The savvy saving move for your excess cash

And why taking the “lump sum” leap may be in your best interest

We're living in strange financial times. Inflation has taken a huge bite out of our purchasing power, yet investors are sitting on record amounts of cash, the same cash that's worth 14% less than it was just three years ago.

High interest rates explain a lot of it. Who wouldn't be tempted by a 5% yield for simply socking away their money?

But interest rates change, and we very well could be coming out of a period of high rates, leaving some savers with lower yields and more cash than they know what to do with.

So let's start there—how much cash do you really need? Then, what should you do with the excess?

How much cash do you really need?

Cash serves three main purposes:

- Paying the bills. The average American household, as an example, spends roughly $6,000 a month.

- Providing a safety net. Most advisors (including us) recommend keeping at least three months' worth of expenses in an emergency fund.

- Purchasing big-ticket items. Think vacations, cars, and homes.

Your spending levels may differ, but for the typical American, that's $24,000 in cash, plus any more needed for major purchases.

If you're more risk averse—and if you're reading this, you just might be—then by all means add more buffer. It's your money! Try a six-month emergency fund. If you’re a freelancer and your income fluctuates month-to-month, consider nine months.

Beyond that, however, you're paying a premium for cash that’s not earmarked for any specific purpose, and the cost is two-fold.

- Your cash, as mentioned earlier, is very likely losing value each day thanks to inflation, even historically-normal levels of inflation.

- Then there's the opportunity cost. You're missing out on the potential gains of the market.

And the historical difference in yields between cash and stocks is stark, to say the least. The MSCI World Index, as good a proxy for the global stock market as there is, has generated a 8.5% annual yield since 1988. High-yield savings accounts, on the other hand, even at today’s record highs, trail that by a solid three percentage points.

So once you've identified your excess cash, and you’ve set your sights on putting it to better use, where do you go from there?

What should you do with the excess?

Say hello to lump sum deposits.

Investing by way of a lump sum deposit can feel like a leap of faith. Like diving into the deep end rather than slowly wading into shallow waters. And it feels that way for a reason! All investing comes with risk.

But when you have extra cash lying around and available to invest, diving in is more likely to produce better returns over the long term, even accounting for the possibility of short-term market volatility.

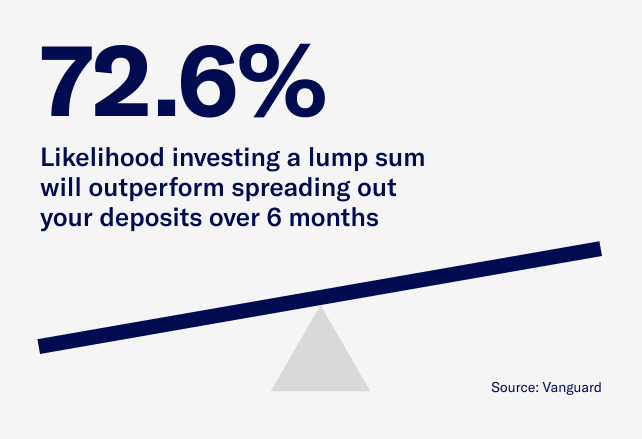

Vanguard crunched the numbers and found that nearly three-fourths of the time, the scales tipped in favor of making a lump sum deposit vs. spreading things out over six months.

The practice of regularly investing a fixed amount is called dollar cost averaging (DCA), and it’s designed for a different scenario altogether: investing your regular cash flow. DCA can help you start and sustain a savings habit, buy more shares of an investment when prices are low, and rebalance your portfolio more cost effectively.

The practice of regularly investing a fixed amount is called dollar cost averaging (DCA), and it’s designed for a different scenario altogether: investing your regular cash flow. DCA can help you start and sustain a savings habit, buy more shares of an investment when prices are low, and rebalance your portfolio more cost effectively.

But in the meantime, if you’ve got excess cash, diving in with a lump sum deposit makes the most sense, mathematically-speaking.

And remember it’s not an either-or proposition! Savvy savers employ both strategies—they dollar cost average their cash flow, and they invest lump sums as they appear. Because in the end, both serve the same goal of building long-term wealth.