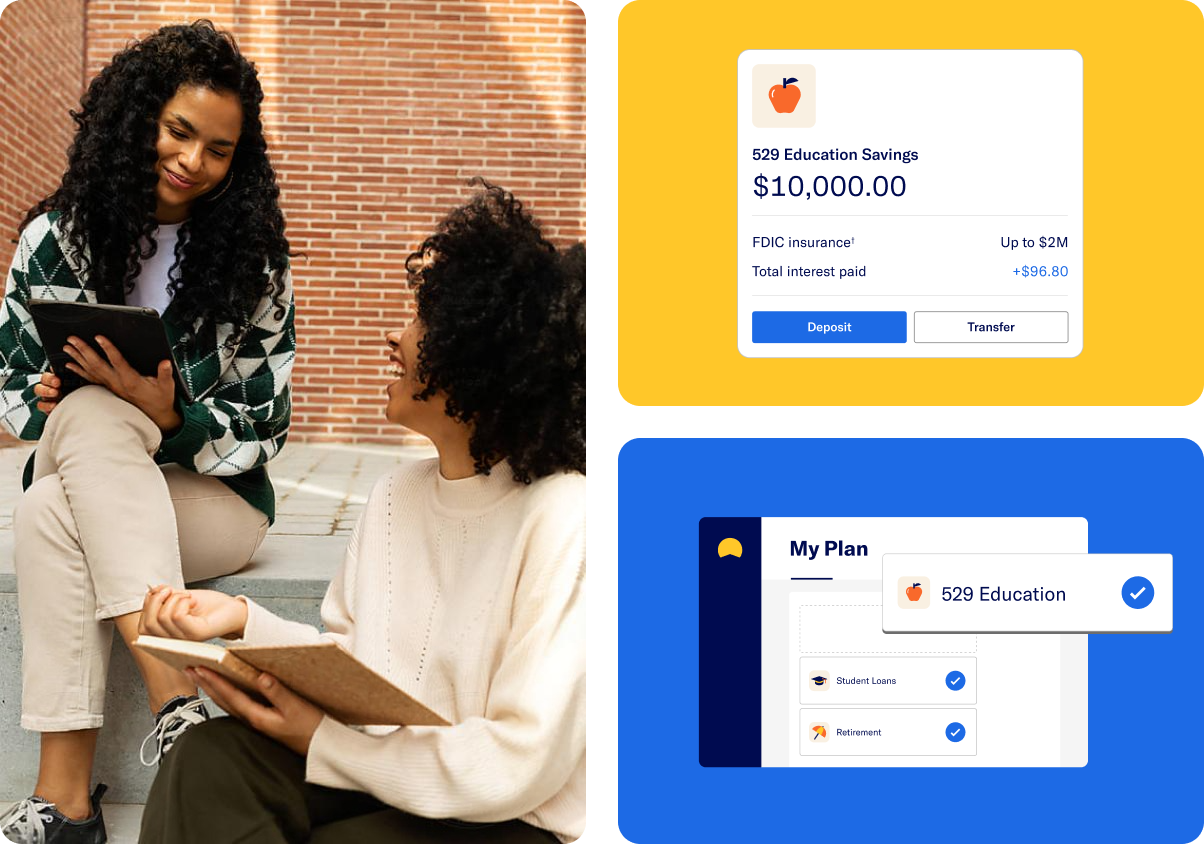

Help employees save for education with a 529

Including tax-advantaged 529s in your benefits package helps employees tackle rising education costs and shows your commitment to their financial health.

Why a 529 is a smart option for your employees.

Whether employees are going to school themselves or planning to put their kids through college, our 529 boasts benefits for both you and your employees.

-

Benefits for employees

Tax-advantaged.

Employee investments grow free of federal taxes, with some states offering even more tax savings.

Flexible usage.

Employees can put savings towards tuition and fees, supplies, and even student loan repayments.

Professionally managed.

Employees get their 529 handled by a plan investment manager who automatically adjusts their savings over time.

-

Benefits for you

Easy-to-manage experience

529s integrate into your existing benefits platform so you can manage everything seamlessly.

Unique employee benefit

Gain an edge in recruiting and retention with a benefit hard for employees to find elsewhere.

Optional match to grow

Choose to offer a contribution match to support employees’ educational savings efforts further.

Saving for college is a top concern among parents in the workforce.

The price of higher education continues to grow.

Parents find they have to make compromises to save

49% of parents prioritized saving for their kids’ education over retirement.

But companies aren’t meeting employees’ concerns

Set your business apart with a 529.