401(k) Considerations for Highly Compensated Employees

Help ensure your 401(k) plan benefits every employee – from senior executives to entry-level workers. Read on for more information.

A 401(k) plan should help every employee – from senior executives to entry-level workers – save for a more comfortable future. To help ensure highly compensated employees (HCEs) don’t gain an unfair advantage through the 401(k) plan, the IRS implemented certain rules that all plans must follow. Wondering how to navigate these special considerations for HCEs? Read on for answers to commonly asked questions.

1. What is an HCE?

According to the IRS, an HCE is an individual who:

- Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much compensation that person earned or received, or

- Received compensation from the business of more than $155,000 (if the preceding year is 2024), and, if the employer so chooses, was in the top 20% of employees when ranked by compensation.

2. Why are there special considerations for HCEs?

Does your plan offer a company match? If so, consider this example: Joe is a senior manager earning $200,000 a year. He can easily afford to max out his 401(k) plan contributions and earn the full company match (dollar-for-dollar up to 6%). Thomas is an entry-level administrative assistant earning $35,000 a year. He can only afford to contribute 2% of his paycheck to the 401(k) plan, and therefore, isn’t eligible for the full company match. Not only that, Joe can contribute more – and earn greater tax benefits – than Thomas. It doesn’t seem fair, right? The IRS doesn’t think so either.

To ensure HCEs don’t disproportionately benefit from the 401(k) plan, the IRS requires annual compliance tests known as non-discrimination tests.

3. What is non-discrimination testing?

In order to retain tax-qualified status, a 401(k) plan must not discriminate in favor of key owners and officers, nor highly compensated employees. This is verified annually by a number of tests, which include:

- Coverage tests – These tests review the ratio of HCEs benefitting from the plan (i.e., of employees considered highly compensated, what percent are benefiting) against the ratio of non-highly compensated employees (NHCEs) benefiting from the plan. Typically, the NHCE percentage benefiting must be at least 70% or 0.7 times the percentage of HCEs considered benefiting for the year, or further testing is required. These tests are performed across employee contributions, matching, and after-tax contributions, and non-elective (employer, non-matching) contributions.

- ADP and ACP tests – The Actual Deferral Percentage (ADP) Test and the Actual Contribution Percentage (ACP) Test help to ensure that HCEs are not saving significantly more than the employee base. The tests compare the average deferral (traditional and Roth) and employer contribution (matching and after-tax) rates between HCEs and NHCEs.

- Top-heavy test – A plan is considered top-heavy when the total value of the Key employees’ plan accounts is greater than 60% of the total value of the plan assets. (The IRS defines a key employee as an officer making more than $220,000 in 2024—and indexed each year after), an owner of more than 5% of the business, or an owner of more than 1% of the business who made more than $150,000 during the plan year.)

4. What if my plan doesn’t pass non-discrimination testing?

You may be surprised to learn that it’s actually easier for large companies to pass the tests because they have many employees at varying income levels contributing to the plan. However, small and mid-size businesses may struggle to pass if they have a relatively high number of HCEs. If HCEs contribute a lot to the plan, but NHCEs don’t, there’s a chance that the 401(k) plan will not pass nondiscrimination testing.

If your plan fails, you’ll need to fix the imbalance by returning 401(k) plan contributions to your HCEs or increasing contributions to your NHCEs. If you have to refund contributions, affected employees may fall behind on their retirement savings—and that money may be subject to state and federal taxes! Not to mention the fact that you may upset several top employees, which could have a detrimental impact on employee satisfaction and retention.

5. How can I avoid this headache-inducing situation?

If you want to bypass compliance tests, consider a safe harbor 401(k) plan. A safe harbor plan is like a typical 401(k) plan except it requires you to:

- Contribute to the plan on your employees’ behalf, sometimes as an incentive for them to save in the plan

- Ensure the mandatory employer contribution vests immediately – rather than on a graded or cliff vesting schedule – so employees can always take these contributions with them when they leave

To fulfill safe harbor requirements, you can elect one of the following employer contribution formulas:

- Basic safe harbor match—Employer matches 100% of employee contributions, up to 3% of their compensation, plus 50% of the next 2% of their compensation

- Enhanced safe harbor match—Employer matches 100% of employee contributions, up to 4% of their compensation.

- Non-elective contribution—Employer contributes at least 3% of each employee’s compensation, regardless of whether they make their own contributions.

Want to contribute more? You absolutely can – the above percentages are only the minimum required of a safe harbor plan.

6. How can a safe harbor plan benefit my top earners?

With a safe harbor 401(k) plan, you can ensure that your HCEs will be able to max out your retirement contributions (without the fear that contributions will be returned if the plan fails nondiscrimination testing).

7. What are the upsides (and downsides) of a safe harbor plan?

Beyond ensuring your HCEs can max out their contributions, a safe harbor plan can help you:

- Attract and retain top talent—Offering your employees a matching or non-elective contribution is a powerful recruitment tool. Plus, an employer contribution is a great way to reward your current employees (and incentivize them to save for their future).

- Improve financial wellness—Studies show that financial stress impacts employees’ ability to focus on work. By helping your employees save for retirement, you help ease that burden and potentially improve company productivity and profitability.

- Save time and stress—Administering your 401(k) plan takes time—and it can become even more time-consuming and stressful if you’re worried that your plan may not pass nondiscrimination testing. Bypass certain tests altogether by electing a safe harbor 401(k).

- Reduce your taxable income—Like any employer contribution, safe harbor contributions are tax deductible! Plus, you can receive valuable tax credits to help offset the costs of your 401(k) plan.

Of course, these benefits come with a cost; specifically the expense of increasing your overall payroll by 3% or more. So be sure to evaluate whether your company has the financial capacity to make employer contributions on an annual basis.

8. Are there other ways for HCEs to save for retirement?

If you decide against a safe harbor plan, you can always encourage your HCEs to take advantage of other retirement-saving avenues, including:

- Health savings account (HSA) – If your company offers an HSA – typically available to those enrolled in a high-deductible health plan (HDHP) – individuals can contribute up to $3,650, families can contribute up to $7,300, and employees age 55 or older can contribute an additional $1,000 in 2022. The key benefits are:

- Contributions are tax free, earnings grow tax-free, and funds can be withdrawn tax-free anytime they’re used for qualified health care expenses.

- The HSA balance carries over and has the potential to grow unlike a “use-it-or-lose-it” FSA.

- Once employees turn 65, they can withdraw money from an HSA for any purpose – not just medical expenses – without penalty. However, they will have to pay income tax, so they may want to consider reserving it for medical expenses in retirement.

- Traditional IRA – If employees make after-tax contributions to a traditional IRA, all earnings and growth are tax-deferred. For 2024, the IRA contribution maximum is $7,000 and employees age 50 or older can make an additional $1,000 catch-up contribution.

- Roth IRA – HCEs may still be eligible to contribute to a Roth IRA, since Roth IRAs have their own separate income limits. But even if an employee’s income is too high to contribute to a Roth IRA, they may be able to convert a Traditional IRA into a Roth IRA via the “backdoor” IRA strategy. To do so, they would make non-deductible contributions to their Traditional IRA, open a Roth IRA, and perform a Roth IRA conversion. This is a more advanced strategy, so for more information, your employees should consult a financial advisor.

- Taxable Account – A taxable account is a great way to save beyond IRS limits. If employees are maxed out their 401(k) and IRA and want to keep saving, they can invest extra cash in a taxable account.

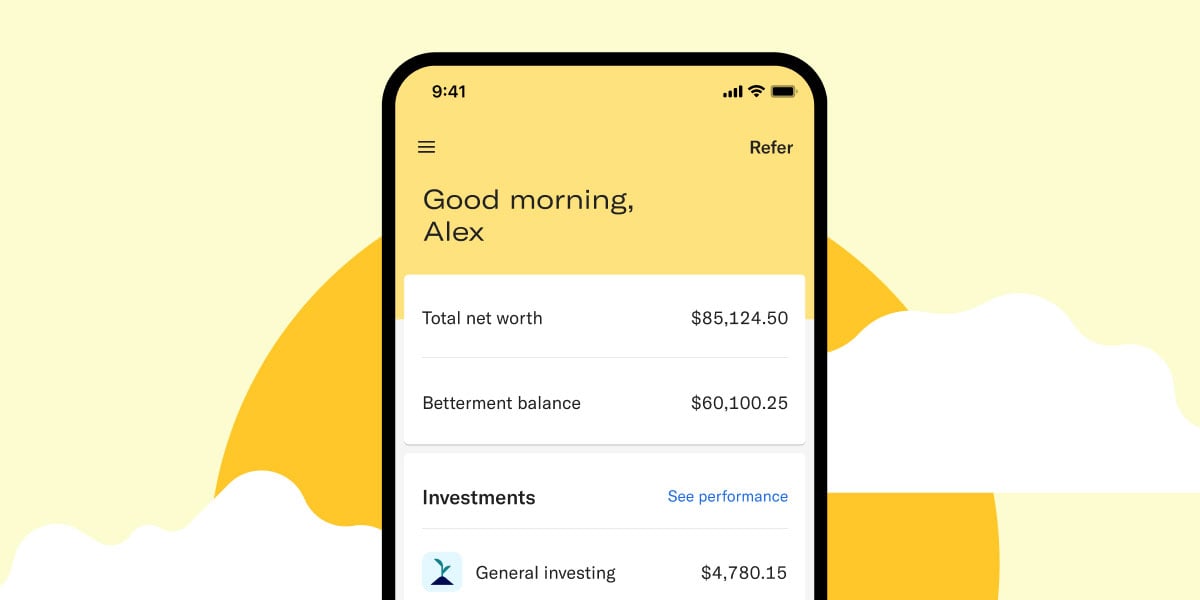

Want to learn more? Betterment can help.

Helping HCEs navigate retirement planning can be a challenge. If you’re considering a safe harbor plan or want to explore new ways to enhance retirement savings for all your employees, talk to Betterment today.

Betterment assumes no responsibility or liability whatsoever for the content, accuracy, reliability or opinions expressed in a third-party website, to which a published article links (a “linked website”) and such linked websites are not monitored, investigated, or checked for accuracy or completeness by Betterment. It is your responsibility to evaluate the accuracy, reliability, timeliness and completeness of any information available on a linked website. All products, services and content obtained from a linked website are provided “as is” without warranty of any kind, express or implied, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, title, non-infringement, security, or accuracy. If Betterment has a relationship or affiliation with the author or content, it will note this in additional disclosure.