Employer Resources

Sort by:

-

![]()

April 2025 market update: Tariff and investment insights

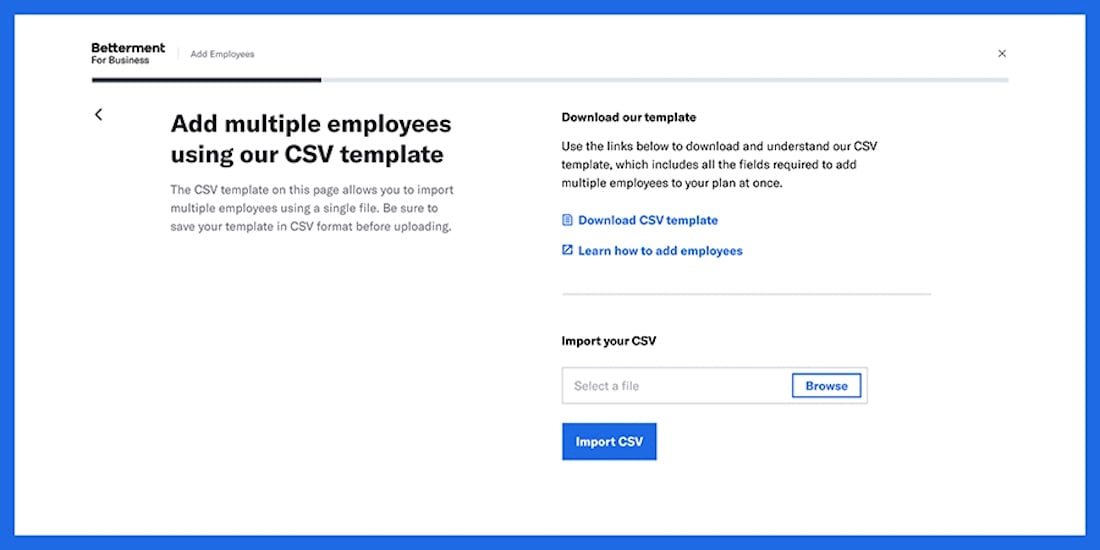

April 2025 market update: Tariff and investment insights BlogPost 188394050843 April 2025 market update: Tariff and investment insights Rising tariffs, market swings, and policy shifts fuel economic uncertainty—discover how diversification can help investors stay grounded. Former European Central Bank President Mario Draghi once described the challenge of decision making amidst ambiguity as: “You just do what you think is right and you temper…. In other words, in a dark room, you move with tiny steps.” For business leaders and investors, the economic landscape has appeared murky of late, and for good reason… The threat of tariffs has become a reality, not just a negotiating tactic, causing uncertainty to pervade expectations for the economy and markets. President Trump just rolled out his most expansive round of global tariffs yet, at levels worse than anticipated ahead of the April 2 announcement. Although USMCA-compliant goods—like dairy and sugar imports from Canada and Mexico—will continue to enjoy a 0% tariff under the trade agreement, non-compliant goods will be subject to higher tariffs. Other countries, including major U.S. trade partners such as China, Taiwan, Vietnam, India, and South Korea, will face significant tariff rates on exports to the U.S., all apparently over 20%. China has notably retaliated against the imposition of tariffs, levying their own 34% tariff on all imports from the US, matching the level of the White House’s reciprocal tariffs on Chinese products. Federal Reserve Chair Jerome Powell has warned that the impact of new tariffs is likely to be significantly larger than expected and could cause higher inflation as well as weaker growth. Read: Making sense of market volatility The state of economic uncertainty But uncertainty isn’t just showing up in market action—it’s in all kinds of data sets. To track uncertainty, researchers create indices that analyze both news reports and economic forecasts, using data to measure the extent of uncertainty. Two key measures—Headline Policy Uncertainty and Trade Policy Uncertainty (shown above)—reveal that economic uncertainty has climbed to its highest levels since the pandemic. Trade policy, specifically, has jumped to levels never before seen in as long as there has been available data, going back to 1960. As the economy shows signs of slowing (growth in Q4 of 2024 was +2.3% compared to +3.1% in Q3, and +3.0% in Q2), the ripple effects of uncertainty are showing up in key indicators of consumer and manufacturer sentiment. In the first quarter of 2025, the University of Michigan’s Consumer Sentiment Index for employment conditions nosedived to levels last observed during the global financial crisis of 2008. U.S. equity markets have clearly taken notice. The S&P 500 has sold off sharply, and even other risk assets such as crypto have plummeted. And, all of the Magnificent 7—the cohort of megatech stocks, including Amazon, Apple, Meta, and Google—have slid over 20% from the latest 52-week high. So, what does this mean for the market While markets have taken a shellacking so far this year, international stocks have served as some consolation. Year-to-date, international developed market stocks have outperformed their U.S. peers by over 10 percentage points. After U.S. stocks outpaced global markets in 2024, the tariff turbulence, as well as more attractive valuations and new stimulus measures from China and Germany, have flipped the script in early 2025. What does this mean for investors Diversify, diversify, diversify. While this kind of noise around trade policy isn’t normal, the market experiencing bouts of volatility is normal and something investors are required to manage over time. Although other asset classes, like international stocks and bonds, have not matched the performance of U.S. stocks in recent years, these assets can help dampen volatility in a period of heightened uncertainty. Diversification can help investors avoid being tied to any individual stock, asset type, or even a country’s performance. For example, the Betterment Core portfolio is globally diversified and has delivered 9.0% annual returns (after fees) since inception.1 Although the future might seem more unknowable right now, one thing we do know is that trying to time the market as policies change is a fool’s errand. Our investing team is here to keep you up-to-date on macro-trends and market insights. -

![]()

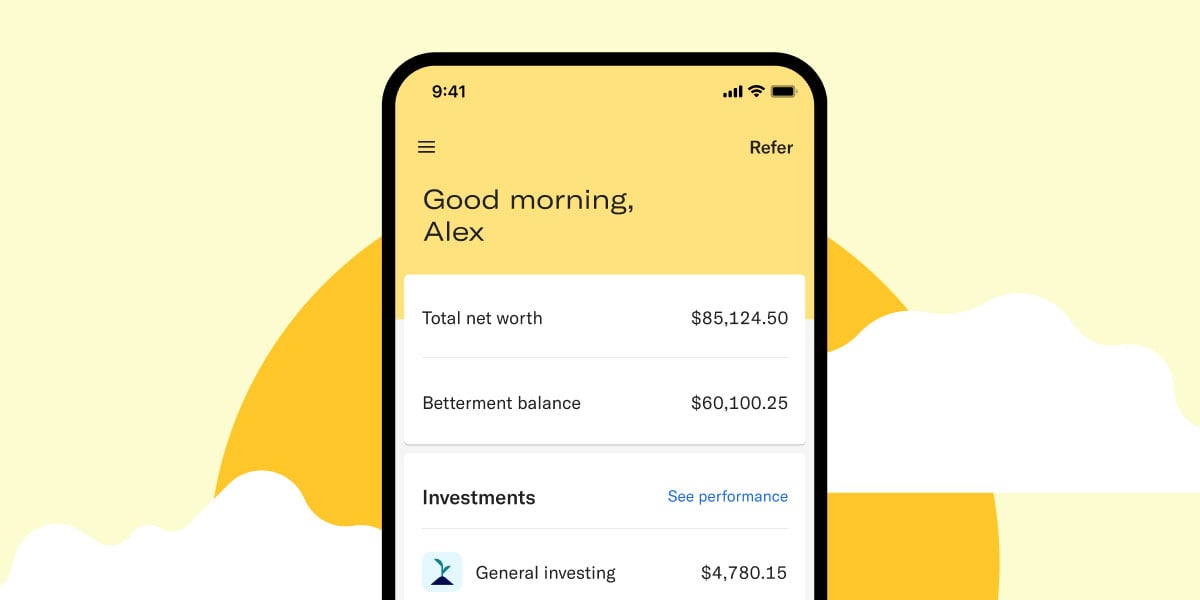

The 401(k) employee engagement starter kit

The 401(k) employee engagement starter kit BlogPost 187977869752 The 401(k) employee engagement starter kit Here are 7 simple tools to help your employees get the most out of their 401(k) plans at Betterment. If you offer a 401(k) plan, making sure that your employees are engaged not only can improve their financial lives, but your business as well. With workers juggling competing financial priorities, we’ve seen that financial anxiety can impact people in every aspect of their lives, including their capacity to perform effectively in their jobs. Our 2024 Retirement Readiness report uncovered the need for employers to engage their employees when it comes to 401(k) education: Not only will engagement help your employees manage financial stress, but it will also help boost your workforce’s overall performance. If “employee engagement” sounds like a lot of work, don’t sweat it, we’ve got you covered. Use the seven tools in this playbook to help your employees feel comfortable navigating their 401(k) from day one. Your 401(k) starter kit: 7 tools to engage your employees Video: How to claim your Betterment 401(k) - Share this video with your employees. It walks them through claiming their account. Your employees will also receive a series of emails from Betterment, inviting them to claim their 401(k) account, but getting this video directly from you is a great way to nudge those who haven’t yet done so.. Video: Getting started webinar - Every month, our team at Betterment offers a live webinar where we walk through your employees’ 401(k). We’ll cover the importance of saving for retirement, how to use the platform, provide additional resources, and answer any questions your team may have. Resource center: Betterment.com/my401k - From 401(k) tricks to investing tips, our resource center has dozens of articles, videos, and more to help your employees navigate their financial lives. Video & article: How to pick a contribution rate - “How much from each paycheck should go into my account?” is a question every plan enrollee asks themselves (and we help them answer it). We highlight key considerations for employees to address when selecting a contribution rate. Article: How to rollover a 401(k) from a former employer - For employees with a 401(k) from an old employer, a rollover can sound daunting. In fact, in our Retirement Readiness Report, we found that 17% of employees don’t even know where their old 401(k) is, 22% don’t know how to do a rollover, and a whopping 34% with an old 401(k) plan have withdrawn it as cash, instead of rolling it into another retirement plan. In this article, we walk through why a rollover may make sense and the process to get started. Article: How to set up an emergency fund along with your 401(k) - Along with a 401(k), it’s recommended that people have three to six months of expenses saved in an emergency fund. We show employees three steps to help them figure out a number that works in their budget. . Article: Understanding required minimum distributions - For employees closer to retirement, required minimum distributions (RMDs) are important to start thinking about. In this article, we explain why the IRS requires RMDs and how they work. Start sharing these resources with your employees today. Together, we can help employees take control of their financial future. -

![]()

Plan sponsor checklist: Key considerations for mergers & acquisitions

Plan sponsor checklist: Key considerations for mergers & acquisitions BlogPost 186681879090 Plan sponsor checklist: Key considerations for mergers & acquisitions Navigate 401(k) challenges during mergers and acquisitions with this guide for plan sponsors on compliance, plan decisions, and employee communication. M&A and your 401(k) Mergers and acquisitions (M&A) can shake things up at a company—including your 401(k) plan. But, with a bit of foresight, plan sponsors can help manage the transition smoothly. Here’s what you need to know to stay compliant and on track. Planning ahead Before an M&A deal, it’s important to evaluate the retirement plans currently in place for both companies. Oftentimes, in the sale agreement, there will be language that dictates what happens to the seller’s 401(k) plan.For instance, it may be noted that the seller’s plan will be terminated before the sale date. This helps ensure that all plan assets are distributed or rolled over appropriately, minimizing potential complications for the acquiring company and employees. Alternatively, the buyer may decide to merge the seller’s plan into their own, which requires a thorough review of both plans to identify differences in features, investment options, and compliance requirements. Understanding these details early allows plan sponsors to make informed decisions, reduce risks, and streamline the process for employees impacted by the transition. Understanding asset purchase vs stock purchase The structure of an M&A deal—whether an asset purchase or a stock purchase—can impact how 401(k) plans are handled during the transition. Asset purchases: The buyer chooses which assets and liabilities to take on, which will be defined in the asset purchase agreement. The seller usually keeps their retirement plan. Stock purchases: The buyer takes control of the entire company, including its retirement plan, which may require more attention post-merger. Think of it like buying a house: In an asset sale, the buyer can choose which furniture or fixtures to keep in the house. In a stock sale, the buyer takes everything. Now, let’s look at the asset sale from the seller’s perspective. The seller retains ownership and responsibility of the 401(k) plan. Even if the seller’s company is going out of business, their 401(k) plan needs to be addressed. Until the two plans are fully combined, the seller still has the risk and liability over the existing plan. Next, let’s look at a stock sale from the buyer’s perspective. During a stock sale, the buyer will inherit everything from the seller, including the 401(k) plan. In this scenario, it is common for the seller’s plan to be terminated before the sale. This would ensure that the buyer does not inherit an active 401(k) plan. If they do inherit the plan, they may be taking on more risk. In this scenario a buyer would now have two active 401(k) plans that they would have to manage. Terminating the seller’s plan is not possible once the buyer “owns” the 401(k) plan, since this would now be considered a “successor 401(k) plan”. The buyer has three options in this scenario: Freeze the acquired plan. This requires full maintenance of the plan, including the accounts, documents, annual Form 5500 filing, as well as any audits, but stops further contributions Merge the acquired plan into the buyer’s plan. This requires a close review of the merged assets, as well as the plan provisions to determine if any changes are needed to accommodate protected benefits. Keep the acquired plan as is. This means the buyer now operates two separate 401(k) plans, and has two sets of documents, two 5500 filings, and potentially two audits. The plan sponsor would also need to combine the plans for compliance testing purposes. How to manage risks and costs As with any major transition, managing costs and mitigating risks requires careful planning and collaboration. The acquiring party will want to budget for extra admin expenses during an M&A transition, such as recordkeeping fees and legal costs, to avoid unexpected financial strain. It’s also crucial to document key decisions to ensure compliance and reduce fiduciary (and litigation) risks. It could be beneficial to partner with experts, like ERISA attorneys, financial advisors, and recordkeepers, who can help you navigate the complexities of transitioning your 401(k) plan. Planning and understanding are everything. You’ll want to share updates with your employees in a timely manner. Let them know the timelines and what they can expect as you start the M&A transition. If you can, it would be helpful to designate an HR person for extra support during the merger, to help them make decisions about their retirement savings. While it is important to ensure participants have a seamless experience during any M&A situation, you want to plan ahead to avoid expensive corrections. The retirement plans involved in M&A deals can be tricky, but by analyzing the details, staying compliant, and seeking expert help, you can set up the merger or acquisition for long-term success. -

![]()

2025 portfolio updates: What plan sponsors need to know

2025 portfolio updates: What plan sponsors need to know BlogPost 185245695849 2025 portfolio updates: What plan sponsors need to know Small updates to Core, Value Tilt, SRI, and Innovative Tech are coming soon. As part of Betterment’s investment oversight serving as your 3(38) investment fiduciary, our Investing team regularly reviews and updates our portfolio strategies to align with changing market conditions. As a fiduciary, Betterment is required to act in your employees’ best interests. We do this in part by regularly adjusting our portfolios' asset allocations, or the specific weights of asset classes (i.e., stocks and bonds) and subasset classes (large- cap stocks, long-term bonds, etc.). For 2025, we are implementing strategic adjustments across multiple portfolios that are guided by updated capital market assumptions and asset class expectations. Let’s quickly walk through our approach to portfolio management, and then we’ll preview the changes coming in the weeks ahead. How we evaluate and manage our portfolios Betterment runs a rigorous, quantitative process to formulate long-term expectations for both the returns and risk levels of various asset classes. Our aim is to maximize your expected return relative to risk, so that you’re compensated appropriately for the level of risk you take with your investing. From there, we simulate thousands of paths for the market, and average the optimal asset allocations for each to build more robust portfolio weights. This “Monte Carlo” technique is ideal for the areas of life where random variables are everywhere, areas like capital markets. It’s important to reiterate that things like interest rate shifts and federal fiscal policy can drive short-term market volatility in the months and year ahead, our portfolios are managed with a long-term outlook. We don’t chase trends, but rather we focus on helping your employees reach their investment goals. 2025 updates This year's portfolio updates, while much smaller in scope and scale than last year's, are no less important. Let’s take a closer look: Core Value Tilt All three SRI portfolios Innovative Technology Here's what's changing: More U.S. exposure While we don't advise going all-in on American markets, the forecasted risk-adjusted return for the U.S. remains strong in the long run (think: decades) relative to international markets. So similar to last year’s portfolio updates, we’re dialing down the international exposure for most portfolios. Those portfolios will see: Small increases in U.S. stock and bond allocations Small decreases in international emerging market stocks and bonds Small decreases in international developed market bonds More short-term corporate bonds The biggest change this year will be felt by portfolios with larger bond allocations. We expect U.S. short-term, high-grade corporate bonds to offer higher yields without undue increases in long-term risk, so we’re increasing the exposure to them while decreasing the weight of short-term U.S. Treasuries. The yields on these types of treasury bonds, which mature in a year or less, tend to fall right along with interest rates, and a lower interest rate environment is still expected in the long run. New innovation ETF Separately, we’re diversifying the Innovative Technology portfolio by adding a new actively-managed fund. This new ETF builds on themes like AI and biotech while adding more exposure to large-cap stocks and the Information Technology sector (hardware, software, etc.) as a whole. What this means for your employees The great thing about technology like ours is that it makes implementing updated portfolios simple. Our automated rebalancing will tax-efficiently transition employees’ portfolios to the new target weights over time. It’s yet another example of how we make it easy to be invested. Additional resources If you’d like to learn more about our approach to investing, you might want to check out these articles: Portfolio Construction Process: Core, Value, Innovative Technology ETF Selection Methodology SRI Methodology Innovative Technology Article and disclosures You can always review our 401(k) investment options here. -

![]()

Everything You Need to Know about Form 5500

Everything You Need to Know about Form 5500 BlogPost 56841825973 Everything You Need to Know about Form 5500 If you’d like to get a general idea of what it takes to file a Form 5500 for a 401(k) plan, here are the top five things you need to know. As you can imagine, the Internal Revenue Service (IRS) and the Department of Labor (DOL) like to keep tabs on employee benefit plans to make sure everything is running smoothly and there are no signs of impropriety. One of the ways they do that is with Form 5500. You may be wondering: What is Form 5500? Well, Form 5500—otherwise known as the Annual Return/Report of Employee Benefit Plan—discloses details about the financial condition, investments, and operations of the plan. Not only for retirement plans, Form 5500 must be filed by the employer or plan administrator of any pension or welfare benefit plan covered by ERISA, including 401(k) plans, pension plans, medical plans, dental plans, and life insurance plans, among others. If you’re a Betterment client, you don’t need to worry about many of these Form 5500 details because we do the heavy lifting for you. But if you’d like to get a general idea of what it takes to file a Form 5500 for a 401(k) plan, here are the top five things you need to know. 1. There are three different versions of Form 5500—each with its own unique requirements. Betterment drafts a signature-ready Form 5500 on your behalf. But if you were to do it yourself, you would select from one of the following form types based on your plan type: Form 5500-EZ – If you have a one-participant 401(k) plan —also known as a “solo 401(k) plan”—that only covers you (and your spouse if applicable), you can file this form. Have a solo 401(k) plan with less than $250,000 in plan assets as of the last day of the plan year? No need to file a Form 5500-EZ (or any Form 5500 at all). Lucky you! Form 5500-SF– If you have a small 401(k) plan—which is generally defined as a plan that covers fewer than 100 participants on the first day of the plan year—you can file a simplified version of the Form 5500 if it also meets the following requirements: It satisfies the independent audit waiver requirements established by the DOL. It is 100% invested in eligible plan assets—such as mutual funds and variable annuities—with determinable fair values. It doesn’t hold employer securities. Form 5500– If you have a large 401(k) plan—which is generally defined as a plan that covers more than 100 participants with assets in the plan—or a small 401(k) plan that doesn’t meet the Form 5500-EZ or Form 5500-SF filing requirements, you must file a long-form Form 5500. Unlike Form 5500-EZ and Form 5500-SF, Form 5500 is not a single-form return. Instead, you must file the form along with specific schedules and attachments, including: Schedule A -- Insurance information Schedule C -- Service provider information Schedule D -- Participating plan information Schedule G -- Financial transaction schedules Schedule H or I -- Financial information (Schedule I for small plan) Schedule R -- Retirement plan information Independent Audit Report Certain forms or attachments may not be required for your plan. Is your plan on the cusp of being a small (or large) plan? If your plan has between 80 and 120 participants on the first day of the plan year, you can benefit from the 80-120 Rule. The rule states that you can file the Form 5500 in the same category (i.e., small or large plan) as the prior year’s return. That’s good news, because it makes it possible for large retirement plans with between 100 and 120 participants to classify themselves as “small plans” and avoid the time and expense of completing the independent audit report. 2. You must file the Form 5500 by a certain due date (or file for an extension). You must file your plan’s Form 5500 by the last business day of the seventh month following the end of the plan year. For example, if your plan year ends on December 31, you should file your Form 5500 by July 31 of the following year to avoid late fees and penalties. If you’re a Betterment client, you’ll receive your signature-ready Form 5500 with ample time to submit it. Plus, we’ll communicate with you frequently to help you meet the filing deadline. But if you need a little extra time, Betterment can file for an extension on your behalf using Form 5558—but you have to do it by the original deadline for the Form 5500. The extension affords you another two and a half months to file your form. (Using the prior example, that would give you until October 15 to get your form in order.) What if you happen to miss the Form 5500 filing deadline? If you miss the filing deadline, you’ll be subject to penalties from both the IRS and the DOL: The IRS penalty for late filing is $250 per day, up to a maximum of $150,000. The DOL penalty for late filing can run up to $2,259 per day, with no maximum. There are also additional penalties for plan sponsors that willfully decline to file. That said, through the DOL’s Delinquent Filer Voluntary Compliance Program (DFVCP), plan sponsors can avoid higher civil penalty assessments by satisfying the program’s requirements. Under this special program, the maximum penalty for a single late Form 5500 is $750 for small 401(k) plans and $2,000 for large 401(k) plans. The DFVCP also includes a “per plan” cap, which limits the penalty to $1,500 for small plans and $4,000 for large plans regardless of the number of late Form 5500s filed at the same time. 3. The Form 5500 filing process is done electronically in most cases. For your ease and convenience, Form 5500 and Form 5500-SF must be filed electronically using the DOL’s EFAST2 processing system (there are a few exceptions). EFAST2 is accessible through the agency’s website or via vendors that integrate with the system. To ensure you can file your Form 5500 quickly, accurately, and securely, Betterment facilitates the filing for you. Whether you file electronically or via hard copy, remember to keep a signed copy of your Form 5500 and all of its schedules on file. Once you file Form 5500, your work isn’t quite done. You must also provide your employees with a Summary Annual Report (SAR), which describes the value of your plan’s assets, any administrative costs, and other details from your Form 5500 return. The SAR is due to participants within nine months after the end of the plan year. (If you file an extension for your Form 5500, the SAR deadline also extends to December 15.) For example, if your plan year ends on December 31 and you submitted your Form 5500 by July 31, you would need to deliver the SAR to your plan participants by September 30. While you can provide it as a hard copy or digitally, you’ll need participants’ prior consent to send it digitally. In addition, participants may request a copy of the plan’s full Form 5500 return at any time. As a public document, it’s accessible to anyone via the DOL website. 4. It’s easy to make mistakes on the Form 5500 (but we aim to help you avoid them). As with any bureaucratic form, mistakes are common and may cause issues for your plan or your organization. Mistakes may include: Errors of omission such as forgetting to indicate the number of plan participants Errors of timing such as indicating a plan has been terminated because a resolution has been filed, yet there are still assets in the plan Errors of accuracy involving plan characteristic codes and reconciling financial information Errors of misinterpretation or lack of information such as whether there have been any accidental excess contributions above the federal limits or failure to report any missed contributions or late deposits Want to avoid making errors on your Form 5500? Betterment prepares the form on your behalf, so all you need to do is review, sign, and submit—it’s as simple as that. 5. Betterment drafts a signature-ready Form 5500 for you, including related schedules When it comes to Form 5500, Betterment does nearly all the work for you. Specifically, we: Prepare a signature-ready Form 5500 that has all the necessary information and related schedules Remind you of the submission deadline so you file it on time Guide you on how to file the Form 5500 (it only takes a few clicks) and make sure it’s accepted by the DOL Provide you with an SAR that’s ready for you to distribute to your participants Ready to learn more about how Betterment can help you with your Form 5500 (and so much more)? Let’s talk. -

![]()

Understanding 401(k) Annual Compliance Testing

Understanding 401(k) Annual Compliance Testing BlogPost 56841825967 Understanding 401(k) Annual Compliance Testing These yearly required tests are meant to ensure everyone is benefiting from your 401(k) plan. If your company has a 401(k) plan—or if you’re considering starting one in the future—you may have heard about annual compliance testing, also known as nondiscrimination testing. But what is it really? And how can you help your plan pass these important compliance tests? Read on for our explanation. What is annual compliance testing? Mandated by ERISA, annual compliance testing helps ensure that 401(k) plans benefit all employees—not just business owners or highly compensated employees. Because the government provides significant tax benefits through 401(k) plans, it wants to ensure that these perks don’t disproportionately favor high earners. We’ll dive deeper into nondiscrimination testing, but let’s first discuss an important component of 401(k) compliance: contribution limits. What contribution limits do I need to know about? Because of the tax advantages given to 401(k) plan contributions, the IRS puts a limit on the amount that employers and employees can contribute. Here’s a quick overview: Limit What is it? Notes for 2024 plan year Employee contribution limits (“402g”) Limits the amount a participant may contribute to the 401(k) plan. The personal limit is based on the calendar year.1 Note that traditional (pre-tax) and Roth (post-tax) contributions are added together (there aren’t separate limits for each). $23,000 is the maximum amount participants may contribute to their 401(k) plan for 2024. Participants age 50 or older during the year may defer an additional $7,500 in “catch-up” contributions if permitted by the plan. Total contribution limit (“415”) Limits the total contributions allocated to an eligible participant for the year. This includes employee contributions, all employer contributions and forfeiture allocations. Total employee and employer contributions cannot exceed total employee compensation for the year. $69,0002 plus up to $7,500 in catch-up contributions (if permitted by the plan) for 2024. Cannot exceed total compensation. Employer contribution limit Employers’ total contributions (excluding employee deferrals) may not exceed 25% of eligible compensation for the plan year. N/A This limit is an IRS imposed limit based on the calendar year. Plans that use a ‘plan year’ not ending December 31st base their allocation limit on the year in which the plan year ends. This is different from the compensation limits, which are based on the start of the plan year. Adjusted annually; see most recent Cost of Living Adjustments table here. What is nondiscrimination testing designed to achieve? Essentially, nondiscrimination testing has three main goals: To measure employee retirement plan participation levels to ensure that the plan isn’t “discriminating” against lower-income employees. To ensure that people of all income levels have equal access to—and awareness of—the company’s retirement plan. To encourage employers to be good stewards of their employees’ futures by making any necessary adjustments to level the playing field (such as matching employees’ contributions) Where do I begin? Before you embark on annual compliance testing, you’ll need to categorize your employees by income level and employee status. Here are the main categories (and acronyms): Highly compensated employee (HCE)—According to the IRS, an employee who meets one or more of the following criteria: Prior (lookback) year compensation—For plan years ending in 2024, earned over $150,000 in the preceding plan year; some plans may limit this to the top 20% of earners (known as the top-paid group election), which would be outlined in your plan document; or Ownership in current or prior year—Owns more than 5% of (1) outstanding corporate stock, (2) voting power across corporate stock, or (3) capital or profits of an entity not considered a corporation Non-highly compensated employee (NHCE)—Someone who does not meet the above criteria. Key employee—According to the IRS, an employee who meets one or more of the following criteria during the plan year: Ownership over 5%—Owns more than 5% of (1) outstanding corporate stock, (2) voting power across corporate stock, or (3) capital or profits of an entity not considered a corporation. Ownership over 1%—Owns more than 1% of the stock, voting power, capital, or profits, and earned more than $150,000. Officer—An officer of the employer who earned more than $220,000 for 2024; this may be limited to the lesser of 50 officers or the greater of 3 or 10% of the employee count. Non-key employee—Someone who does not meet the above criteria. What are the tests that need to be performed? Below are the tests typically performed for 401(k) plans. Betterment will perform each of these tests on behalf of your plan and inform you of the results. 1. 410(b) Coverage Tests—These tests determine the ratios of employees eligible for and benefitting from the plan to show that the plan fairly covers your employee base. Specifically, these tests review the ratio of HCEs benefitting from the plan against the ratio of NHCEs benefitting from the plan. Typically, the NHCE percentage benefitting must be at least 70% or 0.7 times the percentage of HCEs considered benefitting for the year, or further testing is required. These annual tests are performed across different contribution types: employee contributions, employer matching contributions, after-tax contributions, and non-elective (employer, non-matching) contributions. 2. Actual deferral percentage (ADP) test—Compares the average salary deferral of HCEs to that of non-highly compensated employees (NHCEs). This test includes pre-tax and Roth deferrals, but not catch-up contributions. Essentially, it measures the level of engagement of HCEs vs. NHCEs to make sure that high income earners aren’t saving at a significantly higher rate than the rest of the employee base. Specifically, two percentages are calculated: HCE ADP—The average deferral rate (ADR) for each HCE is calculated by dividing the employee’s elective deferrals by their salary. The HCE ADP is calculated by averaging the ADR for all eligible HCEs (even those who chose not to defer). NHCE ADP—The average deferral rate (ADR) for each NHCE is calculated by dividing the employee’s elective deferrals by their salary. The NHCE ADP is calculated by averaging the ADR for all eligible NHCEs (even those who chose not to defer). The following table shows how the IRS limits the disparity between HCE and NHCE average contribution rates. For example, if the NHCEs contributed 3%, the HCEs can only defer 5% (or less) on average. NHCE ADP HCE ADP 2% or less → NHCE% x 2 2-8% → NHCE% + 2 more than 8% → NHCE% x 1.25 3. Actual contribution percentage (ACP) test—Compares the average employer contributions received by HCEs and NHCEs. (So this test is only required if you make employer contributions.) Conveniently, the calculations and breakdowns are the same as with the ADP test, but the average contribution rate calculation includes both employer matching contributions and after-tax contributions. 4. Top-heavy determination—Evaluates whether or not the total value of the plan accounts of “key employees” is more than 60% of the value of all plan assets. Simply put, it analyzes the accrued benefits between two groups: Key employees and non-Key employees. A plan is considered top-heavy when the total value (account balance with adjustments related to rollovers, terminated accounts, and a five-year lookback of distributions) of the Key employees’ plan accounts is greater than 60% of the total value (also adjusted as noted above) of the plan assets, as of the end of the prior plan year. (Exception: The first plan year is determined based on the last day of that year). If the plan is considered top-heavy for the year, employers must make a contribution to non-key employees. The top-heavy minimum contribution is the lesser of 3% of compensation or the highest percentage contributed for key employees. However, this can be reduced or avoided if no key employee makes or receives contributions for the year (including forfeiture allocations). What happens if my plan fails these tests? If your plan fails the ADP and ACP tests, you’ll need to fix the imbalance by returning 401(k) plan contributions to your HCEs or by making additional employer contributions to your NHCEs. If you have to refund contributions, that money may be subject to state and federal taxes. Plus, if you don’t correct the issue in a timely manner, there could also be a 10% penalty fee and other serious ramifications. Why is it common to fail testing? Small and mid-size businesses may struggle to pass if they have a relatively high number of HCEs. If HCEs contribute a lot to the plan, but non-highly compensated employees (NHCEs) don’t, there’s a chance that the 401(k) plan will not pass nondiscrimination testing. It’s actually easier for large companies to pass the tests because they have many employees at varying income levels contributing to the plan. How can I help my plan pass the tests? It pays to prepare for nondiscrimination testing. Here are a few tips that can make a difference: Add automatic enrollment —By adding an auto-enrollment feature to your 401(k) plan, you can automatically deduct elective deferrals from your employees’ wages unless they opt out. It’s a simple way to boost participation rates and help your employees start saving. In fact, the government is getting more behind auto-enrollment; SECURE 2.0 mandates plans that launched after Dec. 29, 2022 add automatic enrollment to the plan by Jan. 1, 2025. Add a Safe Harbor provision to your 401(k) plan—Safe Harbor plan design typically makes compliance testing easier to pass. Make it easy to enroll in your plan—Is your 401(k) plan enrollment process confusing and cumbersome? If so, it might be stopping employees from enrolling. Consider partnering with a tech-savvy provider like Betterment that can help your employees enroll quickly and easily—and support them on every step of their retirement saving journey. Learn more now. Encourage your employees to save—Whether you send emails or host employee meetings, it’s important to get the word out about saving for retirement through the plan. That’s because the more NHCEs that participate, the better chance you have of passing the nondiscrimination tests. (Plus, you’re helping your team save for their future.) Add automatic escalation - By adding automatic escalation, you can ensure that participants who are automatically enrolled in the plan continue to increase their deferral rate by 1% annually until a cap is reached (generally 15%). It’s a great way to increase your employees retirement savings and to engage them in the plan. How can Betterment help? Nondiscrimination testing and many other aspects of 401(k) plan administration can be complex. That’s why we do everything in our power to help make it easier for you as a plan sponsor. We help with year-end compliance testing, including ADP/ACP testing, top-heavy testing, annual additions testing, deferral limit testing, and coverage testing. With our intuitive online platform, you can better manage your plan and get the support you need along the way. Ready to learn more? Let's talk. Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Betterment or its authors endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. The information contained in this article is meant to be informational only and does not constitute investment or tax advice. -

![]()

Meeting Your 401(k) Fiduciary Responsibilities

Meeting Your 401(k) Fiduciary Responsibilities BlogPost 56844814753 Meeting Your 401(k) Fiduciary Responsibilities To help your business avoid any pitfalls, this guide outlines your 401(k) fiduciary responsibilities. If your company has or is considering starting a 401(k) plan, you’ve probably heard the term “fiduciary.” But what does being a fiduciary mean to you as a 401(k) plan sponsor? Simply put, it means that you’re obligated to act in the best interests of your 401(k) plan, its participants and beneficiaries. It’s serious business. If fiduciary responsibilities aren’t managed properly, your business could face legal and financial ramifications. To help you avoid any pitfalls, this guide outlines ways to understand your 401(k) fiduciary responsibilities. A brief history of the 401(k) plan and fiduciary duties When Congress passed the Revenue Act of 1978, it included the little-known provision that eventually led to the 401(k) plan. The Employee Retirement Income Security Act of 1974, referred to as ERISA, is a companion federal law that contains rules designed to protect employee savings by requiring individuals and entities that manage a retirement plan, referred to as “fiduciaries,” to follow strict standards of conduct. Among other responsibilities, fiduciaries must always act with care and prudence and not engage in any conflicts of interest with regard to plan assets. When you adopt a 401(k) plan for your employees as a plan sponsor, you become an ERISA fiduciary. And in exchange for helping employees build retirement savings, you and your employees receive special tax benefits, as outlined in the Internal Revenue Code. The IRS oversees the tax rules, and the Department of Labor (DOL) provides guidance on ERISA fiduciary requirements and enforcement. As you can imagine, following these rules can sometimes feel like navigating a maze. But the good news is that an experienced 401(k) provider like Betterment can help you understand your fiduciary duties, and may even shoulder some of the responsibility for you as we’ll explain below. Key fiduciary responsibilities No matter the size of your company or 401(k) plan, every plan sponsor has fiduciary duties, broadly categorized as follows: You are considered the “named fiduciary” with overall responsibility for the plan, including selecting and monitoring plan investments. You are also considered the “plan administrator” with fiduciary authority and discretion over how the plan is operated. As a fiduciary, you must follow the high standards of conduct required by ERISA when managing your plan’s investments and when making decisions about plan operations. There are five cornerstone rules you must follow: Act in employees’ best interests—Every decision you make about your plan must be solely based on what is best for your participants and their beneficiaries. Act prudently—Prudence requires that you be knowledgeable about retirement plan investments and administration. If you do not have the expertise to handle all of these responsibilities, you will need to engage the services of those who do, such as investment managers or recordkeepers. Diversify plan investments—You must diversify investments to help reduce the risk of large losses to plan assets. Follow the plan documents—You must follow the terms of the plan document when operating your plan (unless they are inconsistent with ERISA). Pay only reasonable plan fees—Fees from plan assets must be reasonable and for services that are necessary for your plan. Detailed DOL rules outline the steps you must take to fulfill this fiduciary responsibility, which include reviewing fees on an ongoing basis, collecting and evaluating fee disclosures for investments and service provider’s revenue, and comparing (or benchmarking) fees to help ensure they are reasonable. You don’t have to pay a lot to get a quality 401(k) plan Fees can really chip away at your participants’ account balances (and have a detrimental impact on their futures). So take care to help ensure that the services you’re paying for are necessary for the plan and that the fees paid from plan assets are reasonable. To determine what’s reasonable you may need to benchmark the fees against those of other similar retirement plans. And if you have an existing 401(k) plan, it’s important to take note of the “ongoing” responsibility to review fees to determine their reasonableness. The industry is continually evolving and what may have been reasonable fees from one provider may no longer be the case! It’s your responsibility as a plan fiduciary to keep an eye on what’s available. Why it’s important to fulfill your fiduciary duties Put simply, it’s incredibly important that you meet your 401(k) fiduciary responsibilities. Not only are your actions critical to your employees’ futures, but there are also serious consequences if you fail to fulfill your fiduciary duties. In fact, plan participants and other plan fiduciaries have the right to sue to correct any financial wrongdoing. If the plan is mismanaged, you face a two-fold risk: Civil and criminal action (including expensive penalties) from the government and the potentially high price of rectifying the issue. Under ERISA, fiduciaries are personally liable for plan losses caused by a breach of fiduciary responsibilities and may be required to: Restore plan losses (including interest) Pay expenses relating to correction of inappropriate actions. While your fiduciary responsibilities can seem daunting, the good news is that ERISA also allows you to delegate many of your fiduciary responsibilities to 401(k) professionals like Betterment. Additional fiduciary responsibilities On top of the five cornerstone rules listed above, there are a few other things on a fiduciary’s to-do list: Deposit participant contributions in a timely manner —This may seem simple, but it’s extremely important to do it quickly and accurately. Specifically, you must deposit participants’ contributions to your plan’s trust account on the earliest date they can be reasonably segregated from general corporate assets. The timelines differ depending on your plan size: Small plan—If your plan has fewer than 100 participants, a deposit is considered timely if it’s made within seven business days from the date the contributions are withheld from employees’ wages. Large plan— If your plan has 100 participants or more, you must deposit contributions as soon as possible after you withhold the money from employees’ wages. It must be “timely,” which means typically within a few days. For all businesses, the deposit should never occur later than the 15th business day of the month after the contributions were withheld from employee wages. However, contributions should be deposited well before then. Fulfill your reporting and disclosure requirements—Under ERISA, you are required to fulfill specific reporting requirements. While the paperwork can be complicated, an experienced 401(k) provider like Betterment should be able to help to guide you through the process. It’s important to note that if required government reports—such as Form 5500—aren’t filed in a timely manner, you may be assessed financial penalties. Plus, when required disclosures—such as Safe Harbor notices—aren’t provided to participants in a timely manner, the consequences can also be severe including civil penalties, plan disqualification by the IRS, or participant lawsuits. Get help shouldering your fiduciary responsibilities For most employers, day-to-day business responsibilities leave little time for the extensive investment research, analysis, and fee benchmarking that’s required to responsibly manage a 401(k) plan. Because of this, many companies hire outside experts to take on certain fiduciary responsibilities. However, even the act of hiring 401(k) experts is a fiduciary decision! Even though you can appoint others to carry out many of your fiduciary responsibilities, you can never fully transfer or eliminate your role as an ERISA fiduciary. Take a look at the chart below to see the different fiduciary roles—and what that would mean for you as the employer: Defined in ERISA section Outside expert Employer No Fiduciary Status Disclaims any fiduciary investment responsibility Retains sole fiduciary responsibility and liability 3(21) Shares fiduciary investment responsibility in the form of investment recommendations Retains responsibility for final investment discretion 3(38) Assumes full discretionary authority for assets and investments Relieves employer of investment fiduciary responsibility (yet still needs to monitor the 3(38) provider) 3(16) Has discretionary responsibility for certain administrative aspects of the plan Relieves employer of certain plan administration responsibilities Betterment can help Betterment serves as a 3(38) investment manager for all plans that we manage and can serve as a limited 3(16) fiduciary with agreed upon administrative tasks as well. This means less work for you and your staff, so you can focus on your business. Get in touch today if you’re interested in bringing a Betterment 401(k) to your organization: 401k@betterment.com. -

![]()

401(k) Glossary of Terms

401(k) Glossary of Terms BlogPost 56841935656 401(k) Glossary of Terms Whether you're offering a 401(k) for the first time or need a refresh on important terms, these definitions can help you make sense of industry jargon. 3(16) fiduciary: A fiduciary partner hired by an employer to handle a plan’s day-to-day administrative responsibilities and ensure that the plan remains in compliance with Department of Labor regulations. 3(21) fiduciary: An investment advisor who acts as co-fiduciary to review and make recommendations regarding a plan’s investment lineup. This fiduciary provides guidance but does not have the authority to make investment decisions. 3(38) fiduciary: A codified retirement plan fiduciary that’s responsible for choosing, managing, and overseeing the plan’s investment options. 401(k) administration costs: The expenses involved with the various aspects of running a 401(k) plan. Plan administration includes managing eligibility and enrollment, coordinating contributions, processing distributions and loans, preparing and delivering legally required notices and forms, and more. 401(k) committee charter: A document that describes the 401(k) committee’s responsibilities and authority. 401(k) compensation limit: The maximum amount of compensation that’s eligible to draw on for plan contributions, as determined by the IRS. 401(k) contribution limits: The maximum amount that a participant may contribute to an employer-sponsored 401(k) plan, as determined by the IRS. 401(k) force-out rule: Refers to a plan sponsor’s option to remove a former employee’s assets from the retirement plan. The sponsor has the option to “force out” these assets (into an IRA in the former employee’s name) if the assets are less than $5,000. 401(k) plan: An employer-sponsored retirement savings plan that allows participants to save money on a tax-advantaged basis. 401(k) plan fees: The various fees associated with a plan. These can include fees for investment management, plan administration, fiduciary services, and consulting fees. While some fees are applied at the plan level — that is, deducted from plan assets — others are charged directly to participant accounts. 401(k) plan fee benchmarking: The process of comparing a plan’s fees to those of other plans in similar industries with roughly equal assets and participation rates. This practice can help to determine if a plan’s fees are reasonable per ERISA requirements. 401(k) set-up costs: The expenses involved in establishing a 401(k) plan. These costs cover plan documents, recordkeeping, investment management, participant communication, and other essential aspects of the plan. 401(k) withdrawal: A distribution from a plan account. Because a 401(k) plan is designed to provide income during retirement, a participant generally may not make a withdrawal until age 59 ½ unless he or she terminates or retires; becomes disabled; or qualifies for a hardship withdrawal per IRS rules. Any other withdrawals before age 59 ½ are subject to a 10% penalty as well as regular income tax. 404(a)(5) fee disclosure: A notice issued by a plan sponsor that details information about investment fees. This notice, which is required of all plan sponsors by the Department of Labor, covers initial disclosure for new participants, new fees, and fee changes. 404(c) compliance: Refers to a participant’s (or beneficiary’s) right to choose the specific investments for 401(k) plan assets. Because the participant controls investment decisions, the plan fiduciary is not liable for investment losses. 408(b)(2) fee disclosure: A notice issued by a plan service provider that details the fees charged by the provider (and its affiliates or subcontractors) and reports any possible conflicts of interest. The Department of Labor requires all plan fiduciaries to issue this disclosure. Actual contribution percentage (ACP) test: A required compliance test that compares company matching contributions among highly compensated employees (HCEs) and non-highly compensated employees (NHCEs). Actual deferral percentage (ADP) test: A required compliance test that compares employee deferrals among highly compensated employees (HCEs) and non-highly compensated employees (NHCEs). Annual fee disclosure: A notice issued by a plan sponsor that details the plan’s fees and investments. This disclosure includes plan and individual fees that may be deducted from participant accounts, as well as information about the plan’s investments (performance, expenses, fees, and any applicable trade restrictions). Automated Clearing House (ACH): A banking network used to transfer funds between banks quickly and cost-efficiently. Automatic enrollment (ACA): An option that allows employers to automatically deduct elective deferrals into the plan from an employee’s wages unless the employee actively elects not to contribute or to contribute a different amount. Beneficiary: The person or persons who a participant chooses to receive the assets in a plan account if he or she dies. If the participant is married, the spouse is automatically the beneficiary unless the participant designates a different beneficiary (and signs a written waiver). If the participant is not married, the account will be paid to his or her estate if no beneficiary is on file. Blackout notice: An advance notice of an upcoming blackout period. ERISA rules require plan sponsors to notify participants of a blackout period at least 30 days in advance. Blackout period: A temporary period (three or more business days) during which a 401(k) plan is suspended, usually to accommodate a change in plan administrators. During this period, participants may not change investment options, make contributions or withdrawals, or request loans. Catch-up contributions: Contributions beyond the ordinary contribution limit, which are permitted to help people age 50 and older save more as they approach retirement. You can check the allowances for catch-up contributions here. Compensation: The amount of pay a participant receives from an employer. For purposes of 401(k) contribution calculations, only compensation is considered to be eligible. The plan document defines which form, for example the W-2, is referred to in determining the compensation amount. Constructive receipt: A payroll term that refers to the impending receipt of a paycheck. The paycheck has not yet been fully cleared for deposit in the employee’s bank account, but the employee has access to the funds. Deferrals: Another term for contributions made to a 401(k) account. Defined contribution plan: A tax-deferred retirement plan in which an employee or employer (or both) invest a fixed amount or percentage (of pay) in an account in the employee’s name. Participation in this type of plan is voluntary for the employee. A 401(k) plan is one type of tax-deferred defined contribution plan. Department of Labor (DOL): The federal government department that oversees employer-sponsored retirement plans as well as work-related issues including wages, hours worked, workplace safety, and unemployment and reemployment services. Distributions: A blanket term for any withdrawal from a 401(k) account. A distribution can include a required minimum distribution (RMD), a loan, a hardship withdrawal, a residential loan, or a qualified domestic relations order (QDRO). Docusign: A third-party platform used for exchanging signatures on documents, especially during plan onboarding. EIN: An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Eligible automatic enrollment arrangement (EACA): An automatic enrollment (ACA) plan that applies a default and uniform deferral percentage to all employees who do not opt out of the plan or provide any specific instructions about deferrals to the plan. Under this arrangement, the employer is required to provide employees with adequate notice about the plan and their rights regarding contributions and withdrawals. ERISA: Refers to the Employee Retirement Income Security Act of 1974, a federal law that requires individuals and entities that manage a retirement plan (fiduciaries) to follow strict standards of conduct. ERISA rules are designed to protect retirement plan participants and secure their access to benefits in the plan. Excess contributions: The amount of contributions to a plan that exceed the IRS contribution limit. Excess contributions made in any year (and their earnings) may be withdrawn without penalty by the tax filing deadline for that year, and the participant is then required to pay regular taxes on the amount withdrawn. Any excess contributions not withdrawn by the tax deadline are subject to a 6% excise tax every year they remain in the account. Exchange-traded fund (ETF): Passively managed index funds that feature low costs and high liquidity. ETFs make it easy to manage portfolios efficiently and effectively. All of Betterment’s 401(k) investment options are ETFs. Fee disclosure: Information about the various fees related to a 401(k) plan, including plan administration, fiduciary services, and investment management. Fee disclosure deadline: The date by which a plan sponsor must provide plan and investment-related fee disclosure information to participants. The DOL requires you to send your participant fee disclosure notice at least once in any 14-month period without regard to whether the plan operates on a calendar-year or fiscal-year basis. Fidelity bond: Also known as a fiduciary bond, this bond protects the plan from losses due to fraud or dishonesty. Every fiduciary who handles 401(k) plan funds is required to hold a fidelity bond. Fiduciary: An individual or entity that manages a retirement plan and is required to always act in the best interests of employees who save in the plan. In exchange for helping employees build retirement savings, employers and employees receive special tax benefits, as outlined in the Internal Revenue Code. When a company adopts a 401(k) plan for employees, it becomes an ERISA fiduciary and takes on two sets of fiduciary responsibilities: “Named fiduciary” with overall responsibility for the plan, including selecting and monitoring plan investments “Plan administrator” with fiduciary authority and discretion over how the plan is operated Most companies hire one or more outside experts (such as an investment advisor, investment manager, or third-party administrator) to help manage their fiduciary responsibilities. Form 5500: An informational document that a plan sponsor must prepare to disclose the identity of the plan sponsor (including EIN and plan number), characteristics of the plan (including auto-enrollment, matching contributions, profit-sharing, and other information), the numbers of eligible and active employees, plan assets, and fees. The plan sponsor must submit this form annually to the IRS and the Department of Labor, and must provide a summary to plan participants. Smaller plans (less than 100 employees) may instead file Form 5500-SF. Hardship withdrawal: A withdrawal before age 59 ½ intended to address a severe and immediate need (as defined by the IRS). To qualify for a hardship withdrawal, a participant must provide the employer with documentation (such as a medical bill, a rent invoice, funeral expenses) that shows the purpose and amount needed. If the hardship withdrawal is authorized, it must be limited to the amount needed (adjusted for taxes and penalties), may still be subject to early withdrawal penalties, is not eligible for rollover, and may not be repaid to the plan. Highly compensated employee (HCE): An employee who earned at least $155,000 in compensation from the plan sponsor during 2024, or owned more than 5% interest in the plan sponsor’s business at any time during the current or previous year (regardless of compensation). Inception to date (ITD): Refers to contribution amounts since the inception of a participant’s account. Internal Revenue Service (IRS): The U.S. federal agency that’s responsible for the collection of taxes and enforcement of tax laws. Most of the work of the IRS involves income taxes, both corporate and individual. Investment advice (ERISA ruling): The Department of Labor’s final ruling (revised in 2020) on what constitutes investment advice and what activities define the role of a fiduciary. Investment policy statement (IPS): A plan’s unique governing document, which details the characteristics of the plan and assists the plan sponsor in complying with ERISA requirements. The IPS should be written carefully, reviewed regularly, updated as needed, and adhered to closely. Key employee: An employee classification used in top-heavy testing. This is an employee who meets one of the following criteria: Ownership stake greater than 5% Ownership stake greater than 1% and annual compensation greater than $150,000 Officer with annual compensation greater than $200,000 (for 2022) Non-discrimination testing: Tests required by the IRS to ensure that a plan does not favor highly compensated employees (HCEs) over non-highly compensated employees (NHCEs). Non-elective contribution: An employer contribution to an employee’s plan account that’s made regardless of whether the employee makes a contribution. This type of contribution is not deducted from the employee’s paycheck. Non-highly compensated employee (NHCE): An employee who does not meet any of the criteria of a highly compensated employee (HCE). Plan sponsor: An organization that establishes and offers a 401(k) plan for its employees or members. Qualified default investment alternative (QDIA): The default investment for plan participants who don’t make an active investment selection. All 401(k) plans are required to have a QDIA. For Betterment’s 401(k), the QDIA is the Core Portfolio Strategy, and a customized risk level is set for each participant based on their age. Qualified domestic relations order (QDRO): A document that recognizes a spouse’s, former spouse’s, child’s, or dependent’s right to receive benefits from a participant’s retirement plan. Typically approved by a court judge, this document states how an account must be split or reassigned. Plan administrator: An individual or company responsible for the day-to-day responsibilities of 401(k) plan administration. Among the responsibilities of a plan administrator are compliance testing, maintenance of the plan document, and preparation of the Form 5500. Many of these responsibilities may be handled by the plan provider or a third-party administrator (TPA). Plan document: A document that describes a plan’s features and procedures. Specifically, this document identifies the type of plan, how it operates, and how it addresses the company’s unique needs and goals. Professional employer organization (PEO): A firm that provides small to medium-sized businesses with benefits-related and compliance-related services. Profit sharing: A type of defined contribution plan in which a plan sponsor contributes a portion of the company’s quarterly or annual profit to employee retirement accounts. This type of plan is often combined with an employer-sponsored retirement plan. Promissory note: A legal document that lays out the terms of a 401(k) loan or other financial obligation. Qualified non-elective contribution (QNEC): A contribution that a plan is required to make if it’s found to be top-heavy. Required minimum distribution (RMD): Refers to the requirement that an owner of a tax-deferred account begin making plan withdrawals each year starting at age 72. The first withdrawal must be made by April 1 of the year after the participant reaches age 72, and all subsequent annual withdrawals must be made by December 31. Rollover: A retirement account balance that is transferred directly from a previous employer’s qualified plan to the participant’s current plan. Consolidating accounts in this way can make it easier for a participant to manage and track retirement investments, and may also reduce retirement account fees. Roth 401(k) contributions: After-tax plan contributions that do not reduce taxable income. Contributions and their earnings are not taxed upon withdrawal as long as the participant is at least age 59½ and has owned the Roth 401(k) account for at least five years. You can check annual limits here. Roth vs. pre-tax contributions: Pre-tax contributions reduce a participant’s current income, with taxes due when funds are withdrawn (typically in retirement). Alternatively, Roth contributions are deposited into the plan after taxes are deducted, so withdrawals are tax-free. Safe Harbor: A plan design option that provides annual testing exemptions. In exchange, employer contributions on behalf of all employees are required. Saver’s credit: A credit designed to help low- and moderate-income taxpayers further reduce their taxes by saving for retirement. The amount of this credit — 10%, 20%, or 50% of contributions, based on filing status and adjusted gross income — directly reduces the amount of tax owed. Stock option: The opportunity for an employee to purchase shares of an employer’s stock at a specific (often discounted) price for a limited time period. Some companies may offer a stock option as an alternative or a complement to a 401(k) plan. Summary Annual Report (SAR): A summary version of Form 5500, which a plan sponsor is required to provide to participants every year within two months after the Form 5500 deadline – September 30 or December 15 (if there was an extension given for Form 5500 filing). Summary Plan Description (SPD): A comprehensive document that describes in detail how a 401(k) plan works and the benefits it provides. Employers are required to provide an SPD to employees free of charge. Third-party administrator (TPA): An individual or company that may be hired by a 401(k) plan sponsor to help run many day-to-day aspects of a retirement plan. Among the responsibilities of a TPA are compliance testing, generation and maintenance of the plan document, and preparation of Form 5500. Traditional contributions: Pre-tax plan contributions that reduce taxable income. These contributions and their earnings are taxable upon withdrawal, which is typically during retirement. Vesting: Another word for ownership. Participants are always fully vested in the contributions they make. Employer contributions, however, may be subject to a vesting schedule in which participant ownership builds gradually over several years. -

![]()

What is a 401(k) QDIA?

What is a 401(k) QDIA? BlogPost 56841935680 What is a 401(k) QDIA? A QDIA (Qualified Default Investment Alternative) is the plan’s default investment. When money is contributed to the plan, it’s automatically invested in the QDIA. What is a QDIA? A 401(k) QDIA (Qualified Default Investment Alternative) is the investment used when an employee contributes to the plan without having specified how the money should be invested. As a "safe harbor," a QDIA relieves the employer from liability should the QDIA suffer investment losses. Here’s how it works: When money is contributed to the plan, it’s automatically invested in the QDIA that was selected by the plan fiduciary (typically, the business owner or the plan sponsor). The employee can leave the money in the QDIA or transfer it to another plan investment. When (and why) was the QDIA introduced? The concept of a QDIA was first introduced when the Pension Protection Act of 2006 (PPA) was signed into law. Designed to boost employee retirement savings, the PPA removed barriers that prevented employers from adopting automatic enrollment. At the time, fears about legal liability for market fluctuations and the applicability of state wage withholding laws had prevented many employers from adopting automatic enrollment—or had led them to select low-risk, low-return options as default investments. The PPA eliminated those fears by amending the Employee Retirement Income Security Act (ERISA) to provide a safe harbor for plan fiduciaries who invest participant assets in certain types of default investment alternatives when participants do not give investment direction. To assist employers in selecting QDIAs that met employees’ long-term retirement needs, the Department of Labor (DOL) issued a final regulation detailing the characteristics of these investments. Learn more about what kinds of investments qualify as QDIAs below. Why does having a QDIA matter? When a 401(k) plan has a QDIA that meets the DOL’s rules, then the plan fiduciary is not liable for the QDIA’s investment performance. Without a QDIA, the plan fiduciary is potentially liable for investment losses when participants don’t actively direct their plan investments. Plus, having a QDIA in place means that employee accounts are well positioned—even if an active investment decision is never taken. If you select an appropriate default investment for your plan, you can feel confident knowing that your employees’ retirement dollars are invested in a vehicle that offers the potential for growth. Does my retirement plan need a QDIA? Yes, it’s a smart idea for all plans to have a QDIA. That’s because, at some point, money may be contributed to the plan, and participants may not have an investment election on file. This could happen in a number of situations, including when money is contributed to an account but no active investment elections have been established, such as when an employer makes a contribution but an employee isn’t contributing to the plan; or when an employee rolls money into the 401(k) plan prior to making investment elections. It makes sense then, that plans with automatic enrollment must have a QDIA. Are there any other important QDIA regulations that I need to know about? Yes, the DOL details several conditions plan sponsors must follow in order to obtain safe harbor relief from fiduciary liability for investment outcomes, including: A notice generally must be provided to participants and beneficiaries in advance of their first QDIA investment, and then on an annual basis after that Information about the QDIA must be provided to participants and beneficiaries which must include the following: An explanation of the employee’s rights under the plan to designate how the contributions will be invested; An explanation of how assets will be invested if no action taken regarding investment election; Description of the actual QDIA, which includes the investment objectives, characteristics of risk and return, and any fees and expenses involved Participants and beneficiaries must have the opportunity to direct investments out of a QDIA as frequently as other plan investments, but at least quarterly For more information, consult the DOL fact sheet. What kinds of investments qualify as QDIAs? The DOL regulations don’t identify specific investment products. Instead, they describe mechanisms for investing participant contributions in a way that meets long-term retirement saving needs. Specifically, there are four types of QDIAs: An investment service that allocates contributions among existing plan options to provide an asset mix that takes into account the individual’s age or retirement date (for example, a professionally managed account like the one offered by Betterment) A product with a mix of investments that takes into account the individual’s age or retirement date (for example, a life-cycle or target-date fund) A product with a mix of investments that takes into account the characteristics of the group of employees as a whole, rather than each individual (for example, a balanced fund) The fourth type of QDIA is a capital preservation product, such as a stable value fund, that can only be used for the first 120 days of participation. This may be an option for Eligible Automatic Contribution Arrangement (EACA) plans that allow withdrawals of unintended deferrals within the first 90 days without penalty. We’re excluding further discussion of this option here since plans must still have one of the other QDIAs in cases where the participant takes no action within the first 120 days. What are the pros and cons of each type of QDIA? Let’s breakdown each of the first three QDIAs: 1. An investment service that allocates contributions among existing plan options to provide an asset mix that takes into account the individual’s age or retirement date Such an investment service, or managed account, is often preferred as a QDIA over the other options because they can be much more personalized. This is the QDIA provided as part of Betterment 401(k)s. Betterment factors in more than just age (or years to retirement) when assigning participants their particular stock-to-bond ratio within our Core portfolios. We utilize specific data including salary, balance, state of residence, plan rules, and more. And while managed accounts can be pricey, they don’t have to be. Betterment’s solution, which is relatively lower in cost due to investing in exchange traded funds (ETFs) portfolios, offers personalized advice and an easy-to-use platform that can also take external and spousal/partner accounts into consideration. 2. A product with a mix of investments that takes into account the individual’s age or retirement date When QDIAs were introduced in 2006, target date funds were the preferred default investment. The concept is simple: pick the target date fund with the year that most closely matches the year the investor plans to retire. For example, in 2020 if the investor is 45 and retirement is 20 years away, the 2040 Target Date Fund would be selected. As the investor moves closer to their retirement date, the fund adjusts its asset mix to become more conservative. One common criticism of target date funds today is that the personalization ends there. Target date funds are too simple and their one-size-fits-all portfolio allocations do not serve any individual investor very well. Plus, target date funds are often far more expensive compared to other alternatives. Finally, most target date funds are composed of investments from the same company—and very few fund companies excel at investing across every sector and asset class. Many experts view target date funds as outdated QDIAs and less desirable than managed accounts. 3. A product with a mix of investments that takes into account the characteristics of the group of employees as a whole This kind of product—for example, a balanced fund—offers a mix of equity and fixed-income investments. However, it’s based on group demographics and not on the retirement needs of individual participants. Therefore, using a balanced fund as a QDIA is a blunt instrument that by definition will have an investment mix that is either too heavily weighted to one asset class or another for most participants in your plan. Better QDIAs—and better 401(k) plans Betterment provides tailored allocation advice based on what each individual investor needs. That means greater personalization—and potentially greater investment results—for your employees. At Betterment, we monitor plan participants’ investing progress to make sure they’re on track to reach their goals. When they’re not on target, we provide actionable advice to help get them back on track. As a 3(38) investment manager, we assume full responsibility for selecting and monitoring plan investments—including your QDIA. That means fiduciary relief for you and better results for your employees. The exchange-traded fund (ETF) difference Another key component that sets Betterment apart from the competition is our exclusive use of ETFs. Here's why we use them: Low cost—ETFs generally cost less than mutual funds, which means more money stays invested. Diversified—All of the portfolios used by Betterment are designed with diversification in mind, so that investors are not overly exposed to individual stocks, bonds, sectors, or countries—which may mean better returns in the long run. Efficient—ETFs take advantage of decades of technological advances in buying, selling, and pricing securities. Helping your employees live better Our mission is simple: to empower people to do what’s best for their money so they can live better. Betterment’s suite of financial wellness solutions, from our QDIAs to our user-friendly investment platform, is designed to give your employees a more personalized experience. We invite you to learn more about what we can do for you. -

![]()

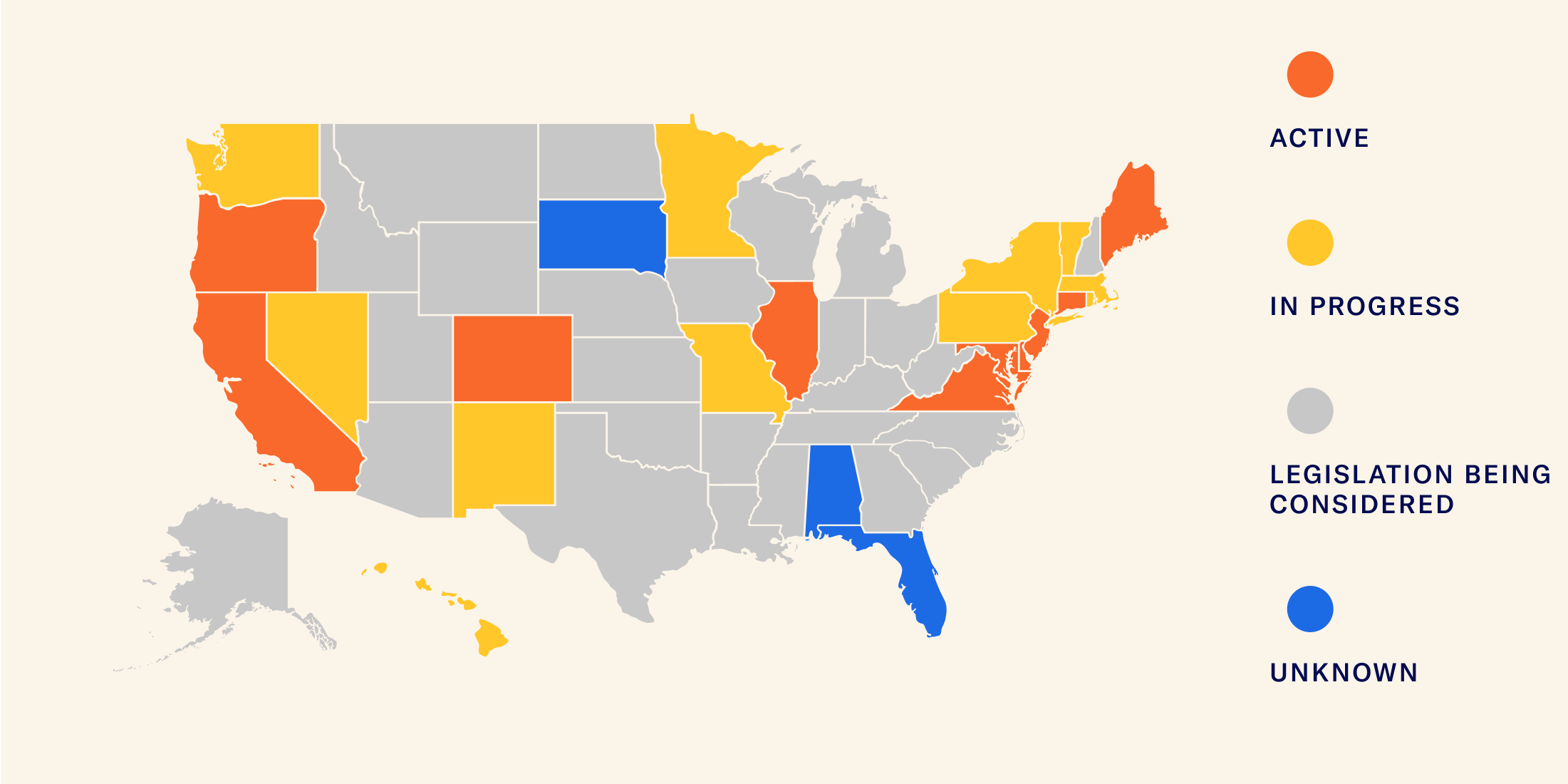

A 50-state guide to state-mandated retirement plans [2025]