The Goldman Sachs Smart Beta portfolio methodology

The Goldman Sachs Smart Beta portfolio is meant for investors who seek to outperform a market-cap portfolio strategy in the long term, despite periods of underperformance.

Our Smart Beta portfolio sourced from Goldman Sachs Asset Management helps meet the preference of our customers who are willing to take on additional risks to potentially outperform a market capitalization strategy.

The Goldman Sachs Smart Beta portfolio strategy reflects the same underlying principles that have always guided the core Betterment portfolio strategy—investing in a globally diversified portfolio of stocks and bonds. The difference is that the Goldman Sachs Smart Beta portfolio strategy seeks higher returns by moving away from market capitalization weightings in and across equity asset classes.

What is a smart beta portfolio strategy?

Portfolio strategies are often described as either passive or active. Most index funds and exchange-traded funds (ETFs) are categorized as “passive” because they track the returns of the underlying market based on asset class. By contrast, many mutual funds or hedge fund strategies are considered “active” because an advisor or fund manager is actively buying and selling specific securities to attempt to beat their benchmark index. The result is a dichotomy in which a portfolio gets labeled as passive or active, and investors infer possible performance and risk based on that label.

In reality, portfolio strategies reside within a plane where passive and active are just two cardinal directions. Smart beta funds, like the ones that were selected for this portfolio, seek to achieve their performance by falling somewhere in between extreme passive and active, using a set of characteristics, called “factors,” with an objective of outperformance while managing risk. The portfolio strategy also incorporates other passive funds to achieve appropriate diversification.

This alternative approach is also the reason for the name “smart beta.” An analyst comparing conventional portfolio strategies usually operates by assessing beta, which measures the sensitivity of the security to the overall market. In developing a smart beta approach, the performance of the overall market is seen as just one of many factors that affects returns. By identifying a range of factors that may drive return potential, we seek the potential to outperform the market in the long term while managing reasonable risk.

When we develop and select new portfolio strategies at Betterment, we operate using five core principles of investing:

- Personalized planning

- A balance of cost and value

- Diversification

- Tax optimization

- Behavioral discipline

The Goldman Sachs Smart Beta portfolio strategy aligns with all five of these principles, but the strategy configures cost, value, and diversification in a different way than Betterment’s Core portfolio. In order to pursue higher overall return potential, the smart beta strategy adds additional systematic risk factors that are summarized in the next section.

Additionally, the strategy seeks to achieve global diversification across stocks and bonds while overweighting specific exposures to securities which may not be included in Betterment’s Core portfolio. Meanwhile, with the smart beta portfolio, we’re able to continue delivering all of Betterment’s tax-efficiency features, such as tax loss harvesting and Tax Coordination.

Investing in smart beta strategies has traditionally been more expensive than a pure market cap-weighted portfolio. While the Goldman Sachs Smart Beta portfolio strategy has a far lower cost than the industry average, it is slightly more expensive than the core Betterment portfolio strategy.

Because a smart beta portfolio incorporates the use of additional systematic risk factors, we typically only recommend this portfolio for investors who have a high risk tolerance and plan to save for the long term.

Which “factors” drive the Goldman Sachs Smart Beta portfolio strategy?

Factors are the variables that drive performance and risk in a smart beta portfolio strategy. If you think of risk as the currency you spend to achieve potential returns, factors are what determine the underlying value of that currency.

We can dissect a portfolio’s return into a linear combination of factors. In academic literature and practitioner research (Research Affiliates, AQR), factors have been shown to drive historical returns. These analyses form the backbone of our advice for using the smart beta portfolio strategy.

Factors reflect economically intuitive reasons and behavioral biases of investors in aggregate, all of which have been well studied in academic literature. Most of the equity ETFs used in this portfolio are Goldman Sachs ActiveBetaTM, which are Goldman Sach’s factor-based smart beta equity funds. Stocks are scored according to four factors where the highest scoring companies have greater weighting. The weights are then constrained to be in-line with the market. These factors include:

Good Value

When a company has solid earnings (after-tax net income), but has a relatively low price (i.e., there’s a relatively low demand by the universe of investors), its stock is considered to have good value. Allocating to stocks based on this factor gives investors exposure to companies that have high growth potential but have been overlooked by other investors.

High Quality

High-quality companies demonstrate sustainable profitability over time. By investing based on this factor, the portfolio includes exposure to companies with strong fundamentals (e.g., strong and stable revenue and earnings) and potential for consistent returns.

Low Volatility

Stocks with low volatility tend to avoid extreme swings up or down in price. What may seem counterintuitive is that these stocks also tend to have higher returns than high volatility stocks. This is recognized as a persistent anomaly among academic researchers because the higher the volatility of the asset, the higher its return should be (according to standard financial theory). Low-volatility stocks are often overlooked by investors, as they usually don’t increase in value substantially when the overall market is trending higher. In contrast, investors seem to have a systematic preference for high-volatility stocks based on the data and, as a result, the demand increases these stocks’ prices and therefore reduces their future returns.

Strong Momentum

Stocks with strong momentum have recently been trending strongly upward in price. It is well documented that stocks tend to trend for some time, and investing in these types of stocks allows you to take advantage of these trends. It’s important to define the momentum factor with precision since securities can also exhibit reversion to the mean—meaning that “what goes up must come down.”

How can these factors lead to future outperformance?

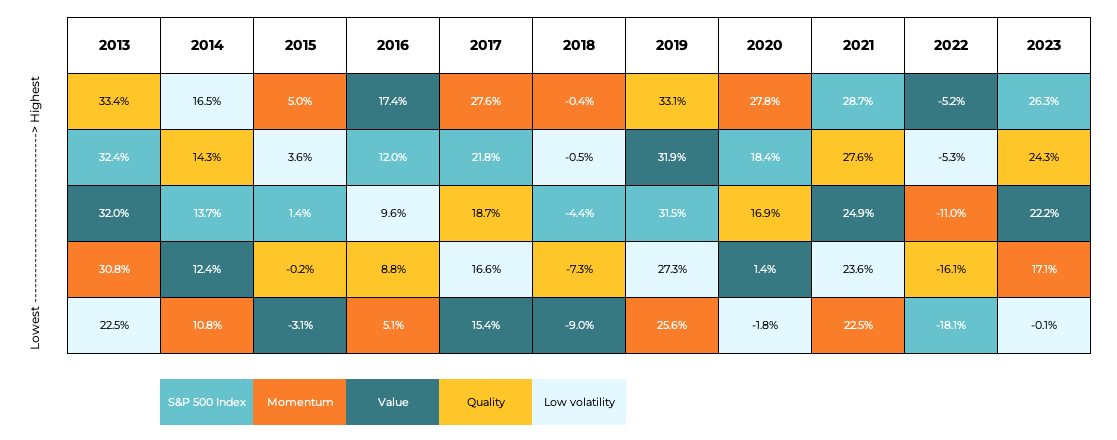

In specific terms, the factors that drive the smart beta portfolio strategy—while having varying performance year-to-year relative to their market cap benchmark—have potential to outperform their respective benchmarks when combined. You can see an example of this in the chart of yearly factor returns for US large cap stocks below. You’ll see that the ranking of the four factor indexes varies over time, rotating outperformance over the S&P 500 Index in nearly all of the years.

Performance Ranking of Smart Beta Indices vs. S&P 500

Benchmark performance information is based on annual returns data from Bloomberg as of January 2013 to December 2023.

Performance is provided for illustrative purposes only, and the factor returns it references are not necessarily the same factor returns in the Goldman Sachs Smart Beta portfolio strategy. For each year, we have ranked the annual performance of each factor alongside the S&P 500 as a comparison. The returns for Momentum, Quality, Value and Low volatility are calculated from the S&P 500 Momentum Total Return Index, S&P 500 Quality Total Return Index, S&P 500 Value Total Return Index, and S&P Low-volatility Total Return Index, respectively. This calculation was not provided by Goldman Sachs Asset Management and does not reflect or predict future performance. Moreover, this analysis does not include fees, liquidity, and other costs associated with actually holding a portfolio based on these exact indexes that would lower returns of the portfolio. Past performance is not indicative of future results. You cannot invest directly in the index. Content is meant for educational purposes and not intended to be taken as advice or a recommendation for any specific investment product or strategy.

Why invest in a smart beta portfolio?

As we’ve explained above, we generally only advise using Betterment’s choice smart beta strategy if you’re looking for a more tactical strategy that seeks to outperform a market-cap portfolio strategy in the long term despite potential periods of underperformance.

For investors who fall into such a scenario, our analysis, supported by academic and practitioner literature, shows that the four factors above may provide higher return potential than a portfolio that uses market weighting as its only factor. While each factor weighted in the smart beta portfolio strategy has specific associated risks, some of these risks have low or negative correlation, which allow for the portfolio design to offset constituent risks and control the overall portfolio risk.

Of course, these risks and correlations are based on historical analysis, and no advisor could guarantee their outlook for the future. An investor who elects the Goldman Sachs Smart Beta portfolio strategy should understand that the potential losses of this strategy can be greater than those of market benchmarks. In the year of the dot-com collapse of 2000, for example, when the S&P 500 dropped by 10%, the S&P 500 Momentum Index lost 21%.

Given the systematic risks involved, we believe the evidence that shows that smart beta factors may lead to higher expected return potential relative to market cap benchmarks, and thus, we are proud to offer the portfolio for customers with long investing horizons.