All the features you want, none of the headache.

Your clients deserve a solo that’s flexible, full-scale, and effortless to manage—from account opening to funding, conversions, and ongoing management.

Retirement solutions for all.

FAQs

-

Solo 401(k) eligibility is limited to self-employed individuals or business owners without employees. There are no age or income restrictions.

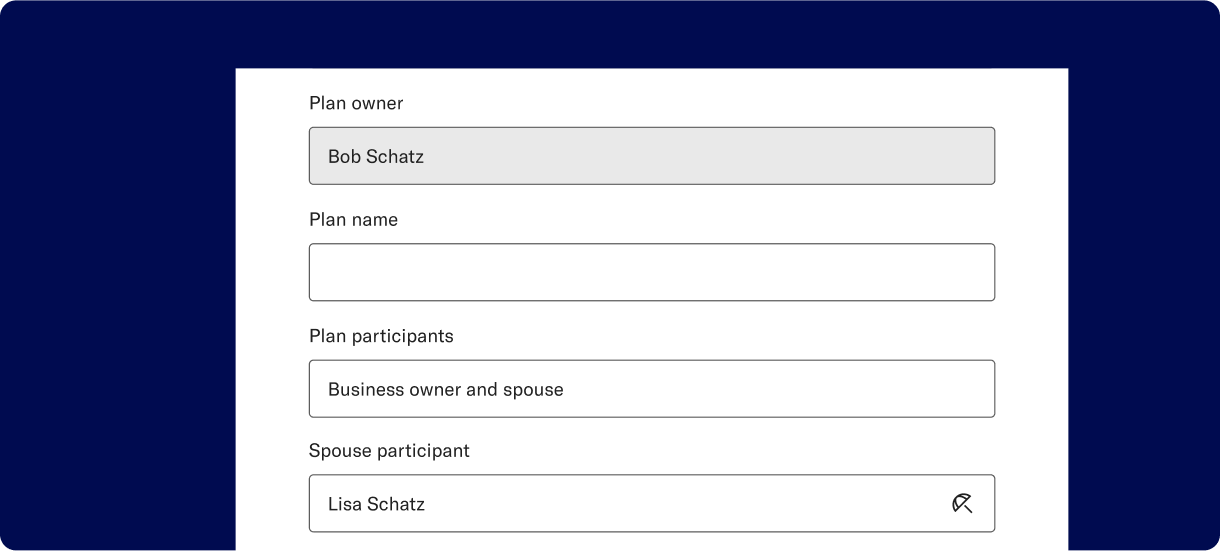

“Owners” must have at least 5% ownership share and have some self-employed income. “Employees” are defined as individuals earning an income from the business, who are at least 21 years old, and have worked over 500 hours per year for 3 consecutive years. The only exception to the employee rule is a spouse.

Spouses can participate in a solo 401(k) plan if they are a full-time employee or an owner earning income from the business. Spouses each have their own individual contribution limits, doubling the total amount a household can save annually.

-

In 2025, the total individual contribution limit is $70,000. Individual clients can make contributions as both the employee and the employer.

As the employee, the client can defer up to $23,500, or 100% of compensation, whichever is less. As the employer, the client can make an additional profit-sharing contribution of up to 25% of compensation or net self-employment income (see nuances by business entity here).

Those ages 50-59 and 64+ can contribute up to an additional $7,500 in catch-up employee contributions ($31,00 total). The SECURE 2.0 Act stipulates that those between the ages of 60 and 63 in 2025 can take advantage of a higher catch-up limit of $11,250.

-

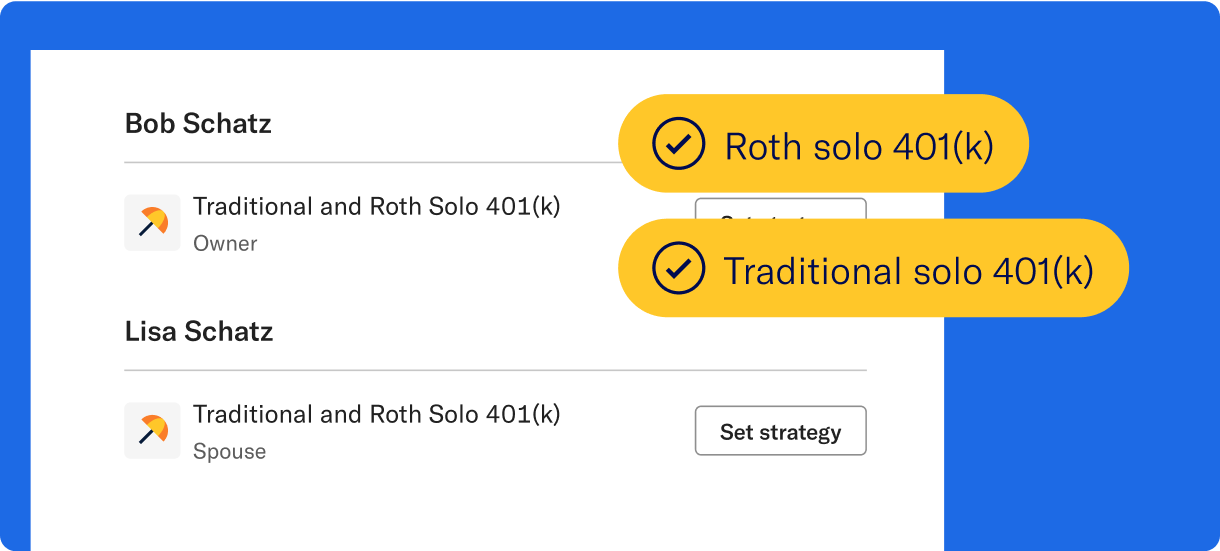

Employer contributions must always be pre-tax, but with a Betterment solo 401(k), employee contributions can be either pre-tax or Roth.

Employee contribution limits are up to $23,500-$34,750 in 2025 (depending on age and total income)—or more than 3x the Roth IRA limit. This makes solos a powerful option for growing your clients’ after-tax retirement savings.

-

SECURE Act 2.0 has several provisions that impact solo 401(k) contributions, including retroactive salary deferrals. This provision now allows eligible employers to establish and fund a solo 401(k) plan with salary deferrals for the prior tax year.

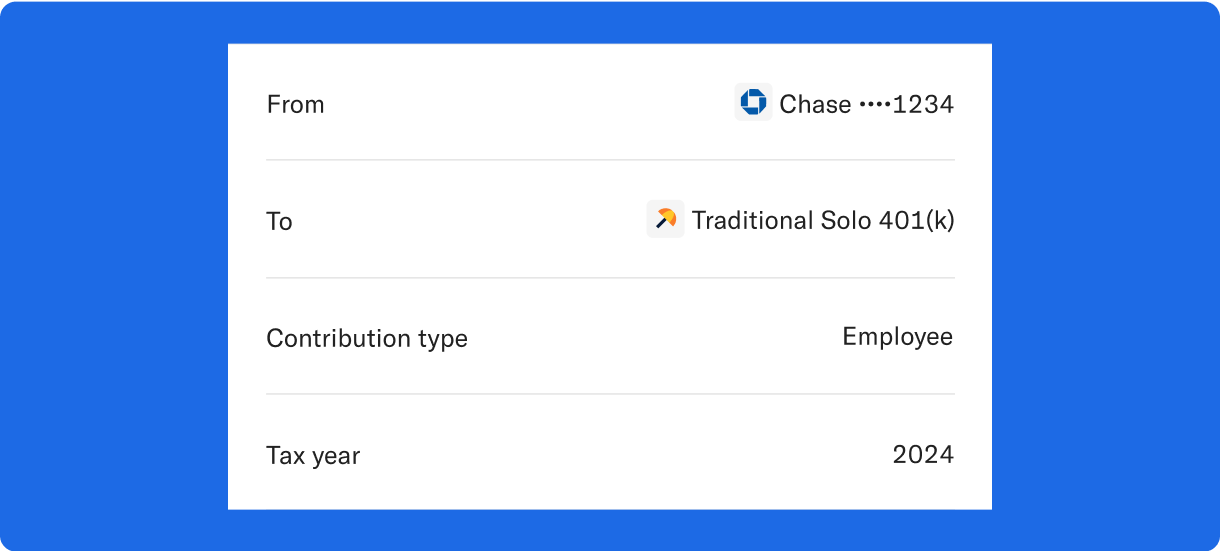

This means that clients who start new solo 401(k) plans in 2025 can make tax-deductible contributions for the 2024 tax year up until October 15, 2025, or their tax filing deadline.*

-

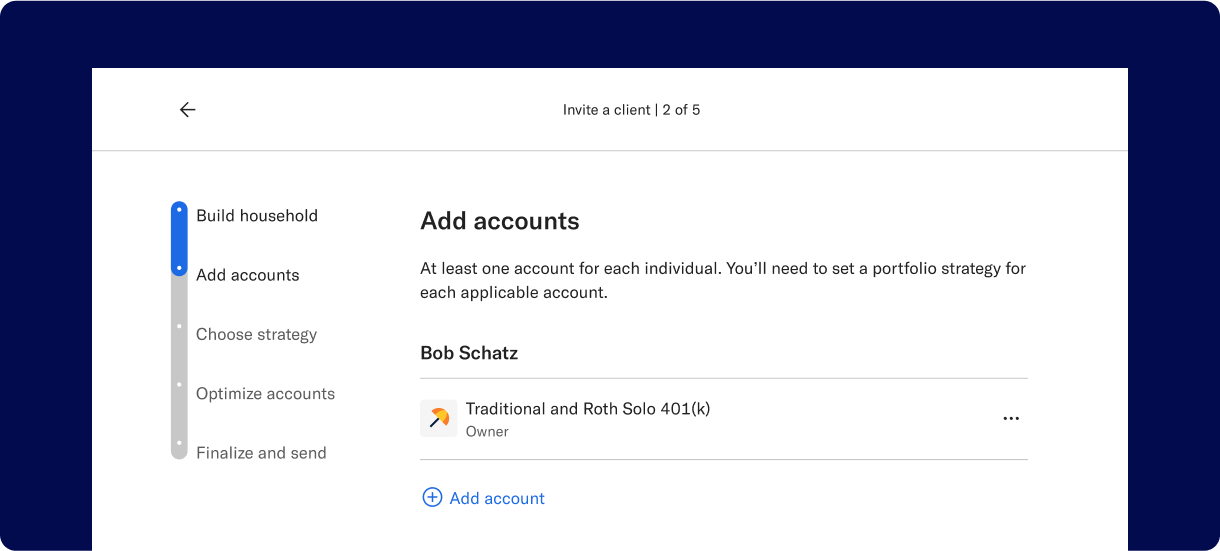

The solo 401(k) setup process is simple, accessible, and fast. To fund, your clients can simply link their business bank account and set up contributions via the client portal. You can also convert an existing solo 401(k) plan to a Betterment solo 401(k) via the standard account opening flow in the advisor dashboard.

Clients can rollover the following accounts into a traditional solo 401(k): Qualified plans (pre-tax), traditional IRA, SIMPLE IRA (after two years), SEP-IRA, Governmental 457(b), and pre-tax 403(b). Clients can rollover the following accounts into a Roth solo 401(k): Designated Roth accounts, qualified plan (pre-tax), Governmental 457(b), pre-tax 403(b). For more information, see here.

Note: All 401(k) to 401(k) rollovers must be initiated by the client in the client portal.

-

We provide comprehensive support to help you and your clients feel at ease. From onboarding and account transfers to ongoing platform guidance and day-to-day troubleshooting, our dedicated teams are reachable.

Our Advisor Support Team prioritizes fast response times, with 98% of calls answered in under two minutes. Beyond reactive support, we offer on-demand training, webinars, and personalized training sessions to help you maximize the platform. Whether you’re navigating complex client needs or exploring new features, we’re here to help you grow better.