A 50-state guide to state-mandated retirement plans [2025]

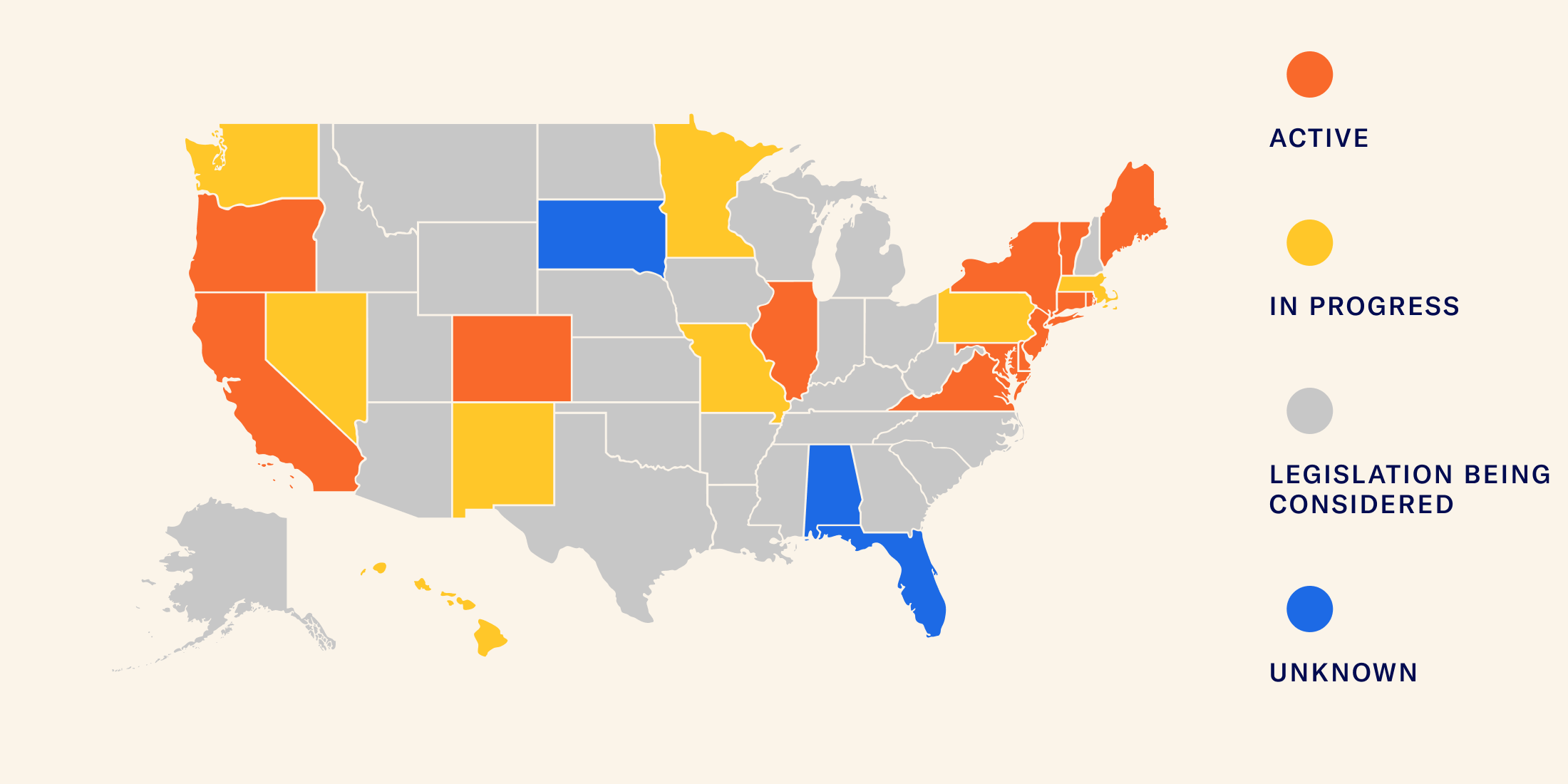

All but three states have either active mandates in place or are working towards implementing mandated retirement programs. Check your state to see how your business may be impacted.

Table of contents:

- All active state mandate programs

- In-progress state mandate programs

- States with legislation being considered

- Unknown state mandate programs

The retirement landscape is changing rapidly, with many Americans living longer but saving less for their golden years. One of the most significant developments in this space has been the rise of state-mandated retirement plans. These plans are designed to provide essential benefits to workers who may not have access to them through their employer.

With a growing number of private workers not having access to these crucial benefits, states are increasingly requiring businesses to provide retirement plans to employees. In 2015, the Department of Labor (DOL) issued guidance to support the states' efforts to help promote retirement benefits within their respective states.

What exactly are state-mandated retirement plans?

In recent years, more states have passed legislation requiring businesses to provide retirement benefits for their employees. In these states, employers have the choice between enrolling their workers in the state-sponsored program or establishing their own workplace retirement plan through providers like Betterment. A state-sponsored plan usually involves an Individual Retirement Account (IRA) set up by the employer for participants to contribute. However, certain features may vary between states, so it's a good idea to research your state's specific program to ensure compliance.

All but three states are currently working on legislation to implement these plans, which means that more and more Americans will have access to the retirement benefits they need. However, it's important to stay up-to-date on these changes, as failing to comply with the new rules could result in hefty fines.

For more details on how state-mandated plans could impact you, read: What state-mandated plans could mean for your small business.

All active state mandate programs

The following states have enacted legislation and have either implemented or are in the process of implementing a state-mandated program.

California

- Plan Name: CalSavers

- Status: Mandate in place

- Deadlines: Deadline passed for 5+ employees; December 31, 2025, for 1-4 employees

- Details: Not all employers are required to participate. Only employers who do not sponsor a retirement plan and have one or more California employees must join CalSavers.

- Fines: $250 per eligible employee

Illinois

- Plan Name: Illinois Secure Choice

- Status: Mandate in place

- Deadlines: Deadline passed for 5+ employees

- Details: Not all employers are eligible. Only private-sector employers who do not offer a qualified retirement plan, had at least five employees in every quarter of the previous calendar year, and have been in business for at least two years must facilitate Illinois Secure Choice.

- Fines: $250 per employee for the first calendar year the employer is non-compliant

Oregon

- Plan Name: OregonSaves

- Status: Mandate in place

- Deadlines: Deadline passed for 1+ employees

- Details: All Oregon employers are required by law to facilitate OregonSaves if they don’t offer a retirement plan for their employees.

- Fines: $100 per affected employee, with a $5,000 maximum fine per year

Connecticut

- Plan Name: MyCTSavings

- Status: Mandate in place

- Deadlines: Deadline passed for 5+ employees

- Details: Eligible Connecticut businesses are required to facilitate MyCTSavings if they don’t offer a retirement plan and have 5 or more employees.

- Fines: Penalties may be imposed. Bill is currently in the legislature.

Colorado

- Plan Name: Colorado SecureSavings Program

- Status: Mandate in place

- Deadlines: Deadline passed for 5+ employees

- Details: All Colorado employers who have been in business for at least 2 years, have 5 or more employees, and don’t offer a qualified retirement plan for their employees are required by law to facilitate Colorado SecureSavings.

- Fines: $100 per affected employee with $5,000 maximum fine per year

Maine

- Plan Name: Maine Retirement Savings Program

- Status: Mandate in place

- Deadlines: Deadline passed for 5+ employees

- Details: Every Maine employer with 5 or more employees will need to facilitate the program if they don’t already offer their own qualified retirement savings plan.

- Fines: Penalties for failing to enroll employees go into effect on July 1, 2025, as follows:

- $20 per employee from July 1, 2025, to July 30, 2026

- $50 per employee from July 1, 2026, to July 30, 2027

- $100 per employee on or after July 1, 2027

Virginia

- Plan Name: RetirePath

- Status: Mandate in place

- Deadlines: Deadline passed for 25+ employees

- Details: State law requires Virginia employers with 25 or more eligible employees who have operated for 2 or more years and not offered a qualified, employer-sponsored retirement plan must now register and facilitate RetirePath.

- Fines: $200 per eligible employee

New Jersey

- Plan Name: RetireReady NJ

- Status: Mandate in place

- Deadlines: Deadline passed for 40+ employees; November 15, 24 for 25+ employees

- Details: Every New Jersey employer with 25 or more employees will need to register with the program if they don't already offer their own qualified retirement savings plan.

- Fines: Businesses that don’t follow state-mandated retirement legislation within one year will receive a written warning. Each following year of non-compliance will result in fines of:

- 2nd year: $100 per employee

- 3rd and 4th years: $250 per employee

- 5th year and beyond: $500 per employee

Delaware

- Plan Name: Delaware EARNS

- Status: Mandate in place

- Deadlines: October 15, 2024 for 5+ employees

- Details: Every Delaware employer with five or more employees will need to facilitate the program if they don’t already offer their own tax-qualified retirement plan.

- Fines: $250 per affected employee, with $5,000 maximum fine per year

Maryland

- Plan Name: Maryland Saves

- Status: Mandate in place

- Deadlines: December 31, 2024 for 1+ employees

- Details: Businesses are required to register if they have been in operation for at least 2 calendar years, have at least one employee over the age of 18, and use an automated payroll system.

- Fines: Maryland does not impose a penalty, instead, they use an incentive, offering businesses that enroll $300 per year, waiving the annual filing fee for Maryland businesses.

Vermont

- Plan Name: Vermont Saves

- Status: Mandatory for Vermont employers with 5+ employees who do not offer a qualified retirement plan.

- Deadlines: March 1, 2025 for 5+ employees

- Details: Employees are automatically enrolled in a Roth IRA with a default contribution rate of 5% that increases by 1% annually up to 8%, unless they opt out or select a different rate. Employers are not required to contribute but must facilitate payroll deductions. The program is free for employers and integrates with existing payroll systems.

- Fines: $10 per employee before October 1, 2025, then $20 per employee until September 30, 2026. After October 1, 2026 employers could pay up to $75 per employee.

New York

- Plan Name: New York State Secure Choice Savings Program

- Status: Mandatory for eligible employers to offer a retirement plan or enroll workers in the state’s Secure Choice program.

- Deadlines:

- Employers with 30 employees must enroll by March 18, 2026

- Employers with 15-29 employees must enroll by May 15, 2026

- Employers with 10-14 employees must enroll by July 15, 2026

- Details: If you’re an employer in New York, state laws require you to offer the Secure Choice Savings Program if you have had 10+ employees during the entire prior calendar year, have been in business for at least two years, and have not offered a qualified retirement plan during the prior two years.

- Fines: Information not available at this time.

Rhode Island

- Plan Name: RISavers

- Status: Mandatory for employers with 5+ employees who do not offer a qualified retirement plan.

- Deadlines: Implementation in progress

- Details: Private-sector employers with five or more employees will be required to offer a qualified retirement plan or opt into the state-run program.

- Fines: Information not available at this time.

In-progress state mandate programs

Nevada

- Plan Name: Nevada Employee Savings Trust

- Status: Will be mandatory

- Deadlines: July 1, 2025 for 1,000+ employees; January 1, 2026 for 500-999 employees; July 1, 2026 for 100-499 employees; Jan 1, 2027 for <100 employees

- Details: In 2023, the Nevada legislature passed SB305 which mandates the establishment of a retirement savings program for private sector employees.

- Fines: Information not available at this time.

Massachusetts

- Plan Name: Massachusetts Defined Contribution CORE Plan

- Status: Nonprofit mandatory only

- Deadlines: Currently effective, but no deadline yet

- Details: Massachusetts nonprofit organizations with 20 employees or fewer may be eligible to adopt the CORE Plan. The CORE Plan is structured as a 401(k) Multiple Employer Plan (MEP). The MEP structure allows each adopting employer to join the CORE Plan under one plan and trust by executing a Participation Agreement.

- Fines: Not applicable.

Minnesota

- Plan Name: Minnesota Secure Choice Retirement Program Act

- Status: Will be mandatory

- Deadlines: Expected to launch by Jan 1, 2025

- Details: On May 19, 2023, Governor Walz signed into law a bill establishing the Minnesota Secure Choice Retirement Program. Employers with 5 or more covered employees that do not sponsor a retirement plan for their employees are required to participate in the plan.

- Fines: Information not available at this time.

Hawaii

- Plan Name: Hawaii Retirement Savings Program

- Status: Will be mandatory

- Deadlines: Implementation in progress

- Details: The Hawaii Retirement Savings Program is a state-facilitated payroll-deduction retirement savings plan where individuals can choose to opt into the program. Employers will be required to provide covered employees with written notice that they may opt into the program, withhold covered employees’ contribution amount from their salary or wages, and transmit covered employees’ payroll deduction contributions to the program.

- Fines: Information not available at this time.

Washington

- Plan Name: Washington Saves

- Status: Will be mandatory

- Deadlines: Expected to launch Jan 1, 2027

- Details: Employers must offer their employees access to a state-facilitated IRA if they don’t offer a retirement savings plan. Employees would be enrolled automatically unless they opt out. The program is slated to launch in 2027 and Washington will continue to offer its small-business retirement marketplace in the meantime.

- Fines: Penalties beginning after January 1, 2030.

New Mexico

- Plan Name: New Mexico Work and Save IRA

- Status: Voluntary

- Deadlines: 7/1/24 deadline, but still voluntary

- Details: Work and Save is a voluntary savings program for private-sector and nonprofit employers and employees and the self-employed facilitated through a Roth Individual Retirement Account.

- Fines: Not applicable.

Missouri

- Plan Name: Missouri Show-Me MyRetirement Savings Plan

- Status: Voluntary

- Deadlines: Expected to launch September 1, 2025

- Details: Missouri introduced HB 1732 in 2022, which would create a voluntary MEP for small employers with 50 or fewer employees.

- Fines: Not applicable.

Pennsylvania

- Plan Name: Keystone Saves

- Status: Will be mandatory

- Deadlines: To be determined pending bill passage by Pennsylvania State Senate

- Details: Employers will be required to offer a state-sponsored IRA or other qualified retirement plan. Employers do not have to participate if they have an established retirement program, have fewer than five employees, or have been in business less than 15 months.

- Fines: According to the current bill, covered employers shall not be subject to a penalty for not participating in the program.

Georgia

- Plan Name: Peach State Saves

- Status: Voluntary

- Deadlines: To be determined pending bill passage

- Details: In February 2025, Georgia introduced SB 226, requiring businesses with 5+ employees and over one year in operation to offer a state-sponsored IRA or another retirement plan unless they already have one.The default payroll deduction is a Roth IRA with a 5% contribution rate. The state may add a traditional IRA option and adjust the contribution rate, increasing it annually by up to 1% (maximum 10%).

- Fines: Not applicable.

States with legislation being considered

The following states have legislation currently being considered for state-mandated reprograms:

Alaska, Arizona, Arkansas, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Montana, Nebraska, New Hampshire, North Carolina, North Dakota, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah, West Virginia, Wisconsin, Wyoming

Unknown state mandate programs

The following states have not yet made clear if they intend to mandate a state retirement program. We will actively update this article as legislation changes.

- Alabama

- Florida

- South Dakota

What do state-mandated plans mean for your business?

Now is the time to plan ahead if you do not offer a retirement plan for your employees, especially if you operate in a state with an upcoming mandate deadline.

In most cases, you’ll have one of two options:

- Implement your state’s plan: You’ll need to follow your state’s procedures for enrolling and offering a retirement plan, usually an IRA, to your employees.

- Implement a 401(k) plan: A second option is to skip the state plan, and instead, offer a 401(k) plan from a private provider like Betterment at Work.

The benefits of offering a 401(k)

Offering a 401(k) has become a tablestakes benefit as employers attempt to attract and retain talent in today’s competitive environment. State mandated plans are designed by the government to address a lack of savings among employees. The purpose is admirable, but state mandated plans may lack some of the benefits of a modern, 401(k) plan, which include:

- Higher contributions limits to help people save more.

- A wider range of investment options depending on the number of funds available.

- The option to provide an employer matching contribution. (Did you know? A 401(k) employer match is the #2 most desired benefit among employees. Learn more.)

Learn how to offer a modern 401(k) today

At Betterment, we make it easy for small and mid-market businesses to provide a scalable retirement plan. With a Betterment 401(k), you get:

- Simplified administration, payroll integrations, fiduciary support, and compliance testing

- Customizable plan features and optional employee benefits

- Service and support at every step