Employee experience A 401(k) your employees will love

Betterment delivers its award-winning retail platform modified for 401(k) plans. We simplify how to onboard, engage, and help employees achieve the retirement they want.

We handle onboarding, you focus on your business.

Get proactive, guided onboarding for current employees and future hires.

We engage your team with a series of emails and webinars designed to

educate and motivate them to set up their accounts and start contributing.

A robust engagement program helps employees achieve long-term success.

In-app retirement advice.

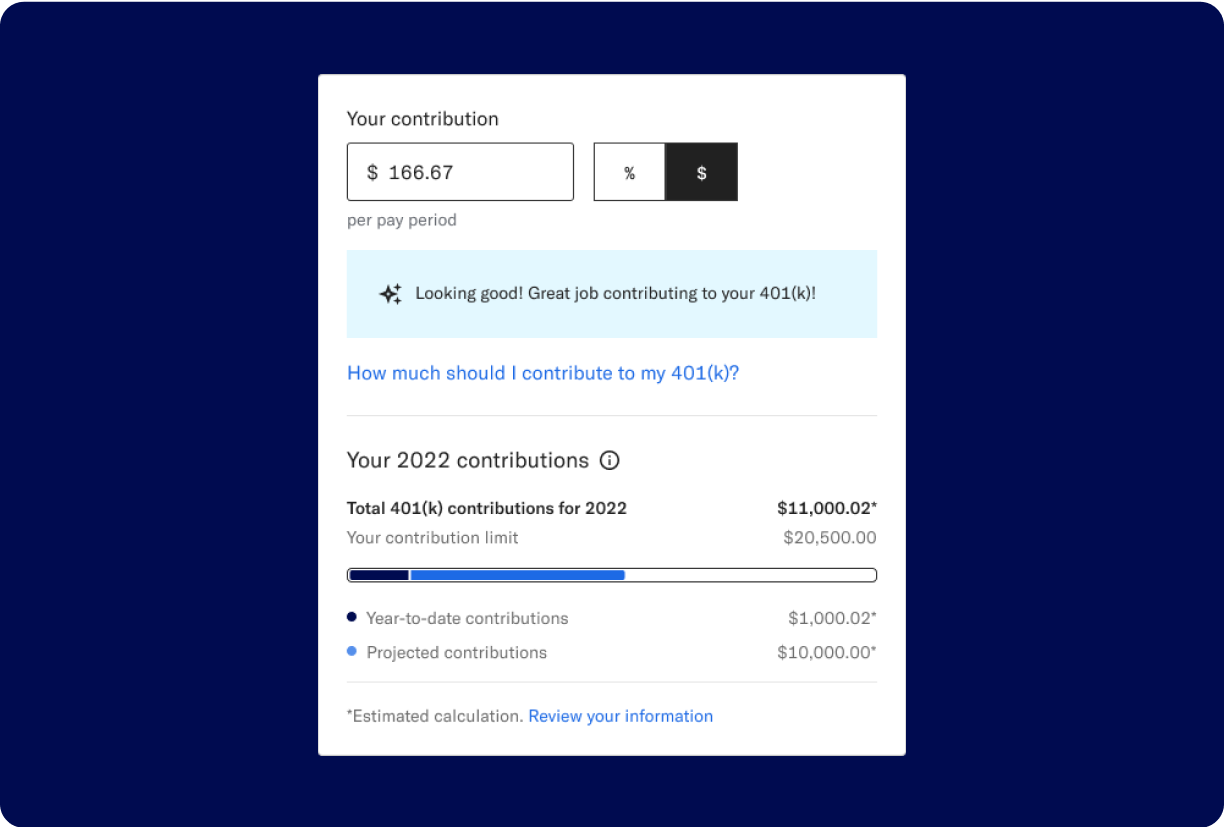

Employees get ongoing retirement guidance with planning tools, contribution tracking, and goal forecasting to see their retirement progress.

Comprehensive email campaigns.

We engage employees with customized emails about a range of 401(k)- related topics, including rollover options, boosting contribution rates, and more.

Educational resources.

Employees can access a wealth of videos, webinars, and articles to answer questions and help them level up their finances.

Technology and support to empower your employees

-

Delightful and highly-rated app

Employees get a bird’s-eye-view of their finances where they can link external accounts, update deferral rates, and track their progress—anytime, anywhere. -

Employee support team

Specialists are available via call, email, or chat

to help resolve their specific needs.

"A few things that stand out are the ease of use for the app, the financial planning tools and the customer service are the best!"

Kyle C.

Additional investing and saving accounts, at no extra cost.

- Automated investing

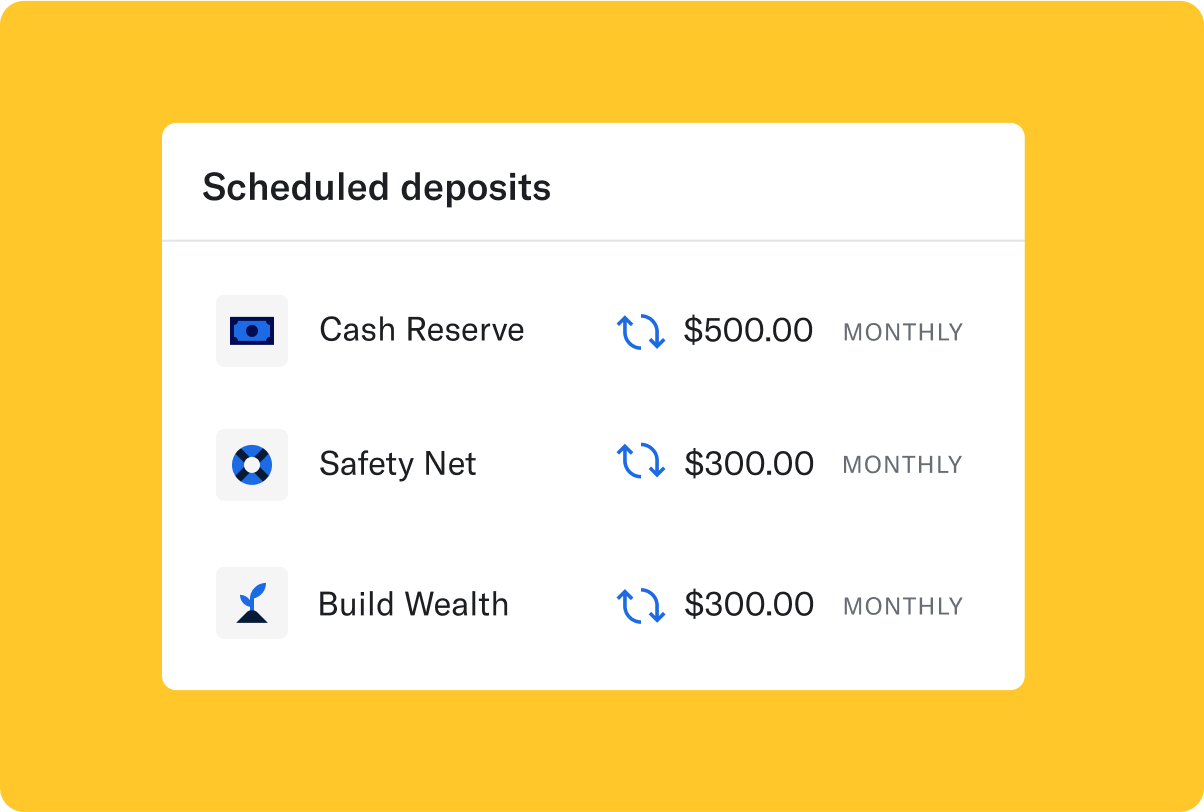

There’s more to investing than just retirement. Employees can invest for other goals with diversified, expert-built portfolios. - High-yield cash savings

Whether building an emergency fund or growing their savings, employees can earn more interest with our high-yield Cash Reserve. - IRAs

Employers can augment their 401(k) savings with a tax-advantaged traditional, Roth, or SEP IRA.

Cash Reserve offered by Betterment LLC and requires a Betterment Securities brokerage account. Betterment is not a bank. FDIC insurance provided by Program Banks, subject to certain conditions. Learn more.