Nick Holeman, CFP®

Meet our writer

Nick Holeman, CFP®

Director of Financial Planning, Betterment

Nick enjoys teaching others how to make sense of their complicated financial lives. Nick earned his graduate degree in Financial and Tax Planning and has since helped countless individuals and families achieve their goals.

Articles by Nick Holeman, CFP®

-

![]()

The benefits of estimating your tax bracket when investing

The benefits of estimating your tax bracket when investing Nov 21, 2024 6:00:00 AM Knowing your tax bracket opens up a huge number of planning opportunities that have the potential to save you taxes and increase your investment returns. If you’re an investor, knowing your tax bracket opens up a number of planning opportunities that can potentially decrease your tax liability and increase your investment returns. Investing based on your tax bracket is something that good CPAs and financial advisors, including Betterment, do for customers. Because the IRS taxes different components of investment income (e.g., dividends, capital gains, retirement withdrawals) in different ways depending on your tax bracket, knowing your tax bracket is an important part of optimizing your investment strategy. In this article, we’ll show you how to estimate your tax bracket and begin making more strategic decisions about your investments with regards to your income taxes. First, what is a tax bracket? In the United States, federal income tax follows what policy experts call a "progressive" tax system. This means that people with higher incomes are generally subject to a higher tax rate than people with lower incomes. 2025 Tax Brackets Tax rate Taxable income for single filers Taxable income for married, filing jointly 10% $0 to $11,925 $0 to $23,850 12% $11,925 to $48,475 $23,850 to $96,950 22% $47,151 to $100,525 $94,301 to $201,050 24% $103,350 to $197,300 $206,700 to $394,600 32% $197,300 to $250,525 $394,600 to $501,050 35% $250,726 to $626,350 $501,050 to $751,600 37% $626,350 or more $751,600 or more Source: Internal Revenue Service Instead of thinking solely in terms of which single tax bracket you fall into, however, it's helpful to think of the multiple tax brackets each of your dollars of taxable income may fall into. That's because tax brackets apply to those specific portions of your income. For example, let's simplify things and say there's hypothetically only two tax brackets for single filers: A tax rate of 10% for taxable income up to $10,000 A tax rate of 20% for taxable income of $10,001 and up If you're a single filer and have taxable income of $15,000 this year, you fall into the second tax bracket. This is what's typically referred to as your "marginal" tax rate. Portions of your income, however, fall into both tax brackets, and those portions are taxed accordingly. The first $10,000 of your income is taxed at 10%, and the remaining $5,000 is taxed at 20%. How difficult is it to estimate my tax bracket? Luckily, estimating your tax bracket is much easier than actually calculating your exact taxes, because U.S. tax brackets are fairly wide, often spanning tens of thousands of dollars. That’s a big margin of error for making an estimate. The wide tax brackets allow you to estimate your tax bracket fairly accurately even at the start of the year, before you know how big your bonus will be, or how much you will donate to charity. Of course, the more detailed you are in calculating your tax bracket, the more accurate your estimate will be. And if you are near the cutoff between one bracket and the next, you will want to be as precise as possible. How Do I Estimate My Tax Bracket? Estimating your tax bracket requires two main pieces of information: Your estimated annual income Tax deductions you expect to file These are the same pieces of information you or your accountant deals with every year when you file your taxes. Normally, if your personal situation has not changed very much from last year, the easiest way to estimate your tax bracket is to look at your last year’s tax return. The 2017 Tax Cuts and Jobs Act changed a lot of the rules and brackets. The brackets may also be adjusted each year to account for inflation. Thus, it might make sense for most people to estimate their bracket by crunching new numbers. Estimating Your Tax Bracket with Last Year’s Tax Return If you expect your situation to be roughly similar to last year, then open up last year’s tax return. If you review Form 1040, you can see your taxable income on Page 1, Line 15, titled “Taxable Income.” As long as you don’t have any major changes in your income or personal situation this year, you can use that number as an estimate to find the appropriate tax bracket. Estimating Your Tax Bracket by Predicting Income, Deductions, and Exemptions Estimating your bracket requires a bit more work if your personal situation has changed from last year. For example, if you got married, changed jobs, had a child or bought a house, those, and many more factors, can all affect your tax bracket. It’s important to point out that your taxable income, the number you need to estimate your tax bracket, is not the same as your gross income. The IRS generally allows you to reduce your gross income through various deductions, before arriving at your taxable income. When Betterment calculates your estimated tax bracket, we use the two factors above to arrive at your estimated taxable income. You can use the same process. Add up your income from all expected sources for the year. This includes salaries, bonuses, interest, business income, pensions, dividends and more. If you’re married and filing jointly, don’t forget to include your spouse’s income sources. Subtract your deductions. Tax deductions reduce your taxable income. Common examples include mortgage interest, property taxes and charity, but you can find a full list on Schedule A – Itemized Deductions. If you don’t know your deductions, or don’t expect to have very many, simply subtract the Standard Deduction instead. By default, Betterment assumes you take the standard deduction. If you know your actual deductions will be significantly higher than the standard deduction, you should not use this assumption when estimating your bracket, and our default estimation will likely be inaccurate. The number you arrive at after reducing your gross income by deductions and exemptions is called your taxable income. This is an estimate of the number that would go on line 15 of your 1040, and the number that determines your tax bracket. Look up this number on the appropriate tax bracket table and see where you land. Again, this is only an estimate. There are countless other factors that can affect your marginal tax bracket such as exclusions, phaseouts and the alternative minimum tax. But for planning purposes, this estimation is more than sufficient for most investors. If you have reason to think you need a more detailed calculation to help formulate your financial plan for the year, you can consult with a tax professional. How Can I Use My Tax Bracket to Optimize My Investment Options? Now that you have an estimate of your tax bracket, you can use that information in many aspects of your financial plan. Here are a few ways that Betterment uses a tax bracket estimate to give you better, more personalized advice. Tax-Loss Harvesting: This is a powerful strategy that seeks to use the ups/downs of your investments to save you taxes. However, it typically doesn't make sense if you fall into a lower tax bracket due to the way capital gains are taxed differently. Tax Coordination: This strategy reshuffles which investments you hold in which accounts to try to boost your after-tax returns. For the same reasons listed above, if you fall on the lower end of the tax bracket spectrum, the benefits of this strategy are reduced significantly. Traditional vs. Roth Contributions: Choosing the proper retirement account to contribute to can also save you taxes both now and throughout your lifetime. Generally, if you expect to be in a higher tax bracket in the future, Roth accounts are best. If you expect to be in a lower tax bracket in the future, Traditional accounts are best. That’s why our automated retirement planning advice estimates your current tax bracket and where we expect you to be in the future, and uses that information to recommend which retirement accounts make the most sense for you. In addition to these strategies, Betterment’s team of financial experts can help you with even more complex strategies such as Roth conversions, estimating taxes from moving outside investments to Betterment and structuring tax-efficient withdrawals during retirement. Tax optimization is a critical part to your overall financial success, and knowing your tax bracket is a fundamental step toward optimizing your investment decisions. That’s why Betterment uses estimates of your bracket to recommend strategies tailored specifically to you. It’s just one way we partner with you to help maximize your money. -

![]()

How to plan for retirement

How to plan for retirement Nov 18, 2024 9:00:00 AM It depends on the lifestyle you want, the investment accounts available, and the income you expect to receive. Most people want to retire some day. But retirement planning looks a little different for everyone. There’s more than one way to get there. And some people want to live more extravagantly—or frugally—than others. Your retirement plan should be based on the life you want to live and the financial options you have available. And the sooner you sort out the details, the better. Even if retirement seems far away, working out the details now will set you up to retire when and how you want to. In this guide, we’ll cover: How much you should save for retirement Choosing retirement accounts Supplemental income to consider Self-employed retirement options How much should you save for retirement? How much you need to save ultimately depends on what you want retirement to look like. Some people see themselves traveling the world when they retire. Or living closer to their families. Maybe there’s a hobby you’ve wished you could spend more time and money on. Perhaps for you, retirement looks like the life you have now—just without the job. For many people, that’s a good place to start. Take the amount you spend right now and ask yourself: do you want to spend more or less than that each year of retirement? How long do you want your money to last? Answering these questions will give you a target amount you’ll need to reach and help you think about managing your income in retirement. Don’t forget to think about where you’ll want to live, too. Cost of living varies widely, and it has a big effect on how long your money will last. Move somewhere with a lower cost of living, and you need less to retire. Want to live it up in New York City, Seattle, or San Francisco? Plan to save significantly more. And finally: when do you want to retire? This will give you a target date to save it by (in investing, that’s called a time horizon). It’ll also inform how much you need to retire. Retiring early reduces your time horizon, and increases the number of expected years you need to save for. Choosing retirement accounts Once you know how much you need to save, it’s time to think about where that money will go. Earning interest and taking advantage of tax benefits can help you reach your goal faster, and that’s why choosing the right investment accounts is a key part of retirement planning. While there are many kinds of investment accounts in general, people usually use five main types to save for retirement: Traditional 401(k) Roth 401(k) Traditional IRA (Individual Retirement Account) Roth IRA (Individual Retirement Account) Health Savings Account (HSA) Traditional 401(k) A Traditional 401(k) is an employer-sponsored retirement plan. These have two valuable advantages: Your employer may match a percentage of your contributions Your contributions are tax deductible You can only invest in a 401(k) if your employer offers one. If they do, and they match a percentage of your contributions, this is almost always an account you’ll want to take advantage of. The contribution match is free money. You don’t want to leave that on the table. And since your contributions are tax deductible, you’ll pay less income tax while you’re saving for retirement. Roth 401(k) A Roth 401(k) works just like a Traditional one, but with one key difference: the tax advantages come later. You make contributions, your employer (sometimes) matches a percentage of them, and you pay taxes like normal. But when you withdraw your funds during retirement, you don’t pay taxes. This means any interest you earned on your account is tax-free. With both Roth and Traditional 401(k)s, you can contribute a maximum of $24,500 in 2025, or $32,500 if you’re age 50 or over. Traditional IRA (Individual Retirement Account) As with a 401(k), an IRA gives you tax advantages. Depending on your income, contributions may lower your pre-tax income, so you pay less income tax leading up to retirement. The biggest difference? Your employer doesn’t match your contributions. The annual contribution limits are also significantly lower: just $7,500 for 2025, or $8,600 if you’re age 50 or over. Roth IRA (Individual Retirement Account) A Roth IRA works similarly, but as with a Roth 401(k), the tax benefits come when you retire. Your contributions still count toward your taxable income right now, but when you withdraw in retirement, all your interest is tax-free. So, should you use a Roth or Traditional account? One option is to use both Traditional and Roth accounts for tax diversification during retirement. Another strategy is to compare your current tax bracket to your expected tax bracket during retirement, and try to optimize around that. Also keep in mind that your income may fluctuate throughout your career. So you may choose to do Roth now, but after a significant promotion you might switch to Traditional. Health Savings Account (HSA) An HSA is another solid choice. Contributions to an HSA are tax deductible, and if you use the funds on medical expenses, your distributions are tax-free. After age 65, you can withdraw your funds just like a traditional 401(k) or IRA, even for non-medical expenses. You can only contribute to a Health Savings Accounts if you’re enrolled in a high-deductible health plan (HDHP). In 2025, you can contribute up to $4,400 to an HSA if your HDHP covers only you, and up to $8,750 if your HDHP covers your family. What other income can you expect? Put enough into a retirement account, and your distributions will likely cover your expenses during retirement. But if you can count on other sources of income, you may not need to save as much. For many people, a common source of income during retirement is social security. As long as you or your spouse have made enough social security contributions throughout your career, you should receive social security benefits. Retire a little early, and you’ll still get some benefits (but it may be less). This can amount to thousands of dollars per month. You can estimate the benefits you’ll receive using the Social Security Administration’s Retirement Estimator. Retirement accounts for the self-employed Self-employed people have a few additional options to consider. One Participant 401(k) Plan or Solo 401(k) A Solo 401(k) is similar to a regular 401(k). However, with a Solo 401(k), you’re both the employer and the employee. You can combine the employee contribution limit and the employer contribution limit. As long as you don’t have any employees and you’re your own company, this is a pretty solid option. However, a Solo 401(k) typically requires more advance planning and ongoing paperwork than other account types. If your circumstances change, you may be able to roll over your Solo 401(k) plan or consolidate your IRAs into a more appropriate retirement savings account. Simplified Employee Pension (SEP IRA) With a SEP IRA, the business sets up an IRA for each employee. Only the employer can contribute, and the contribution rate must be the same for each qualifying employee. Savings Incentive Match Plan for Employees (SIMPLE IRA) A SIMPLE IRA is ideal for small business owners who have 100 employees or less. Both the employer and the employee can contribute. You can also contribute to a Traditional IRA or Roth IRA—although how much you can contribute depends on how much you’ve put into other retirement accounts. -

![]()

Financing an education: a guide for students and parents

Financing an education: a guide for students and parents Nov 1, 2024 9:00:00 AM There’s more than one way to finance your education. Learn more about two common ways: 529 plans and student loans. Whether you’re looking at university or trade school, education is expensive. And if you’re like most people, you probably don’t have that kind of cash on hand. Some manage to work their way through college, but depending on the school, even a full-time job will barely put a dent in your expenses. So how should you pay for school? The answer depends on how much time you have, where you live, and where you want to go. If you have money to set aside for school, a 529 plan might be your best bet. Student loans are always an option, too—you just have to be careful. In this guide, we’ll cover: Investing in a 529 plan Financing responsibly with student loans What’s a 529 plan and how do you choose one? A 529 plan is a specialized investment account with tax benefits. It works similarly to a Roth IRA or Roth 401(k). You put money into the account and pay taxes up front, and if you withdraw for education expenses, you usually don’t have to pay taxes on anything you earned. While IRAs and 401(k)s help you plan for retirement, 529 plans help you plan for education expenses. Oh, and every state has its own plan. There are two types of 529 plans: Prepaid tuition plans With a prepaid tuition plan, you pay for tuition credits upfront, using today’s tuition rates. Fewer and fewer states offer these plans, but since tuition costs are always increasing, they can be a good option. Who knows how much tuition will cost in the coming years! The downside is that this money can only be used for tuition, and there are plenty of other education expenses. Education savings plans An education savings plan is more like a traditional investment account. You invest in funds, stocks, bonds, and other financial assets, and your account has the potential to grow through compound interest. You can also use this money on more than just tuition. Depending on your state, you could use your account for education fees, living expenses, technology, school supplies, or even student loan payments. Use it on anything else, and there’s a 10% penalty. 529 plan limitations Every 529 plan needs a specific beneficiary. It could be yourself, your child, a grandkid, a friend—whoever. Their age doesn’t matter. The only limitations are what the funds can be used for and how much you can contribute. Everything you put into a 529 plan is considered “a gift” to the beneficiary. And there are limits to how much you can gift to a person each year before being subject to gift tax rules. But you also have a lifetime limit in the millions of dollars. After that, there’s a gift tax. Gift tax rules are complex, so we recommend consulting a tax professional. Every state is different 529 plans can vary widely from state-to-state. And since you can choose plans from other states, it’s worth shopping around. While some plans let you apply your account to in-state or out-of-state education, others don’t. If you’re looking at a plan you can only use in-state, make sure you’re comfortable with the available schools. Some states offer a match program, where they’ll match a percentage of 529 plan contributions from low- and middle-income families. This could substantially boost your savings. Your state might also offer a full or partial tax break on your contributions—but that usually only applies if you live in state. And of course, each 529 plan is an investment account, so you’ll also want to review the investment choices and consider the cost of fees. For every plan, the account’s total worth can only be equal to the “expected amount” of future education expenses for each beneficiary. But that’s going to vary widely from state to state. The exact limit depends on which 529 plan you choose, but it’s typically a few hundred thousand dollars for each beneficiary. If you’re wanting to save for a private college or grad program, that may not be enough. And if your state’s limit is lower than what you think you’ll need, that may offset the benefit of a state tax break or match program. And according to Federal law, you can use up to $10,000 from a 529 plan to pay for “enrollment or attendance at an eligible elementary or secondary school.” It also lets you apply $10,000 toward student loans. But some states don’t follow these federal laws. If they don’t, and you use your funds like this anyway, you’ll have to pay a 10% penalty. Bottom line: Do your research, and make sure you’re familiar with the specifics of your 529 plan. How to choose a 529 plan The best 529 plan for you depends on: Where you live Where you or your beneficiary will go to school How much you want to save What you want to spend this money on But if you’re wondering how to tell which plan is likely to make the most of your money, it really comes down to just three things: tax benefits, fees, and investment choices. Be sure to look at all plan details and compare these factors before choosing one. Student loan basics Student loans have a bad reputation. And it’s understandable. About 43 million Americans owe an average of $39 thousand in student loans. The average student needs to borrow about $30,000 to earn their bachelor’s degree. But when it comes down to it, if you don’t have money to contribute to a 529 plan or investment account (or your account doesn’t have enough money), your options are: Work your way through college Take out student loans Even with a job, you may need to take student loans. Used wisely (and sparingly), student loans don’t have to consume your finances or derail your other goals. But as with 529 plans, you can’t assume every loan is the same. Types of student loans There are two main types of student loans to consider: Federal Private Federal student loans often (but not always) have the lowest interest rates, don’t require credit checks, and come with benefits like pathways to loan forgiveness. You don’t need a cosigner to get most federal loans, and nearly all students with a highschool diploma or GED are eligible for them. However, there’s a cap on how much money you can take out in federal loans, and some types of federal loans require you to demonstrate financial need. Financial institutions like banks can also provide private student loans. These typically require a good credit score, and you can take out as much as you need (as long as you’re approved for it). Another big difference: with private loans, you typically start making payments immediately and have a fixed repayment schedule set by your lender. With federal loans, you may not have to pay while you’re in school, you get a six-month grace period after you graduate, and you can choose from four repayment plans. Federal loan repayment options Federal loans give you flexibility with repayment. If you’re struggling to make monthly payments, you can choose one of four Income-Driven Repayment (IDR) plans that may work better for your situation. Each of these plans allows for payments based on your income, usually 10-20% of it with a few exceptions, which makes individual payments more manageable. Unfortunately, this usually also means you’ll be making payments for longer. Check out the Federal Student Loan website for more detailed information on each plan. If you want to pay off your loans faster, you can also select a Graduated Repayment Plan, which increases your payments periodically, ensuring you pay off your loans in 10 years. There’s also another way to ditch your federal loan payments ahead of schedule: loan forgiveness. Student loan forgiveness With federal loans, there are two pathways to loan forgiveness: Public service Income-Driven Repayment Go into the right line of work after college, and you could be eligible for Public Student Loan Forgiveness (PSLF). This is available to students who pursue careers with nonprofits, government agencies, and some public sectors. If you make monthly qualifying payments for 10 years, then you can apply for forgiveness. If you don’t qualify for PSLF, but you’re on an IDR plan, you have another potential pathway to forgiveness. After 20-25 years of monthly payments, you may qualify for forgiveness, too. Unfortunately, on this path, you have to pay income taxes on the amount that was forgiven. (This is referred to as a “tax bomb.”) Consolidating and refinancing student loans Sometimes it’s tough to juggle multiple repayment schedules, interest rates, and payment amounts. If you’re having a hard time keeping track of your student loans, you may want to consider consolidating them so you have one monthly payment. Consolidating through a private institution could also give you a new interest rate (the average of your old ones, or sometimes lower, depending on your circumstances) and let you adjust your payment time horizon. The federal consolidation program won’t change your interest rate, but it will still group your loans into a single payment for you. Whatever loans you wind up with and whatever your repayment plan, make sure you stay on top of your minimum payments. Fees and penalties can significantly increase your debt over time. -

![]()

How to manage your income in retirement

How to manage your income in retirement Nov 1, 2024 7:00:00 AM An income strategy during retirement can help make your portfolio last longer, while also easing potential tax burdens. Retirement planning doesn’t end when you retire. To have the retirement you’ve been dreaming of, you need to ensure your savings will last. And how much you withdraw each month isn’t all that matters. In this guide we’ll cover: Why changes in the market affect you differently in retirement How to help keep bad timing from ruining your retirement How to decide which accounts to withdraw from first How Betterment helps take the guesswork out of your retirement income Part of retirement planning involves thinking about your retirement budget. But whether you’re already retired or you’re simply thinking ahead, it’s also important to think about how you’ll manage your income in retirement. Retirement is a huge milestone. And reaching it changes how you have to think about taxes, your investments, and your income. For starters, changes in the market can seriously affect how long your money lasts. Why changes in the market affect you differently in retirement Stock markets can swing up or down at any time. They’re volatile. When you’re saving for a distant retirement, you usually don’t have to worry as much about temporary dips. But during retirement, market volatility can have a dramatic effect on your savings. An investment account is a collection of individual assets. When you make a withdrawal from your retirement account, you’re selling off assets to equal the amount you want to withdraw. So say the market is going through a temporary dip. Since you’re retired, you have to continue making withdrawals in order to maintain your income. During the dip, your investment assets may have less value, so you have to sell more of them to equal the same amount of money. When the market goes back up, you have fewer assets that benefit from the rebound. The opposite is true, too. When the market is up, you don’t have to sell as many of your assets to maintain your income. There will always be good years and bad years in the market. How your withdrawals line up with the market’s volatility is called the “sequence of returns.” Unfortunately, you can’t control it. In many ways, it’s the luck of the withdrawal. Still, there are ways to help decrease the potential impact of a bad sequence of returns. How to keep bad timing from ruining your retirement The last thing you want is to retire and then lose your savings to market volatility. So you’ll want to take some steps to try and protect your retirement from a bad sequence of returns. Adjust your level of risk As you near or enter retirement, it’s likely time to start cranking down your stock-to-bond allocation. Invest too heavily in stocks, and your retirement savings could tank right when you need them. Betterment generally recommends turning down your ratio to about 56% stocks in early retirement, then gradually decreasing to about 30% toward the end of retirement. Rebalance your portfolio During retirement, the two most common cash flows in/out of your investment accounts will likely be dividends you earn and withdrawals you make. If you’re strategic, you can use these cash flows as opportunities to rebalance your portfolio. For example, if stocks are down at the moment, you likely want to withdraw from your bonds instead. This can help prevent you from selling stocks at a loss. Alternatively, if stocks are rallying, you may want to reinvest your dividends into bonds (instead of cashing them out) in order to bring your portfolio back into balance with your preferred ratio of stocks to bonds. Keep an emergency fund Even in retirement, it’s important to have an emergency fund. If you keep a separate account in your portfolio with enough money to cover three to six months of expenses, you can likely cushion—or ride out altogether—the blow of a bad sequence of returns. Supplement your income Hopefully, you’ll have enough retirement savings to produce a steady income from withdrawals. But it’s nice to have other income sources, too, to minimize your reliance on investment withdrawals in the first place. Social Security might be enough—although a pandemic or other disaster can deplete these funds faster than expected. Maybe you have a pension you can withdraw from, too. Or a part-time job. Or rental properties. Along with the other precautions above, these additional income sources can help counter bad returns early in retirement. While you can’t control your sequence of returns, you can control the order you withdraw from your accounts. And that’s important, too. How to decide which accounts to withdraw from first In retirement, taxes are usually one of your biggest expenses. They’re right up there with healthcare costs. When it comes to your retirement savings, there are three “tax pools” your accounts can fall under: Taxable accounts: individual accounts, joint accounts, and trusts. Tax-deferred accounts: individual retirement accounts (IRAs), 401(k)s, 403(b)s, and Thrift Savings Plans Tax-free accounts: Roth IRAs, Roth 401(k)s Each of these account types (taxable, tax-deferred, and tax-free) are taxed differently—and that’s important to understand when you start making withdrawals. When you have funds in all three tax pools, this is known as “tax diversification.” This strategy can create some unique opportunities for managing your retirement income. For example, when you withdraw from your taxable accounts, you only pay taxes on the capital gains, not the full amount you withdraw. With a tax-deferred account like a Traditional 401(k), you usually pay taxes on the full amount you withdraw, so with each withdrawal, taxes take more away from your portfolio’s future earning potential. Since you don’t have to pay taxes on withdrawals from your tax-free accounts, it’s typically best to save these for last. You want as much tax-free money as possible, right? So, while we’re not a tax advisor, and none of this information should be considered advice for your specific situation, the ideal withdrawal order generally-speaking is: Taxable accounts Tax-deferred accounts Tax-free accounts But there are a few exceptions. Incorporating minimum distributions Once you reach a certain age, you must generally begin taking required minimum distributions (RMDs) from your tax-deferred accounts. Failure to do so results in a steep penalty on the amount you were supposed to take. This changes things—but only slightly. At this point, you may want to consider following a new order: Withdraw your RMDs. If you still need more, then pull from taxable accounts. When there’s nothing left in those, start withdrawing from your tax-deferred accounts. Pull money from tax-free accounts. Smoothing out bumps in your tax bracket In retirement, you’ll likely have multiple sources of non-investment income, coming from Social Security, defined benefit pensions, rental income, part-time work, and/or RMDs. Since these income streams vary from year to year, your tax bracket may fluctuate throughout retirement. With a little extra planning, you can sometimes use these fluctuations to your advantage. For years where you’re in a lower bracket than usual–say, if you’re retiring before you plan on claiming Social Security benefits–it may make sense to fill these low brackets with withdrawals from tax-deferred accounts before touching your taxable accounts, and possibly consider Roth conversions. For years where you’re in a higher tax bracket, like if you sell a home and end up with large capital gains–it may make sense to pull from tax-free accounts first to minimize the effect of higher tax rates. Remember, higher taxes mean larger withdrawals and less money staying invested. -

![]()

What is a fiduciary, and do I need one for my investments?

What is a fiduciary, and do I need one for my investments? Nov 1, 2024 6:00:00 AM When it comes to getting help managing your financial life, transparency is the name of the game. When you seek out financial advice, it’s reasonable to assume your advisor would put your best interests ahead of their own. But the truth is, if the investment advisor isn’t a fiduciary, they aren’t actually required to do so. So in this guide, we’ll: Define what exactly a fiduciary is and how they differ from other financial advisors Consider when it can be important to work with a fiduciary Learn how to be a proactive investment shopper What is a fiduciary, and what is the fiduciary duty? A fiduciary is a professional or institution that has the power to act on behalf of another party, and is required to do what is in the best interest of the other party to preserve good faith and trust. An investment advisor with a fiduciary duty to its clients is obligated to follow both a duty of care and a duty of loyalty to their clients. The duty of care requires a fiduciary to act in the client’s best interest. Under the duty of loyalty, the fiduciary must also attempt to eliminate or disclose all potential conflicts of interest. Not all advisors are held to the same standards when providing advice, so it’s important to know who is required to act as a fiduciary. Financial advisors not acting as fiduciaries operate under a looser guideline called the suitability standard. Advisors who operate under a suitability standard have to choose investments that are appropriate based on the client’s circumstances, but they neither have to put the clients’ best interests first nor disclose or avoid conflicts of interest so long as the transaction is considered suitable. What are examples of conflicts of interest? When in doubt, just follow the money. How do your financial advisors get paid? Are they incentivised to take actions that might not be in your best interest? Commissions are one of the most common conflicts of interest. At large brokerages, it’s still not uncommon for investment professionals to primarily rely on commissions to make money. With commission-based pay, your advisor might receive a cut each time you trade, plus a percentage each time they steer your money into certain investment companies’ financial products. They can be motivated to recommend you invest in funds that pay them high commissions (and cost you a higher fee), even if there’s a comparable and cheaper fund that benefits your financial strategy as a client. When is it important to work with a fiduciary? When looking for an advisor to trade on your behalf and make investment decisions for you, you should strongly consider choosing a fiduciary advisor. This should help ensure that you receive suitable recommendations that will also be in your best interest. If you want to entrust an advisor with your financials and give them discretion, you may want to make sure they’re legally required to put your interests ahead of their own. On the other hand, if you’re simply seeking help trading securities in your portfolio, or you don’t want to give an advisor discretion over your accounts, you may not need a fiduciary advisor. How to be a proactive investment shopper Hiring a fiduciary advisor to manage your portfolio is one of the best ways to try and ensure you are receiving unbiased advice. We highly recommend verifying that your professional is getting paid to meet your needs, not the needs of a broker, fund, or external portfolio strategy. Ask the tough questions: “I’d love to learn how you’re paid in this arrangement. How do you make money?” “How do you protect your clients from your own biases? Can you tell me about potential conflicts of interest in this arrangement?” “What’s the philosophy behind the advice you give? What are the aspects of investment management that you focus on most?” “What would you say is your point of differentiation from other advisors?” Some of these questions may be answered in a Form CRS, which is a relationship summary that advisors and brokers are required to give their clients or customers as of summer 2020. You should also know the costs of your current investments and compare them with other options in the marketplace as time goes on. If alternatives seem more attractive, ask your advisor why they haven’t suggested making a switch. And if the explanation you get seems inadequate, consider whether you should continue working with your investment professional. Why is Betterment a fiduciary? A common point of confusion is whether or not robo-advisors can be fiduciaries. So let’s clear up any ambiguities: Yes, they certainly can be. Betterment is a Registered Investment Advisor (RIA) with the SEC and is held to the fiduciary standard as required under the Investment Advisers Act. Acting as a fiduciary aligns with Betterment’s mission because we are committed to helping you build a better life, where you can save more for the future and can make the most of your money through our cash management products and our investing and retirement products. I, as well as the rest of Betterment’s dedicated team of human advisors, are also Certified Financial Planners® (CFP®, for short). We’re held to the fiduciary standard, too. This way, you can be sure that the financial advice you receive from Betterment, whether online or from our team of human advisors, is in your best interest. -

![]()

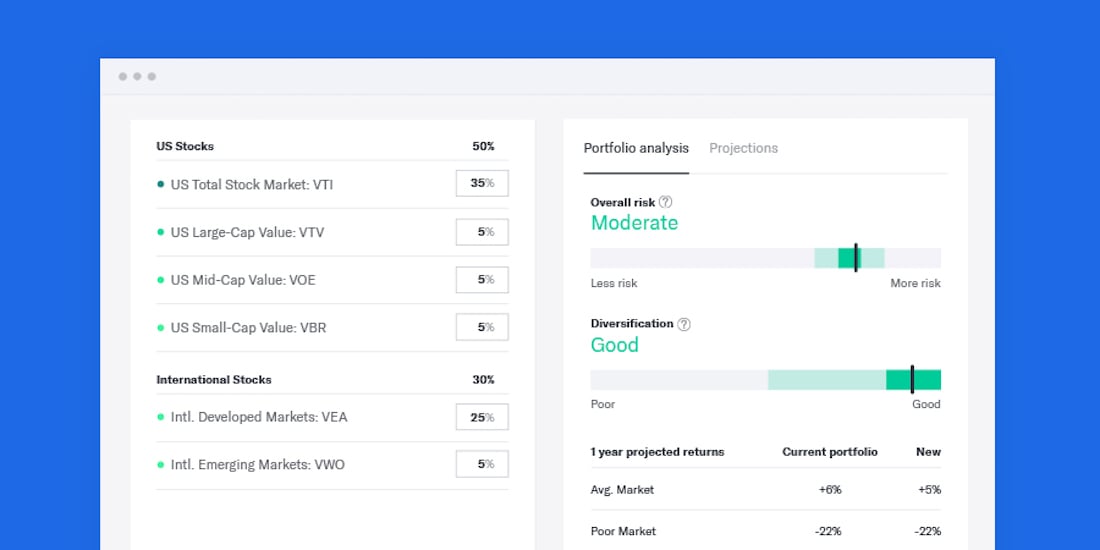

Take on More Control with Flexible Portfolios

Take on More Control with Flexible Portfolios Nov 1, 2024 6:00:00 AM For experienced investors looking to tweak asset class weights, we offer a Flexible portfolio option. Let’s say you’re an experienced investor. You’re already a Betterment customer—or you’re considering becoming one. You dig our personalized approach to automated investing, but you’d like to get granular with your portfolio’s specific asset class weights. Well, our Flexible portfolio option lets you do just that. It starts with our Core portfolio’s distribution of asset classes before handing over the wheel to you, so to speak. In the process, you get access to additional asset classes including Commodities, High Yield Bonds, and REITs. If all of this sounds a little overwhelming or confusing, you should probably consider sticking with one of our expert-built, curated portfolio options. But for those comfortable with the added risk, research, and responsibility in general that comes with managing your own portfolio, a Flexible portfolio may be a good fit. Keep reading for more details on the pros, cons and other considerations of this option. The benefits of a Flexible portfolio You get a sound start with the Betterment portfolio strategy Our investing advice has several layers, and the portfolio we recommend to you is just one of them. At the core is our approach to building a diversified, risk-efficient portfolio strategy and our cost-aware selection of ETFs. A Flexible portfolio lets you benefit from this approach and start with the asset class weighting we believe comprises a diversified portfolio, but gives you the final say in those weights. You get principled feedback on your Flexible portfolio You can tweak the asset class weights, but we’ll still rate the diversification and relative risk of those tweaks before any investment changes are actually made. We want any customer with a Flexible portfolio to better understand the risks of the changes they’re considering. This also lets you experiment with different weights in theory before putting them into practice. You can still benefit from our automation and tax optimization Although the use of a Flexible portfolio means your preferences may deviate from our portfolio recommendation, you still get access to our automated investing and tax features. These include things like automatic rebalancing and Tax Loss Harvesting. Altering or removing asset classes altogether, however, may impact the effectiveness of tax-saving strategies. The drawbacks of a Flexible portfolio Adjusting an investment portfolio requires careful consideration, experience, and a higher level of effort beyond choosing one of our preset portfolio strategies. Your performance may be better or worse than the performance of those portfolio strategies with a comparable level of risk. And beyond the potential for diminished tax-saving strategies, choosing a Flexible portfolio also disables the Auto-adjust feature. This feature automatically “glides” your portfolio to a lower overall risk level as you get closer to the end date of your goal. Without it, you’ll be responsible for manually maintaining the appropriate allocation of stocks and/or bonds and its corresponding risk level. -

![]()

Buying A Home: Down Payments, Mortgages, And Saving For Your Future

Buying A Home: Down Payments, Mortgages, And Saving For Your Future Oct 31, 2024 9:00:00 AM Your home may be the largest single purchase you make during your lifetime. That can make it both incredibly exciting and nerve wracking. Purchasing a primary residence often falls in the gray area between a pure investment (meant to increase one’s capital) and a consumer good (meant to increase one’s satisfaction). Your home has aspects of both, and we recognize that you may purchase a home for reasons that are not strictly monetary, such as being in a particular school district or proximity to one’s family. Those are perfectly valid inputs to your purchasing decision. However, this guide will focus primarily on the financial aspects of your potential home purchase: We’ll do this by walking through the five tasks that should be done before you purchase your home: Build your emergency fund Choose a fixed-rate mortgage Save for a down payment and closing costs Think long-term Calculate your monthly affordability Build your emergency fund Houses are built on top of foundations to help keep them stable. Just like houses, your finances also need a stable foundation. Part of that includes your emergency fund. We recommend that, before purchasing a home, you should have a fully-funded emergency fund. Your emergency fund should be a minimum of three months’ worth of expenses. How big your emergency fund should be is a common question. By definition, emergencies are difficult to plan for. We don’t know when they will occur or how much they will cost. But we do know that life doesn’t always go smoothly, and thus that we should plan ahead for unexpected emergencies. Emergency funds are important for everyone, but especially so if you are a homeowner. When you are a renter, your landlord is likely responsible for the majority of repairs and maintenance of your building. As a homeowner, that responsibility now falls on your shoulders. Yes, owning a home can be a good investment, but it can also be an expensive endeavor. That is exactly why you should not purchase a home before having a fully-funded emergency fund. And don’t forget that your monthly expenses may increase once you purchase your new home. To determine the appropriate size for your emergency fund, we recommend using what your monthly expenses will be after you own your new home, not just what they are today. Choose a fixed-rate mortgage If you’re financing a home purchase by way of a mortgage, you have to choose which type of mortgage is appropriate for you. One of the key factors is deciding between an adjustable-rate mortgage (ARM) and a fixed-rate mortgage (FRM). Betterment generally recommends choosing a fixed-rate mortgage, because while ARMs usually—but not always—offer a lower initial interest rate than FRMs, this lower rate comes with additional risk. With an ARM, your monthly payment can increase over time, and it’s difficult to predict what those payments will be. This may make it tough to stick to a budget and plan for your other financial goals. Fixed-rate mortgages, on the other hand, lock in the interest rate for the lifetime of the loan. This stability makes budgeting and planning for your financial future much easier. Locking in an interest rate for the duration of your mortgage helps you budget and minimizes risk. Most home buyers do choose a fixed-rate mortgage. According to 2021 survey data by the National Association of Realtors®, 92% of home buyers who financed their home purchase used a fixed-rate mortgage, and this was very consistent across all age groups. Research by the Urban Institute also shows FRMs have accounted for the vast majority of mortgages over the past 2 decades. Save for a down payment and closing costs You’ll need more than just your emergency fund to purchase your dream home. You’ll also need a down payment and money for closing costs. Betterment recommends making a down payment of at least 20%, and setting aside about 2% of the home purchase for closing costs. It’s true that you’re often allowed to purchase a home with down payments far below 20%. For example: FHA loans allow down payments as small as 3.5%. Fannie Mae allows mortgages with down payments as small as 3%. VA loans allow you to purchase a home with no down payment. However, Betterment typically advises putting down at least 20% when purchasing your home. A down payment of 20% or more can help avoid Private Mortgage Insurance (PMI). Putting at least 20% down is also a good sign you are not overleveraging yourself with debt. Lastly, a down payment of at least 20% may help lower your interest rate. This is acknowledged by the CFPB and seems to be true when comparing interest rates of mortgages with Loan-to-Values (LTVs) below and above 80%. Depending on your situation, it may even make sense to go above a 20% down payment. Just remember, you likely should not put every spare dollar you have into your home, as that could mean you don’t have enough liquid assets elsewhere for things such as your emergency fund and other financial goals like retirement. Closing Costs In addition to a down payment, buying a home also has significant transaction costs. These transaction costs are commonly referred to as “closing costs” or “settlement costs.” Closing costs depend on many factors, such as where you live and the price of the home. ClosingCorp, a company that specializes in closing costs and services, conducted a study that analyzed 2.9 million home purchases throughout 2020. They found that closing costs for buyers averaged 1.69% of the home’s purchase price, and ranged between states from a low of 0.71% of the home price (Missouri) up to a high of 5.90% of the home price (Delaware). The chart below shows more detail. Source: ClosingCorp, 2020 Closing Cost Trends. Visualization of data by Betterment. As a starting point, we recommend saving up about 2% of the home price (about the national average) for closing costs. But of course, if your state tends to be much higher or lower than that, you should plan accordingly. In total, that means that you should generally save at least 20% of the home price to go towards a down payment, and around 2% for estimated closing costs. With Betterment, you can open a Major Purchase goal and save for your downpayment and closing costs using either a cash portfolio or investing portfolio, depending on your risk tolerance and when you think you’ll buy your home. Think long-term We mentioned the closing costs for buyers above, but remember: There are also closing costs when you sell your home. These closing costs mean it may take you a while to break even on your purchase, and that selling your home soon after is more likely to result in a financial loss. That’s why Betterment doesn’t recommend buying a home unless you plan to own that home for at least 4 years, and ideally longer. The below chart is built from 2020 survey data by the National Association of Realtors® and shows that most home sellers stay in their homes beyond this 4 year rule of thumb. Across all age groups, the median length of time was 10 years. That’s excellent. However, we can see that younger buyers, on average, come in well below the 10-year median, which indicates they are more at risk of not breaking even on their home purchases. Source: National Association of Realtors®, 2020 Home Buyers and Sellers Generational Trends. Visualization of data by Betterment. Some things you can do to help ensure you stay in your home long enough to at least break even include: If you’re buying a home in an area you don’t know very well, consider renting in the neighborhood first to make sure you actually enjoy living there. Think ahead and make sure the home makes sense for you four years from now, not just you today. Are you planning on having kids soon? Might your elderly parents move in with you? How stable is your job? All of these are good questions to consider. Don’t rush your home purchase. Take your time and think through this very large decision. The phrase “measure twice, cut once” is very applicable to home purchases. Calculate your monthly affordability The upfront costs are just one component of home affordability. The other is the ongoing monthly costs. Betterment recommends building a financial plan to determine how much home you can afford while still achieving your other financial goals. But if you don’t have a financial plan, we recommend not exceeding a debt-to-income (DTI) ratio of 36%. In other words, you take your monthly debt payments (including your housing costs), and divide them by your gross monthly income. Lenders often use this as one factor when it comes to approving you for a mortgage. Debt income ratios There are lots of rules in terms of what counts as income and what counts as debt. These rules are all outlined in parts of Fannie Mae’s Selling Guide and Freddie Mac’s Seller/Servicer Guide. While the above formula is just an estimate, it is helpful for planning purposes. In certain cases Fannie Mae and Freddie Mac will allow debt-to-income ratios as high as 45%-50%. But just because you can get approved for that, doesn’t mean it makes financial sense to do so. Keep in mind that the lender’s concern is your ability to repay the money they lent you. They are far less concerned with whether or not you can also afford to retire or send your kids to college. The debt to income ratio calculation also doesn’t factor in income taxes or home repairs, both of which can be significant. This is all to say that using DTI ratios to calculate home affordability may be an okay starting point, but they fail to capture many key inputs for calculating how much you personally can afford. We outline our preferred alternative below, but if you do choose to use a DTI ratio, we recommend using a maximum of 36%. That means all of your debts—including your housing payment—should not exceed 36% of your gross income. In our opinion, the best way to determine how much home you can afford is to build a financial plan. That way, you can identify your various financial goals, and calculate how much you need to be saving on a regular basis to achieve those goals. With the confidence that your other goals are on-track, any excess cash flow can be used towards monthly housing costs. Think of this as starting with your financial goals, and then backing into home affordability, instead of the other way around. Wrapping things up If owning a home is important to you, the five steps in this guide can help you make a wiser purchasing decision: Have an emergency fund of at least three months’ worth of expenses to help with unexpected maintenance and emergencies. Choose a fixed-rate mortgage to help keep your budget stable. Save for a minimum 20% down payment to avoid PMI, and plan for paying ~2% in closing costs. Don’t buy a home unless you plan to own it for at least 4 years. Otherwise, you are not likely to break even after you factor in the various costs of homeownership. Build a financial plan to determine your monthly affordability, but as a starting point, don’t exceed a debt-to-income ratio of 36%. -

![]()

How To Compare Financial Advisors

How To Compare Financial Advisors Oct 31, 2024 8:00:00 AM Think fiduciary first—and don’t settle for surface-level answers to questions on investing philosophy, performance and personalization. In 1 minute “Financial advisor” is kind of a gray area in the professional world. Many different types of professionals share this title, despite having very different qualifications, regulations, and motives. Bottom line: you want a financial advisor who is also a fiduciary. Fiduciaries are legally bound to act in your best interest and disclose conflicts of interest upfront. But even then, it’s worth taking time to learn about their approach to financial advice. What’s their philosophy? What tools do they use to help you reach your goals? How do your goals affect their decisions? Some financial advisors are more accessible than others, too. Ask what you should expect from your interactions with them. How often can you adjust your portfolio? Will they adjust your risk as you get closer to your goal? Every financial advisor should be able to talk you through how they measure performance and what you should expect from them. But don’t settle for surface-level answers. Challenge them to tell you about performance at different levels of risk, using time-weighted returns. Ultimately, you want a financial advisor you can trust to help you reach your goals. In 5 minutes In this guide, we’ll explain: Financial advisor fees Approaches to financial advice Evaluating investment performance Tax advisors You want to make the most of your finances. And you probably have some financial goals you’d like to accomplish. A financial advisor helps with both of these things. But choose the wrong advisor, and you may find yourself going backward, with your goals getting further away. (At the very least, you won’t make as much progress.) Many people focus on historical performance as they compare potential advisors. That‘s understandable. But unless you’re looking at decades of performance data and net investor returns, you’re not getting a good look at what to expect over time. And there are plenty of other factors that affect which advisor is right for you. For starters, let’s talk fees. Take a closer look at their fees Fees can have a major impact on how much money you actually take away. And it’s not just management fees that you need to consider. There could be fees for every trade. Or additional costs for trades within a fund. Plus you’ll want to look at expense ratios—the percentage of your investment that goes toward all the fund’s expenses. These costs can vary widely between robo-advisors, traditional advisors, do-it-yourself ETFs, and mutual funds. And you have to pay them every year. Basically what it comes down to is: how does your financial advisor get paid? Put another way, how will you have to pay for their services? Compare their qualifications Unfortunately, “financial advisor” is a bit of a catch-all term. It describes professionals who may have a variety of certifications and backgrounds. Not everyone who calls themselves a financial advisor has the same regulations, expertise, motivation, or approach. In fact, some aren’t even legally required to act in your best interest! They can choose the investments that benefit them the most instead of the ones that are most likely to help you reach your goals. A fiduciary, however, is a type of financial advisor that’s legally obligated to do two things: Make decisions based on what’s in your best interest Tell you if there’s ever a conflict of interest If you’re going to work with a traditional advisor, you should ask them about their qualifications. At Betterment, we recommend engaging with a fiduciary who is a Certified Financial Planner™ (CFP®), a designation that has requirements for years of experience and continuing education – and has a high standard in quality and ethical financial planning advice. Consider their approach to financial advice and investing There’s more than one school of thought when it comes to investing and financial planning. And there are many different investment vehicles a financial advisor could use to manage your money. So two excellent fiduciaries may have very different ideas of what’s in your best interest. For example, hedge funds work well for some investors, but they’re too risky and expensive for many people. The main thing is to find an advisor whose approach aligns with your goals. How do they ensure that your risk level fits your timeline? How do they diversify your portfolio to help protect your finances? How do they respond to market volatility as prices rise and fall? You want an advisor who makes decisions based on what you’re trying to accomplish, not what’s best for some cookie-cutter investment strategy. It’s also important to learn more about what working with them looks like. How often will you interact? How frequently can you review and modify your account? What ongoing actions do you need to take? The answers to these questions will vary depending on advisor service levels, so make sure they sound realistic to you. For example, Betterment recommends you check-in on your investment allocations once per quarter. If you feel more comfortable with having an in-depth relationship, you can opt for our Premium plan, which offers unlimited calls and emails with our team of CFP® professionals. Evaluate portfolio performance Financial advisors should be transparent about performance. They should have clear explanations for discrepancies between expected and actual returns of an investment. But if you only ask generic questions about what a portfolio returns, the numbers may sound better than they actually are. Ask each financial advisor to walk you through the returns associated with portfolios at various levels of risk. Additionally, consider using time-weighted return statistics when comparing investments. Time-weighted returns aren’t affected by the amount and timing of deposits and withdrawals. The harder an advisor makes it to understand performance (and your net returns), the less likely it is that your investments will meet your expectations. What about tax advisors? A good financial advisor should also be able to structure your investments in a tax-efficient manner. As a few examples, Betterment offers strategies such as tax loss harvesting, HSAs, municipal bonds, Roth IRA conversions, and more. However, there is a distinction between a tax-savvy financial advisor and an actual licensed tax professional. Most financial advisors are not trained or licensed to actually file your taxes for you, or to give advice on all areas of the tax code. For that level of detail, you would be wise to consider working with a true tax professional in addition to your financial advisor. When searching for a tax professional, the designations to look out for include a CPA, Enrolled Agent or a licensed tax attorney. Lastly, your financial advisor and your tax professional should be transparent with one another. You want to ensure both are on the same page and aren’t catching one another by surprise. For example, if your financial advisor is tax loss harvesting for you, it’s probably wise to inform your tax professional about that. Financial expertise you can trust At Betterment, our investing experts and technology help clients build a diversified portfolio that’s right for them, then keep it optimized all year long. To top it all off, we’re a fiduciary—we always focus on your best interest. While our technology combines automation with personalization, you can also get one-on-one advice from our financial experts with an advice package or our Premium plan.