Plan Design Matters

Thoughtful 401(k) plan design can help motivate even reluctant retirement savers to start investing for their future.

Designing a 401(k) plan is like building a house. It takes care, attention, and the help of a few skilled professionals to create a plan that works for both you and your employees. In fact, thoughtful plan design can help motivate even reluctant retirement savers to start investing for their future - read more to learn how.

How to tailor a 401(k) plan you and your employees will love

As you embark on the 401(k) design process, there are many options to consider. In this article, we’ll take you through the most important choices so you can make well-informed decisions. Since certain choices may not be available on the various pricing models of any given provider, make sure you understand your options and the trade-offs you’re making.

Let’s get started!

401(k) eligibility

When would you like employees to be eligible to participate in the plan? You can opt to have employees become eligible:

- Immediately – as soon as they begin working for your company

- After a specific length of service – for example, a period of hours, months, or years of service

It’s also customary to have an age requirement (for example, employees must be 18 years or older to participate in the plan). You may also want to consider an “employee class exclusion” to prevent part-time, seasonal, or temporary employees from participating in the plan.

Once employees become eligible, they can immediately enroll – or, you can restrict enrollment to a monthly, quarterly, or semi-annual basis. If you have immediate 401(k) eligibility and enrollment, in theory, more employees could participate in the plan. However, if your company has a higher rate of turnover, you may want to consider adding service length requirements to alleviate the unnecessary administrative burden of having to maintain many small accounts of employees who are no longer with your organization.

Enrollment

Enrollment is another important feature to consider as you structure your plan. You may simply allow employees to enroll on their own, or you can add an automatic enrollment feature. Automatic enrollment (otherwise known as auto-enrollment) allows employers to automatically deduct elective deferrals from employees’ wages unless they elect not to contribute.

With automatic enrollment, all employees are enrolled in the plan at a specific contribution rate when they become eligible to participate in the plan. Employees have the freedom to opt out and change their contribution rate and investments at any time.

As you can imagine, automatic enrollment can have a significant impact on plan participation. In fact, according to research by The Defined Contribution Institutional Investment Association (DCIIA), automatic enrollment 401(k) plans have participation rates greater than 90%! That’s in stark contrast to the roughly 50% participation rate for plans in which employees must actively opt in.

With the passage of SECURE 2.0, auto-enrollment goes into effect on eligible plans on January 1, 2025. Deferrals must be between 3-10%, escalating to 10-15%. Newly auto-enrolled participants have a 90-day window to request their funds back. Many financial experts recommend a retirement savings rate of 10% to 15%, so using a higher automatic enrollment default rate would give employees even more of a head start.

Auto-escalation

Auto-escalation is an important feature to look out for as you design your plan. It enables employees to increase their contribution rate over time as a way to increase their savings.

With auto-escalation, eligible employees will automatically have their contribution rate increased by 1% every year until they reach a maximum cap of 15%. Employees can also choose to set their own contribution rate at any time, at which point they will no longer be enrolled in the auto-escalation feature. For example, if an employee is auto-enrolled at 6% with a 1% auto-escalation rate, and they choose to change their contribution rate to 8%, they will no longer be subject to the 1% increase every year.

Compensation

You’re permitted to exclude certain types of compensation for plan purposes, including compensation earned prior to plan entry and fringe benefits for purposes of compliance testing and allocating employer contributions. You may choose to define your compensation as:

- W2 (box 1 wages) plus deferrals – Total taxable wages, tips, prizes, and other compensation

- 3401(a) wages – All wages taken into account for federal tax withholding purposes, plus the required additions to W-2 wages listed above

- Section 415 Safe Harbor – All compensation received from the employer which is includible in gross income

Employer contributions

Want to encourage employees to enroll in the plan? Free money is a great place to start! That’s why more employers are offering profit sharing or matching contributions.

Some common employer contributions are:

- Safe harbor contributions – With the added bonus of being able to avoid certain time-consuming compliance tests, safe harbor contributions often follow one of these formulas:

- Basic safe harbor match—Employer matches 100% of employee contributions, up to 3% of their compensation, plus 50% of the next 2% of their compensation.

- Enhanced safe harbor match—The most common employer match formula is 100% of employee contributions, up to 4% of their compensation, but this could vary.

- Non-elective contribution—Employer contributes at least 3% of each employee’s compensation, regardless of whether they make their own contributions.

- Discretionary matching contributions – You decide what percentage of employee 401(k) deferrals to match and the maximum percentage of pay to match. For example, you could elect to match 50% of contributions on up to 6% of compensation. One advantage of having a discretionary matching contribution is that you retain the flexibility to adjust the matching rate as your business needs change.

- Non-elective contributions – Each pay period, you have the option of contributing to your employees’ 401(k) accounts, regardless of whether they contribute. For example, you could make a profit sharing contribution (one type of non-elective contribution) at the end of the year as a percentage of employees’ salaries or as a lump-sum amount.

In addition to helping your employees build their retirement nest eggs, employer contributions are also tax deductible (up to 25% of total eligible compensation), so it may cost less than you think. Plus, we believe offering an employer contribution can play a key role in recruiting and retaining top employees.

401(k) vesting

If you elect to make an employer contribution, you also need to decide on a vesting schedule (an employee’s own contributions are always 100% vested). Note that all employer contributions made as part of a safe harbor plan are immediately and 100% vested (although QACA plans can be subject to a 2-year cliff).

The three main vesting schedules are:

- Immediate – Employees are immediately vested in (or own) 100% of employer contributions as soon as they receive them.

- Graded – Vesting takes place in a gradual manner. For example, a six-year graded schedule could have employees vest at a rate of 20% a year until they are fully vested.

- Cliff – The entire employer contribution becomes 100% vested all at once, after a specific period of time. For example, if you had a three-year cliff vesting schedule and an employee left after two years, they would not be able to take any of the employer contributions (only their own).

Like your eligibility and enrollment decisions, vesting can also have an impact on employee participation. Immediate vesting may give employees an added incentive to participate in the plan. On the other hand, a longer vesting schedule could encourage employees to remain at your company for a longer time.

Service counting method

If you decide to use length of service to determine your eligibility and vesting schedules, you must also decide how to measure it. Typically, you may use:

- Elapsed time – Period of service as long as employee is employed at the end of period

- Actual hours – Actual hours worked. With this method, you’ll need to track and report employee hours

- Actual hours/equivalency – A formula that credits employees with set number of hours per pay period (for example, monthly = 190 hours)

401(k) withdrawals and loans

Naturally, there will be times when your employees need to withdraw money from their retirement accounts. Your plan design will have rules outlining the withdrawal parameters for:

- Termination

- In-service withdrawals (at attainment of age 59 ½; rollovers at any time)

- Hardships

- Qualified Domestic Relations Orders (QDROs)

- Required Minimum Distributions (RMDs)

Plus, you’ll have to decide whether to allow participants to take 401(k) plan loans (and the maximum amount of the loan). While loans have the potential to derail employees’ retirement dreams, having a loan provision means employees can access their money if they need it and employees can pay themselves back plus interest. If employees are reluctant to participate because they’re afraid their savings will be “locked up,” then a loan provision can help alleviate that fear.

Investment options

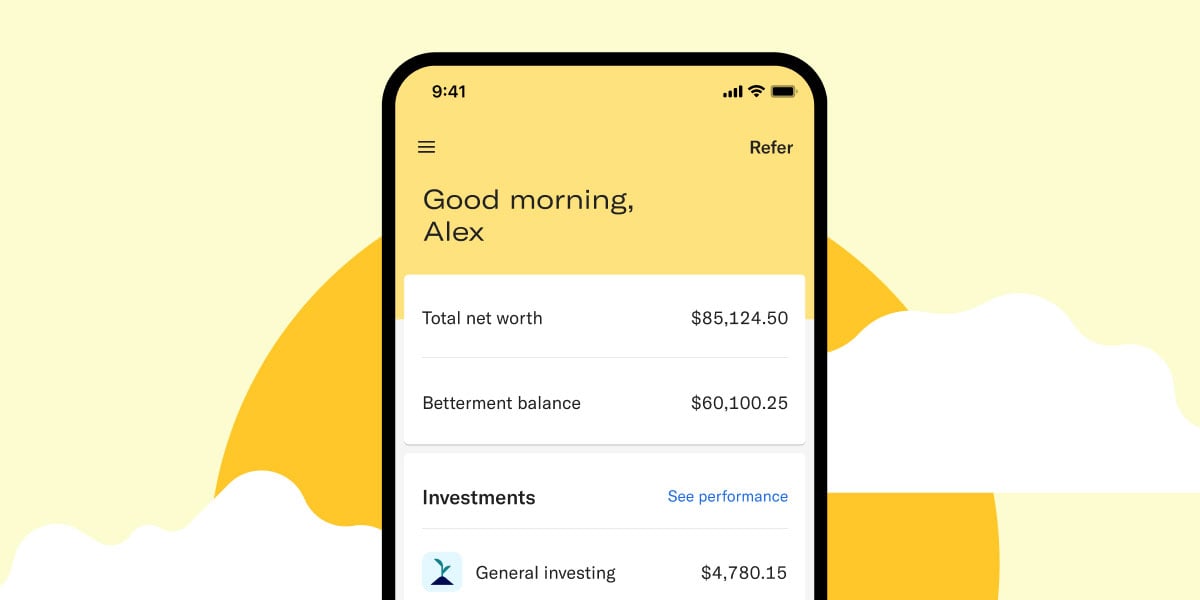

When it comes to investment methodology, there are many strategies to consider. Your plan provider can help guide you through the choices and associated fees. For example, at Betterment, we believe that our expert-built ETF portfolios offer investors significant diversification and flexibility at a low cost. Plus, we offer ETFs in conjunction with personalized advice to help today’s retirement savers pursue their goals.

Get help from the experts

Your 401(k) plan provider can walk you through your plan design choices and help you tailor a plan that works for your company and your employees. Once you’ve settled on your plan design, you will need to codify those features in the form of a formal plan document to govern your 401(k) plan. At Betterment, we draft the plan document for you and provide it to you for review and final approval.

Your business is likely to evolve—and your plan design can evolve, too. Drastic increase in profits? Consider adding an employer match or profit sharing contribution to share the wealth. Plan participation stagnating? Consider adding an automatic enrollment feature to get more employees involved. Employees concerned about access to their money in an uncertain world? Consider adding a 401(k) loan feature.

Need a little help figuring out your plan design? Talk to Betterment. Our experts make it easy for you to offer your employees a better 401(k) —at one of the lowest costs in the industry.