tasks, from pending invites and account approvals to failed ACATs and missing beneficiaries. This quarter, we introduced a new section, Onboarding lockouts, to help you quickly surface clients who are blocked from completing their onboarding due to KYC issues.

Co-pilot is designed to intelligently surface unresolved client tasks, from pending invites and account approvals to failed ACATs and missing beneficiaries. This quarter, we introduced a new section, Onboarding lockouts, to help you quickly surface clients who are blocked from completing their onboarding due to KYC issues.

Co-pilot will now signal when clients are actively stuck in the identity verification process, presenting the date of account suspension and the current status of ID review. From the Co-pilot dash, you can quickly unblock clients and streamline your personal to-do lists by:

- Resending identify verification instruction

- Uploading your client’s identity verification documents

- Removing accounts from the list that were already addressed offline.

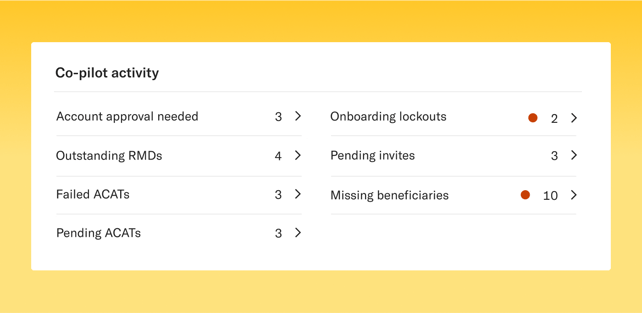

Our product squad is also sprucing up the dashboard Summary page. The new Co-pilot notifications display gives you an overview of active and recently resolved Co-pilot tasks as soon as you log in.

Our product squad is also sprucing up the dashboard Summary page. The new Co-pilot notifications display gives you an overview of active and recently resolved Co-pilot tasks as soon as you log in.

Client activity reporting

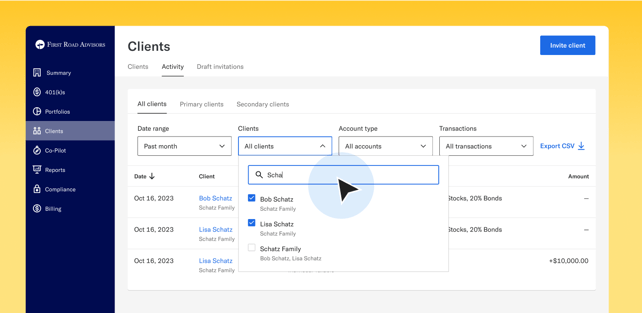

We rolled out a new Clients page experience, with comprehensive search functionality and reporting tools built in. You can now view historical transactions across all your clients from the Activity tab.

We rolled out a new Clients page experience, with comprehensive search functionality and reporting tools built in. You can now view historical transactions across all your clients from the Activity tab.

Sort and filter transaction history by date, account type, and transaction type to get a more detailed view into total weekly flows (no client impersonation necessary). You can also search for an individual client or household by name. When you're ready, export the data you need as a CSV file.

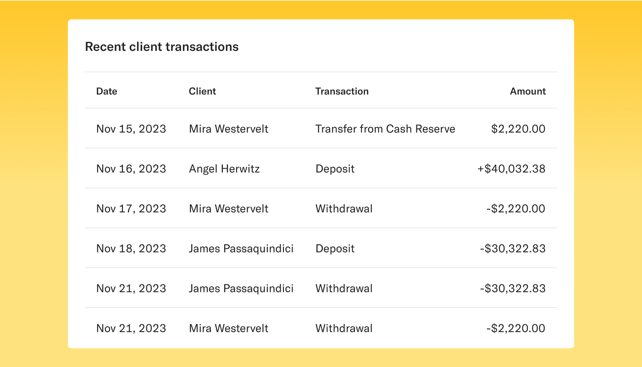

We also introduced a recent client transactions display on the new and improved Summary page. Get a detailed summary of the latest account transactions—deposits, withdrawals, rebalances, fees, and more—right from your dashboard.

We also introduced a recent client transactions display on the new and improved Summary page. Get a detailed summary of the latest account transactions—deposits, withdrawals, rebalances, fees, and more—right from your dashboard.

.png?width=642&height=66&name=Frame%207546%20(2).png)

Get the support you deserve with Transition Services

Our dedication to independent, small RIAs extends beyond technology. We've long had a human support team in place, and firmly believe that our commitment to service excellence is what sets us apart from other custodians.

To that end, we’re actively growing our Transition Services Team. This team works with advisors to minimize disruption to practice operations and clients, from communicating the change, to supporting account opening, facilitating ACATs, and building the new client experience after asset transitions are complete. And the best part: no AUM commitment is required to engage our team.

The Transition Services Team has hit the ground running in 2024. See how one $125mm firm with over 300 clients recently made a switch.

.png?width=592&height=94&name=Frame%207548%20(1).png) Gain a competitive edge with 401(k) matching on student loan repayments

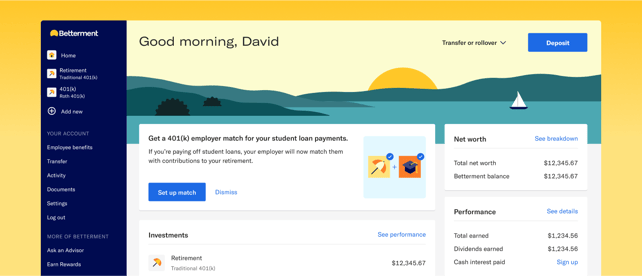

Gain a competitive edge with 401(k) matching on student loan repayments

In January, our 401(k) team introduced a new, bundled solution to help bridge the gap between retirement planning and debt repayment.

Student loans are a significant financial obstacle for millions and investors are increasingly looking to their companies for help.1 With this new benefit, your plan sponsor clients can offer employees a 401(k) match on eligible student loan repayments—and gain a competitive edge in attracting top talent.

"We know that student debt can be a major impediment to saving for retirement," says Sarah Levy, CEO. "Our industry-first student loan 401(k) matching solution is a compelling addition to our modern 401(k) that will help to broaden plan participation to those whose student debt previously kept them from saving for retirement."

"We know that student debt can be a major impediment to saving for retirement," says Sarah Levy, CEO. "Our industry-first student loan 401(k) matching solution is a compelling addition to our modern 401(k) that will help to broaden plan participation to those whose student debt previously kept them from saving for retirement."

How it works: Plan participants can record qualified loan payments on their Betterment 401(k), and employers can then match those payments with a contribution to the individual’s 401(k) account annually or during each payroll period.

Edit custom portfolios

Managing your custom portfolios is now easier than before. With editable models, you can routinely adjust strategies across accounts to better meet your clients’ needs amidst evolving markets.

To edit portfolios assigned to client accounts, simply:

- Add or remove portfolio holdings

- Update your desired target allocations

- Select a tax-aware migration strategy to implement changes across clients.

Automated 401(k) force-outs

Cut down on time and potential expenses for your plan sponsor clients with 401(k) force-outs. This feature automatically removes former employees' assets from the 401(k) plan, or transitions the assets into an IRA when their total balance is less than $5,000. This automation not only reduces per-participant record keeping fees, but can help keep plans below the 100+ participant threshold for annual independent audits.