Get a sound start with our selection of ETFs.

At the core of our approach to building a diversified, risk-adjusted portfolio strategy are cost-efficient ETFs. Employees can select from these assets and adjust the weights to meet their investing needs.

-

U.S. Total Stock Market

U.S. Large Cap Stocks

U.S. Mid Cap Stocks

U.S. Small Cap Stocks

U.S. Value Stocks - Large Cap

U.S. Value Stocks - Mid Cap

U.S. Value Stocks - Small Cap

U.S. Growth Stocks - Large Cap

Innovative Technology Stocks

U.S. Dividend Grower Stocks

NASDAQ Stocks

Investing backed by technology to support your employees.

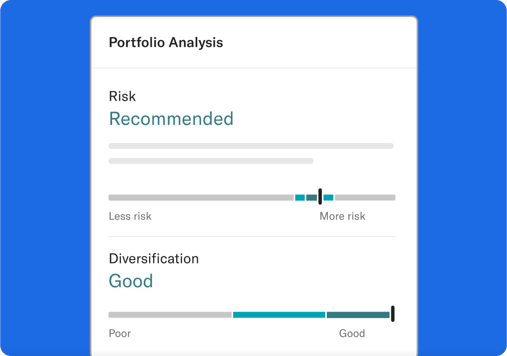

Risk management through rebalancing

We continually monitor and rebalance investments, keeping each employee aligned with their intended risk level.

Tax-efficient investing

Tools like Tax Loss Harvesting+ and asset location help minimize employees’ taxes and maximize their returns.

Advice as they build their portfolios

We provide a recommended target allocation to balance risk and growth, helping employees invest confidently for the future. We also assess how their portfolio's diversification measures up to an optimal globally diversified portfolio.