Employer Contributions

Featured articles

-

![]()

401(k) QNECs & QMACs: what are they and does my plan need them?

QNECs and QMACs are special 401(k) contributions employers can make to correct certain ...

401(k) QNECs & QMACs: what are they and does my plan need them? QNECs and QMACs are special 401(k) contributions employers can make to correct certain compliance errors without incurring IRS penalties. Even the best laid plans can go awry, especially when some elements are out of your control. Managing a 401(k) plan is no different. For example, your plan could fail certain required nondiscrimination tests depending solely on how much each of your employees chooses to defer into the plan for that year (unless you have a safe harbor 401(k) plan that is deemed to pass this testing) QNECs and QMACs are designed to help employers fix specific 401(k) plan problems by making additional contributions to the plan accounts of employees who have been negatively affected. What is a QNEC? A Qualified Nonelective Contribution (QNEC) is a contribution employers can make to the 401(k) plan on behalf of some or all employees to correct certain types of operational mistakes and failed nondiscrimination tests. They are typically calculated based on a percentage of an employee’s compensation. QNECs must be immediately 100% vested when allocated to participants’ accounts. This means they are not forfeitable and cannot be subject to a vesting schedule. QNECs also must be subject to the same distribution restrictions that apply to elective deferrals in a 401(k) plan. In other words, QNECs cannot be distributed until the participant has met one of the following triggering events: severed employment, attained age 59½, died, become disabled, or met the requirements for a qualified reservist distribution or a financial hardship (plan permitting). These assets may also be distributed upon termination of the plan. What is a QMAC? A Qualified Matching Contribution (QMAC) is also an employer contribution that may be used to assist employers in correcting problems in their 401(k) plan. The QMAC made for a participant is a matching contribution, based on how much the participant is contributing to the plan (as pre-tax deferrals, designated Roth contributions, or after-tax employee contributions), or it may be based on the amount needed to bring the plan into compliance, depending on the problem being corrected. QMACs also must be nonforfeitable and subject to the distribution limitations listed above when they are allocated to participant’s accounts. QNECs vs. QMACs Based on % of employee’s compensation based on amount of employee’s contribution QNECs (Qualified Nonelective Contribution) QMACs (Qualified Matching Contribution) Commonly used to pass either the Actual Deferral Percentage (ADP) or Actual Contribution Percentage (ACP) test Most commonly used to pass the Actual Contribution Percentage (ACP) test Frequently Asked Questions about QNECs and QMACs How are QNECs and QMACs used to correct nondiscrimination testing failures? One of the most common situations in which an employer might choose to make a QNEC or QMAC is when their 401(k) plan has failed the Actual Deferral Percentage (ADP) test or the Actual Contribution Percentage (ACP) test for a plan year. These tests ensure the plan does not disproportionately benefit highly compensated employees (HCEs). The ADP test limits the percentage of compensation the HCE group can defer into the 401(k) plan based on the deferral rate of the non-HCE group. The ACP test ensures that the employer matching contributions and after-tax employee contributions for HCEs are not disproportionately higher than those for non-HCEs. When the plan fails one of these tests at year-end, the employer may have a few correction options available, depending on their plan document. Many plans choose to distribute excess deferrals to HCEs to bring the HCE group’s deferral rate down to a level that will pass the test. Your HCEs, however, may not appreciate a taxable refund at the end of the year or a cap on how much they can save for retirement. Making QNECs and QMACs are another option for correcting failed nondiscrimination tests. This option allows HCEs to keep their savings in the plan because the employer is making additional contributions to raise the deferral or contribution rate of the lower paid employees (non-HCEs) to a level that passes the test. How much would I have to contribute to correct a testing failure? For QNECs, the plan usually allows the employer to contribute the minimum QNEC amount needed to boost the non-HCE group’s deferral rate enough to pass the ADP test. The contribution formula may require that an allocation be a specific percentage of compensation that will be given equally to all non-HCEs, or it may allow the allocation to be used in a more targeted fashion that gives the amount needed to pass the test to just certain non-HCEs. QMACs are most commonly made to pass the ACP test. As with QNECs, there are allocation options available to the plan sponsor when making QMACs. A plan sponsor can make targeted QMACs, which are an amount needed to satisfy a nondiscrimination testing failure, or they can allocate QMACs based on the percentage of compensation deferred by a participant. QNECs and QMACs can both be made to help pass the ADP and ACP tests, but a contribution cannot be double counted. For example, if a QNEC was used to help the plan pass the ADP test, that QNEC cannot also be used to help pass the ACP test. How long do I have to make a QNEC or QMAC to correct a testing failure? QNECs/QMACs used to correct ADP/ACP tests generally must be made within 12 months after the end of the plan year being tested. Beware, however, if you use the prior-year testing method for your ADP/ACP tests. If you use this testing method, the QNEC/QMAC must be made by the end of the plan year being tested. For example, if you’re using the prior-year testing method for the 2022 plan year ADP test, the non-HCE group’s deferral rate for 2021 is used to determine the passing rate for HCE deferrals for 2022 testing. Using this prior-year method can help plans proactively determine the maximum amount HCEs may defer each year. But, if the plan still fails testing for some reason, a QNEC or QMAC would have to be made by the end of 2022, which is before the ADP/ACP test would be completed for 2022. QNECs and QMACs deposited by the employer’s tax-filing deadline (plus extensions) for a tax year will be deductible for that tax year. What other types of compliance issues may be corrected with a QNEC or QMAC? Through administrative mix-ups or miscommunications with payroll, a plan administrator might fail to recognize that an employee has met the eligibility requirements to enter the plan or fail to notify the employee of their eligibility. These types of errors tend to happen especially in plans that have an automatic enrollment feature. And sometimes, even when the employee has made an election to begin deferring into the plan, the election can be missed. These types of errors are considered a “missed deferral opportunity.” The employer may correct its mistake by contributing to the plan on behalf of the employee. How is a QNEC or QMAC calculated for a “missed deferral opportunity”? When a missed deferral opportunity is discovered, the employer can correct this operational error by making a QNEC contribution up to 50% of what the employee would have deferred based on their compensation for the year and the average deferral rate for the group the employee belongs to (HCE or non-HCE) for the year the mistake occurred. The QNEC must also include the amount of investment earnings that would be attributable to the deferral had it been contributed timely. If a missed deferral opportunity is being corrected and the plan is a 401(k) safe harbor plan, the employer must make a matching contribution in the form of a QMAC to go with the QNEC to make up for the missed deferrals, plus earnings. Is there a way to reduce the cost of QNECs/QMACs? Employers who catch and fix their mistakes early can reduce the cost of correcting a compliance error. For example, no QNEC is required if the correct deferral amount begins for an affected employee by the first payroll after the earlier of 3 months after the failure occurred, or The end of the month following the month in which the employee notified the employer of the failure. Plans that have an automatic enrollment feature have an even longer time to correct errors. No QNEC is required if the correct deferral amount begins for an affected employee by the first payroll after the earlier of 9½ months after the end of the plan year in which the failure occurred, or The end of the month after the month in which the employee notified the employer of the failure. If it has been more than three months but not past the end of the second plan year following the year in which deferrals were missed, a 25% QNEC (reduced from 50%) is sufficient to correct the plan error. The QNEC must include earnings and any missed matching contributions and the correct deferrals must begin by the first payroll after the earlier of: The end of the second plan year following the year the failure occurred, or The end of the month after the month in which the employee notified the employer of the failure. For all these reduced QNEC scenarios, employees must be given a special notice about the correction within 45 days of the start of the correct deferrals. For More Information These rules are complex, and the calculation of the corrective contribution, as well as the deadline to contribute, varies based on the type of mistake being corrected. You can find more information about correcting plan mistakes using QNECs or QMACs on the IRS’s Employee Plans Compliance Resolution System (EPCRS) webpage. And you can contact your Betterment for Business representative to discuss the correction options for your plan. -

![]()

True-Ups: What are they and how are they determined?

You've been funding 401(k) matching contributions, but you just learned you must make an ...

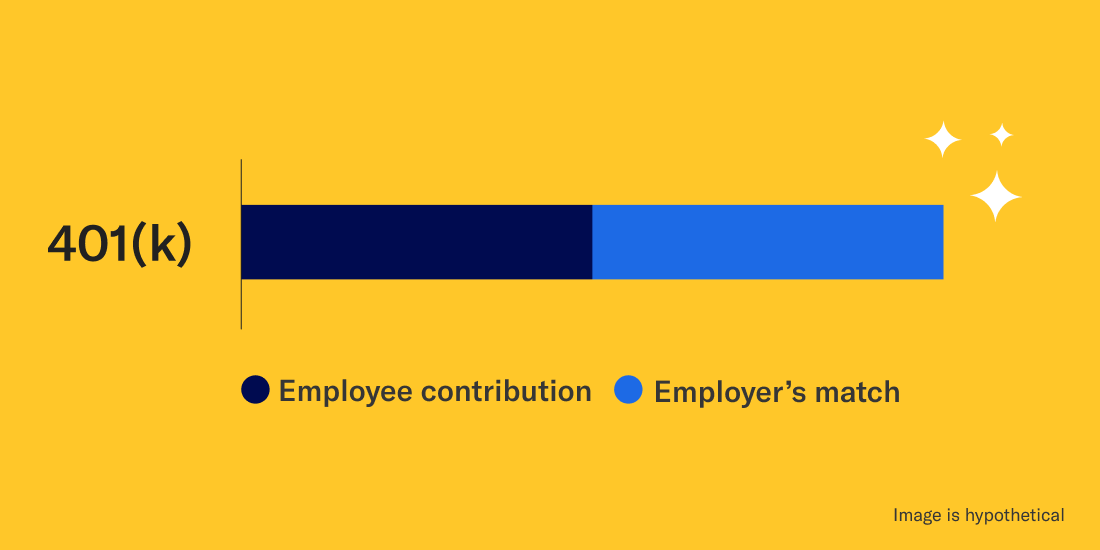

True-Ups: What are they and how are they determined? You've been funding 401(k) matching contributions, but you just learned you must make an additional “true-up” contribution. What does this mean and how was it determined? Employer matching contributions are a great benefit and can help attract and retain employees. It’s not unusual for employers to fund matching contributions each pay period, even though the plan document requires that the matching contribution be calculated on an annualized basis. This means that the matching contribution will need to be calculated both ways (pay period versus annualized) and may result in different matching contribution amounts to certain participants, especially those whose contribution amounts varied throughout the year. For many employers (and payroll systems), the per-pay-period matching contribution method can be easier to administer and help with company cash flow. Employer matching contributions are calculated based on each employee’s earnings and contributions per pay period. However, this method can create problems for employees who max out their 401(k) contributions early, as we will see below. Per-pay-period match: Consistent 401(k) contributions throughout the year Suppose a company matches dollar-for dollar-on the first 4% of pay and pays employees twice a month for a total of 24 pay periods in a year. The per period gross pay of an employee with an annual salary of $120,000, then, is $5,000. If the employee makes a 4% contribution to their 401(k) plan, their $200 per pay period contribution will be matched with $200 from the company. Suppose a company matches dollar-for dollar-on the first 4% of pay and pays employees twice a month for a total of 24 pay periods in a year. The per period gross pay of an employee with an annual salary of $120,000, then, is $5,000. If the employee makes a 4% contribution to their 401(k) plan, their $200 per pay period contribution will be matched with $200 from the company. Per-pay-period matching contribution methodology for $120K employee contributing 4% for full year Employee contribution Employer matching contribution Total Contributions per pay period $200 $200 $400 Full year contributions $4,800 $4,800 $9,600 For the full year, assuming the 401(k) contribution rate remains constant, this employee would contribute a total of $4,800 and receive $4,800 from their employer, for a total of $9,600. Per-pay-period match: Maxing out 401(k) contributions early Employees are often encouraged to optimize their 401(k) benefit by contributing the maximum allowable amount to their plan. Suppose instead that this same employee is enthusiastic about this suggestion and, determined to maximize their 401(k) contribution, elects to contribute 20% of their paycheck to the company’s 401(k) plan. Sounds great, right? At this rate, however, assuming the employee is younger than age 50, the employee would reach the $23,500 annual 401(k) contribution limit (2025 annual limit) during the 19th pay period. Their contributions to the plan would stop, but so too would the employer matching contributions, even though the company had only deposited $3,800 into this employee’s account, — $1,000 less than the amount that would have been received if the employee had spread their contributions throughout the year and received the full matching contribution for every pay period. Per-pay-period matching contribution methodology for $120K employee contributing 20% from beginning of year Employee contribution Employer matching contribution Total Contributions per pay period $1,250 $200 $1,450 Full year contributions $23,500 $3,800 $27,300 Employees who max out too soon on their own contributions are at risk of missing out on the full employer matching contribution amount. This can happen if the contribution rate or compensation (due to bonuses, for instance) varies throughout the year. Numbers above reflect 2025 IRS contribution limits. True-up contributions using annualized matching calculation When the plan document stipulates that the matching contribution calculation will be made on an annualized basis, plans who match each pay period will be required to make an extra calculation after the end of the plan year. The annualized contribution amount is based on each employee’s contributions and compensation throughout the entire plan year. The difference between these annualized calculations and those made on a per-pay-period basis will be the “true-up contributions” required for any employees who maxed out their 401(k) contributions early and therefore missed out on the full company matching contribution. In the example above, the employee would receive a true-up contribution of $1,000 in the following year. Plans with the annualized employer matching contribution requirement (per their plan document) may still make matching contributions each pay period, but during compliance testing, which is based on annual compensation, matching amounts are reviewed and true-ups calculated as needed. The true-up contribution is normally completed within the first two months following the plan year end and before the company’s tax filing deadline. Making true-up contributions means employees won’t have to worry about adjusting their contribution percentages to make sure they don’t max out too early. Employees can front-load their 401(k) contributions and still receive the full matching contribution amount. Often true-up contributions affect senior managers or business owners; hence companies are reluctant to amend their plan to a per-pay-period matching contribution calculation. That said, employers should be prepared to make true-up contributions and not be surprised when they are required. -

![]()

Understanding 401(k) Compensation

Using an incorrect definition of compensation is on the top ten list of mistakes the IRS sees ...

Understanding 401(k) Compensation Using an incorrect definition of compensation is on the top ten list of mistakes the IRS sees in voluntary correction filings. Compensation is used to determine various elements of any 401(k) plan including: Participant elective deferrals Employer contributions Whether the plan satisfies certain nondiscrimination requirements Highly compensated employees (HCEs) for testing purposes The IRS permits a plan to use multiple definitions of compensation for different purposes, but there are rules surrounding which definition can be used when. This is why using an incorrect definition of compensation is on the top ten list of mistakes the IRS sees in voluntary correction filings. General Definition of Plan Compensation There are three safe harbor definitions outlined in IRC Section 415(c)(3) that can be used to define “plan compensation” used to allocate participant contributions. W-2 Definition—Wages reported in box 1 of W2 PLUS the taxable portion of certain insurance premiums and taxable fringe benefits. The 3401(a) Definition–Wages subject to federal income tax withholding at the source PLUS taxable fringe benefits. The 415 Definition–Wages, salaries, and other amounts received for services rendered such as bonuses, and commissions. It also includes items such as taxable medical or disability benefits and other taxable reimbursements. In some contexts, the plan is required to use this definition for purposes of determining HCEs and the maximum permissible contributions. For all of these definitions, pre-tax elective deferrals are included in reported compensation. In addition, it’s important to note the annual cost of living adjustments on compensation as well as contribution limits by the IRS. These will impact the amount of allowable employer and employee contributions. Compensation for Non-Discrimination Testing As defined in IRC Section 414(s), this definition of compensation is primarily used for various nondiscrimination tests. Safe harbor match or safe harbor nonelective plans, for example, must use this definition to bypass the actual deferral percentage (ADP) and the actual contribution percentage (ACP) test. Each of the three 415(c)(3) definitions also satisfy the 414(s) compensation definition of compensation and can be used for non-discrimination testing. However, a 414(s) definition of compensation can include certain modifications that are not permissible where a 415(c)(3) definition is required. It is not uncommon for the 414(s) definition to exclude fringe benefits such as personal use of a company car or moving expenses. Exclusions of certain forms of pay must be clearly stated and identified in the plan document but may trigger additional nondiscrimination testing (known as compensation ratio testing) to make sure non-highly compensated employees are not disproportionately affected. Additional Compensation Definitions Pre-entry or pre-participation Compensation Plans that have a waiting or eligibility period may elect to exclude compensation earned prior to entering the plan from the compensation definition. This may help alleviate some of the financial burden associated with an employer match or profit-sharing contribution. Although such an exclusion would not trigger any compensation discrimination test, a plan that is deemed “top-heavy” (more than 60% of assets belong to key employees) must calculate any required employer contribution using the full year’s worth of compensation. Post-severance Compensation Post severance compensation are amounts that an employee would have been entitled to receive had they remained employed. It usually includes amounts earned but not yet paid at time of termination (bonuses, commissions), payments for unused leave such as vacations or sick days, and any distributions made from a qualified retirement plan. To be considered as post-severance pay eligible and included in the definition of plan compensation, amounts must be paid before the later of the last day of the plan year in which the employee terminated or two and a half months following the date of termination. Taxable Fringe Benefits Non-cash items of value given to the employee, such as the use of a company car for personal use, must be reported as taxable income. A plan can exclude taxable fringe benefits from its compensation definition and therefore not be subject to the compensation ratio test. Bonuses, Commissions, and Overtime These types of payments are considered plan compensation unless specifically excluded in the plan document. Many employers decide to exclude them because they are not regularly recurring, but should be aware that such exclusions will trigger the compensation ratio test. However, such exclusions must be specifically detailed in the plan document. For example, If a company offers a performance bonus, hiring bonus, and holiday bonus but decides to exclude the hiring and holiday bonuses from the definition of plan compensation, then it must be specific, since “bonus” would be too broad and include all types. Reimbursements and Allowances Allowances (amounts received without required documentation) are taxable, while reimbursements for documented and eligible expenses are not taxable. Allowances are therefore included in the definition of plan compensation while reimbursements are not. An allowance is generally considered a taxable fringe benefit so it is reported and follows certain rules above in regards to compensation definitions. International Compensation Tax implications can easily rise when dealing with international workers and compensation. Employers with foreign affiliates that sponsor non-US retirement plans still may be subject to the US withholding and reporting requirements under the Foreign Account Tax Compliance Act (FATCA) to combat tax evasions. Companies with employees who either work outside of the U.S. or who work in the U.S. with certain visas will need to carefully review each employee’s status and 401(k) eligibility. Rules and requirements vary by country. However, when 401(k) eligibility is based on citizenship or visa status, work location and compensation currency is not a factor. Define Plan Compensation Carefully Payroll is often a company’s largest expense, so it’s no surprise that companies devote significant time and energy to develop their compensation strategies. However, companies need to be mindful of the implications of their compensation program. Even simple pay structures do not necessarily translate into simple 401(k) plan definitions of compensation. It’s important to review the plan document carefully to be sure compensation definitions used reflect the desires of the company, that the definitions chosen are accurately applied, and that implications are clearly understood.

All Employer Contributions articles

-

![]()

The Importance and Benefits of Offering Employer Match

The Importance and Benefits of Offering Employer Match Some employees resist saving because they feel retirement is too far away, can’t afford it, or can’t grasp the benefit. You can help change that mentality by offering a 401(k) employer match. A 401(k) does more than attract talent—it can spark real savings habits across your workforce. Still, some employees might hesitate, thinking retirement’s too far off or their budget’s too tight. However, as a 401(k) plan sponsor, you can help change that mentality by offering a 401(k) employer matching contribution. What is a 401(k) employer matching contribution? With an employer match, a portion or all of an employee’s 401(k) plan contribution will be “matched” by the employer. Common matching formulas include: Dollar-for-dollar match: Carla works for ABC Company, which runs payroll on a semi-monthly basis (two times a month = 24 pay periods a year). Her gross pay every period is $2,000. She has decided to defer 4% of her pre-tax pay every pay period, or $80 (4% x $2,000). The ABC Company 401(k) plan generously offers a dollar-for-dollar match up to 4% of compensation deferred. With each payroll, $80 of Carla’s pay goes to her 401(k) account on a pre-tax basis, and ABC Company also makes an $80 matching contribution to Carla’s 401(k) account. At a 4% contribution rate, Carla is maximizing the employer contribution amount. If she reduces her contribution to 3%, her company matching contribution would also drop to 3%; but if she increases her contribution to 6%, the formula dictates that her employer would only contribute 4%. Partial match (simple): Let’s take the same scenario as above, but ABC Company 401(k) plan matches 50% on the first 6% of compensation deferred. This means that it will match half of the 401(k) contributions. If Carla contributes $80 to the 401(k) plan, ABC Company will contribute $40 on top of her contribution as the match. Tiered match: By applying different percentages to multiple tiers, employers can encourage employees to contribute to the plan while controlling their costs. For example, ABC Company could match 100% of deferrals up to 3% of compensation and 50% on the next 3% of deferrals. Carla contributes 4% of her pay of $2,000, which is $80 per pay period. Based on their formula, ABC Company will match her dollar-for-dollar on 3% of her contribution ($60 = 3% x $2,000), and 50 cents on the dollar on the last 1% of her contribution for a total matching contribution of $70 or 3.5%. The plan’s matching formula is chosen by the company and specified in the plan document or may be defined as discretionary, in which case the employer may determine not only whether or not to make a matching contribution in any given year, but also what formula to use. Is there a limit to how much an employer can match? The IRS limits annual 401(k) contributions, and these limits change from year to year. It’s also important to note that the IRS caps annual compensation that’s eligible to be matched. Potential Benefits of Providing an Employer Match Attract talent: In Betterment at Work annual Retirement Readiness Report, 57% of employees said better benefits would entice them to switch jobs. The most appealing benefit? An employer match (55%). What’s more, 75% of employees who have a 401(k) also receive an employer match, underlining the rising importance of this benefit in today’s job market. Boost 401(k) plan participation: Unlike other types of employer contributions, a matching contribution requires employees to contribute their own money to the plan. In fact, 90% of those with a match contribute enough to receive the match. In other words, the existence of the match drives plan participation up, encouraging employee engagement and increasing the likelihood of having your plan pass certain compliance tests. Financial well-being of employees: A matching contribution shows employees that you care about their financial well-being and are willing to make an investment in their future. In fact, 52% of employees said their company showed strong levels of commitment to supporting their financial wellness, compared to just 41% in 2023. Improved retention: An employer match is a valuable part of an employee’s total compensation—one that’s hard to walk away from. And by applying a vesting schedule to the employer match, you can incentivize employees to stay longer with your company to gain the full benefits of the 401(k) plan. Employer tax deduction: Matching contributions are tax deductible, which means you can deduct them from your company’s income so long as they don’t exceed IRS limits. Offering a 401(k) plan is already a huge step forward in helping your employees save for their retirement. Providing a 401(k) matching contribution enhances that benefit for both your employees and your organization. Ready for a better 401(k) solution? Whether you’re considering a matching contribution or not, Betterment is here to help. We offer an all-in-one dashboard that seeks to simplify plan administration, at one of the lowest costs in the industry., Our dedicated onboarding team, and support staff are here to help you along the way. -

![]()

Share the Wealth: Everything you need to know about profit sharing 401(k) plans

Share the Wealth: Everything you need to know about profit sharing 401(k) plans In addition to bonuses, raises, and extra perks, many employers elect to add profit sharing to their 401(k) plan. Read on for answers to frequently asked questions. Has your company had a successful year? A great way to motivate employees to keep up the good work is by sharing the wealth. In addition to bonuses, raises, and extra perks, many employers elect to add profit sharing to their 401(k) plan. Wondering if it might be right for your business? Read on for answers to frequently asked questions about profit sharing 401(k) plans. What is profit sharing? Let’s start with the basics. Profit sharing is a way for you to give extra money to your staff. While you could make direct payments to your employees, it’s very common to combine profit sharing with an employer-sponsored retirement plan. That way, you reward your employees—and help them save for a brighter future. What is a profit sharing plan? A profit sharing plan is a type of defined contribution plan that allows you to help your employees save for retirement. With this type of plan, you make “nonelective contributions” to your employees’ retirement accounts. This means that each year, you can decide how much cash (or company stock, if applicable) to contribute—or whether you want to contribute at all. It’s important to note that the name “profit sharing” comes from a time when these plans were actually tied to the company’s profits. Nowadays, companies have the freedom to contribute what they want, and they don’t have to tie their contributions to the company’s annual profit (or loss). In a pure profit sharing plan, employees do not make their own contributions. However, most companies offer a profit sharing plan in conjunction with a 401(k) plan. What is a profit sharing 401(k) plan? A 401(k) with profit sharing enables both you and your employees to contribute to the plan. Here’s how it works: The 401(k) plan allows employees to make their own salary deferrals up to the IRS limit. The profit sharing component allows employers to contribute up to the IRS limit, noting that the maximum includes the employee's contributions as well. After the end of the year, employers can make their pre-tax profit sharing contribution, as a percentage of each employee’s salary or as a fixed dollar amount Employers determine employee eligibility, set the vesting schedule for the profit sharing contributions, and decide whether employees can select their own investments (or not) What’s the difference between profit sharing and an employer match? Profit sharing and employer matching contributions seem similar, but they’re actually quite different: Employer match—Employer contributions that are tied to employee savings up to a certain percentage of their salary (for example, 50 cents of every dollar saved up to 6% of pay) Profit sharing—An employer has the flexibility to choose how much money—if any at all—to contribute to employees’ accounts each year; the amount is not tied to how much employees save. What kinds of profit sharing plans are there? There are four main types of profit sharing plans: Pro-rata plan—Every plan participant receives employer contributions at the same rate. For example, every employee receives the equivalent of 5% of their salary or every employee receives a flat dollar amount such as $1,000. Why is it good? It’s simple and rewarding. New comparability profit sharing plan (otherwise known as “cross-tested plans”)—Employees are placed into separate benefit groups that receive different profit sharing amounts. For example, business owners (or other highly compensated employees) are in one group that receives the maximum contribution and all other employees are in another group and receive a lower amount. Why is it good? It offers older owners the most flexibility. Minimum Gateway – In order to utilize new comparability, the plan must satisfy the Minimum Gateway Contribution – All non-highly compensated employees (NHCEs) must receive an allocation that is no less than the lesser of 5% of the participant's gross compensation, or 1/3 of the highest contribution rate given to any highly compensated employees (HCEs). General Test – Once the minimum gateway is passed, it must pass the general test which breaks up the plan into “rate groups” based on their Equivalent benefit Accrual Rate (EBAR). Every HCE is in their separate rate group, which includes all participants who have an EBAR equal to or greater than that HCE. If the ratio percentage for each rate group is 70% or higher, the plan passes, and no further testing is necessary. If each rate group does not satisfy the ratio percentage test, then we revert to using the average benefits test. The average benefits test is the more complicated test, and consists of two parts: the nondiscriminatory classification test and the average benefits test. Betterment will always try to make the test pass using the ratio test method first. Permitted disparity—Employees are given a pro-rata base contribution on their entire compensation (up until the IRS limit). In addition, employees who earn more than the integration level, will receive an excess contribution on the amount over that limit. The integration level that provides the highest disparity allowed (5.7%) is the Social Security Taxable Wage Base (SSTWB). Plans that choose to lower the integration amount will receive a reduced disparity limit. Why is it good? It offers younger HCE’s who make more than the SSTWB a greater benefit. Age-weighted profit sharing plan—Employees are given profit sharing contributions based on their retirement age. That is, the older the employee, the higher the contribution. Why is it good? It can help with employee retention. How do I figure out our company’s profit sharing contribution? First, consider which type of profit sharing plan you’ll be using—pro-rata, new comparability, permitted disparity, or age-weighted. Next, take a look at your company’s profits, business outlook, and other financial factors. Keep in mind that: There is no set amount that you have to contribute You don’t need to make contributions Even though it’s called “profit sharing,” you don’t need to show profits on your books to make contributions The IRS notes that the “comp-to-comp” or pro-rata method is one of the most common ways to determine each participant’s allocation. Using this method, you calculate the sum of all of your employees’ compensation (the “total comp”). To determine the profit sharing allocation, divide the profit sharing pool by the total comp. You then multiply this percentage by each employee’s salary. Here’s an example of how it works: Your profit sharing pool is $15,000, and the combined compensation of your three eligible employees is $180,000. Therefore, each employee would receive a contribution equal to 8.3% of their salary. Employee Salary Calculation Profit sharing contribution Taylor $40,000 $15,000 x 8.3% $3,333 Robert $60,000 $15,000 x 8.3% $5,000 Lindsay $80,000 $15,000 x 8.3% $6,667 What are the key benefits of profit sharing for employers? It’s easy to see why profit sharing helps employees, but you may be wondering how it helps your small business. Consider these key benefits: Provide a valuable benefit (while controlling costs)—With employer matching contributions, your costs can dramatically rise if you onboard several new employees. However, with profit sharing, the amount you contribute is entirely up to you. Business is doing well? Contribute more to share the wealth. Business hits a rough spot? Contribute less (or even skip a year). Attract and retain top talent—Profit sharing is a generous perk when recruiting new employees. Plus, you can tweak your profit sharing rules to aid in retention. For example, some employers may elect to have a graded or cliff profit sharing contribution vesting schedule to motivate employees to continue working for their company. Rack up the tax deductions—Profit sharing contributions are tax deductible and not subject to payroll (e.g., FICA) taxes! So if you’re looking to lower your taxable income in a profitable year, your profit sharing plan can help you make the highest possible contribution (and get the highest possible tax write-off). Motivate employees to greater success—Employees who know they’ll receive financial rewards when their company does well are more likely to perform at a higher level. Companies may even link profit sharing to performance goals to motivate employees. What are the rules? The IRS clearly defines rules for contribution limits and calculation rules, tax deduction limits, deadlines, and disclosures (as with any type of 401(k) plan!). Be sure to keep an eye out for any annual changes from the IRS. Are there any downsides to offering a profit sharing plan? Contribution rate flexibility is one of the greatest benefits of a profit sharing 401(k) plan—but it could also be one of its greatest downsides. If business is down one year and employees get a lower profit sharing contribution than they expect, it could have a detrimental impact on morale. However, for many companies, the advantages of a profit sharing 401(k) plan outweigh this risk. How do I set up a profit sharing 401(k) plan? If you already have a 401(k) plan, it requires an amendment to your plan document. However, you’ll want to take the time to think through how your profit sharing plan supports your company’s goals. Betterment can help. At Betterment, we’re here to help with a range of tasks from nondiscrimination testing to plan design consulting to ensure your profit sharing 401(k) plan is working the way your business needs. And as a 3(38) fiduciary, we take full responsibility for selecting and monitoring your investments so you can focus on running your business—not managing your retirement plan. Ready for a better profit sharing 401(k) plan? Get started here. -

![]()

How to decide if you should offer a 401(k) match on student loan payments

How to decide if you should offer a 401(k) match on student loan payments SECURE 2.0 gives 401(k) plan sponsors the option to offer matching contributions on qualified student loan payments. Our three-step process balances the needs of your people, your budget, and your operations to help you as you decide if offering a 401(k) match on student loan payments is right for your company. Step 1: Assess your people’s needs When thinking about your team, it’s important to consider your current employees and future hires. The workforce is evolving and the needs of your employees may evolve as you hire. Your current employee’s needs: You’ll want to review your workforce’s current participation in your 401(k) plan. If you see that enrollment and savings are high, you may not have a need. On the other hand, if you see larger portions of younger graduates not enrolled, student loan matching may be a good fit. If feasible, talk with your employees to better understand their needs. Remember, it’s not always younger employees who are paying student loans. (Tip: If you offer other student loan benefits, like direct reimbursements, look at who is using those benefits and whether or not those employees are also contributing to their 401(k). A 401(k) match on student loan payments may be a good fit if you see a savings problem.) Your future employee’s needs: Your workforce in a few years might look different than your workforce today. Consider the types of employees you want to attract over the coming years. For recent grads, especially when hiring for key roles, this new type of 401(k) match could be a differentiating factor when deciding where to accept a job. Knowing your employee’s needs is crucial to engagement and retention, but next, you’ll need to know how much that will cost. Step 2: Review your budget There are two cost aspects to consider when budgeting for offering a 401(k) match on student loan payments. Matching contributions: You’ll need to review the cost of matching contributions, considering employees whom you previously did not provide with matching contributions. Your goal is to calculate the incremental cost. You may already be budgeting for these potential contributions if you include them in your salary match budget. But it’s important to estimate the actual increase you could see year-over-year in matching contributions. Operational costs: Depending on your 401(k) provider, you may have technology-related costs, although they should be minimal in most cases. Also, consider “soft costs” like employee time used to manage operating processes. With the right technology, these operational costs can be relatively low. The goal of reviewing your budget is to walk away with a confident estimate of the total annual costs of offering the benefit. Knowing that, you can decide whether the cost makes sense. Ultimately, understanding the ROI of the decision is fundamental for your business. That’s why we recommend taking it a step further and calculating the ROI of offering a 401(k) match on student loan payments. Step 3: Understand your operational needs Anything new in business usually comes with process changes. And that’s true if you adopt a 401(k) match on student loan payments. When analyzing how to efficiently manage this new plan feature, consider the following: Automation via technology: Work with your plan’s tech platform to understand their capabilities. Ideally, most of the process will be streamlined for you and your employees. Human intervention: There will most likely be some manual intervention, such as approving qualified student loan payments in order to process the matching contributions. Understanding who on your team will complete these tasks can help create an efficient process and avoid operational issues post-implementation. We recommend mapping out a process as you initially launch a 401(k) match on student loan payments. You’ll be able to train your staff, explain the feature to employees, and make adjustments as needed. -

![]()

The ROI potential of offering a 401(k) match on student loan payments

The ROI potential of offering a 401(k) match on student loan payments Over 20% of employees would consider leaving their jobs for a 401(k) match on their student loan payments. But can you afford to offer the benefit? In a 2022 Betterment survey of over 1,000 employees, we found that student loans are an important issue for many employees. 64% of employees said student loans have had an impact on their ability to save for retirement 21% of employees reported that a 401(k) match on student loan payments would entice them to leave their jobs. Generally, we believe that the more employees who participate in a 401(k) program, the less turnover a company will see. Data from payroll software provider Gusto backs up that belief. They report that employees with a 401(k) plan are 32% less likely to quit in any given month. We see a large opportunity for savvy employers to build stronger 401(k) programs to retain their employees. Adding benefits like a 401(k) match on student loan payments could be a difference maker. But how does an employer know if the costs of offering a 401(k) match on student loan payments is worth it? Let’s dive in and find out. First, some SECURE 2.0 fast facts Before we look at the potential ROI of this new match, let’s cover some fast facts about the provision included in the SECURE 2.0 Act. Effective date: January 1, 2024 401(k) student loan matching: Qualified student loan repayments could count as elective deferrals and qualify for 401(k) matching contributions from their employer. Employees who take advantage of this would be compliance tested separately. How it works: At a high level, there are three things to know. Employees are required to certify that they made loan payments. They do not have to show proof of payments if the employer doesn’t require it. An employer can rely on employee certification alone. Matching contributions must vest on the same schedule as salary deferral matching contributions. Employers can make matching contributions less frequently than salary matches, although contributions must be made at least once a year. Understanding the costs of a 401(k) match on student loan payments First, let's take a wider view of cost. Replacing a single employee may not directly show up on your company’s financial statements, but it's expensive, no matter the company, especially if it happens more than once. One report by SHRM cites employee replacement costs as being six to nine months of an employee’s salary. Another report by Gallup cites one-half to two times the employee's annual salary. Employee replacement costs to consider include: Hard costs: These are straightforward to quantify and include hiring costs like HR staff, technology, and job postings. Once an employee is hired there are also hard costs like onboarding training, new equipment, and processing paperwork. Soft costs: These can be murky to measure but impact every hiring decision. These include the time spent by employees who help with the hiring process, from interviews to position description reviews and onboarding planning. As a new employee joins the company, these costs continue with additional onboarding meetings and lowered productivity as the new team member gets up to speed. Now that you’ve considered the real costs of recruiting and onboarding a new employee (vs. retaining a good team member), we can talk about the cost of this new 401(k) match. Provision implementation costs may include: Participant Fee: If you are using a modern 401(k) tech platform, these costs are minimal often ranging from $5 to $10 per month. You can also consider passing these small costs on to the employee. Nondiscrimination testing: Depending on your 401(k) provider, an increase in participants may result in increases in fees for additional compliance testing. (Note: At Betterment at Work, there are zero additional compliance testing fees if your plan has an increase in participants.) Matching contribution costs: If more employees use the 401(k), contributions may increase, although some companies may have already budgeted for a portion of these in their overall 401(k) match budget. Administrative costs: Tracking self-certifications requires implementing a process. This can be reduced if your company leverages technology to streamline this workflow. There are costs to administering the 401(k) student loan match provision. But compared to losing a talented employee, provision costs may be far less. Think of the match benefit as an investment in talent. Calculating ROI of a 401(k) match on student loan payments It’s important to note that when calculating ROI for your company, you should take into consideration each employee’s unique value and the costs associated with replacing their role. To help illustrate, consider the following hypothetical example of an employee making $75,000 at a company offering a 6% 401(k) match. Estimated replacement costs: $37,500 to $150,000 one-time cost An employee making $75,000 could cost between $37,500 and $150,000 to replace using the benchmark of one-half to two times the employee's annual salary. Estimated 401(k) student loan match costs: $4,620 to $5,000 per year If that employee uses the 401(k) student loan matching program with a 6% match, the employer would pay $4,500 in matching contributions. We’ll add on $120 per year in estimated monthly participant plan fees plus potential administrative costs estimated at a few hundred dollars to process and test this employee’s student loan match. We see that with a full employer match plus administrative fees, we are still not even close to the costs associated with needing to replace the employee. It would take over seven years in 401(k) matching costs to reach the low-end cost of replacing the employee. That’s without considering the value a satisfied, tenured employee brings in workplace production, institutional knowledge, cultural contributions, and more. -

![]()

Plan Design Matters

Plan Design Matters Thoughtful 401(k) plan design can help motivate even reluctant retirement savers to start investing for their future. Designing a 401(k) plan is like building a house. It takes care, attention, and the help of a few skilled professionals to create a plan that works for both you and your employees. In fact, thoughtful plan design can help motivate even reluctant retirement savers to start investing for their future - read more to learn how. How to tailor a 401(k) plan you and your employees will love As you embark on the 401(k) design process, there are many options to consider. In this article, we’ll take you through the most important choices so you can make well-informed decisions. Since certain choices may not be available on the various pricing models of any given provider, make sure you understand your options and the trade-offs you’re making. Let’s get started! 401(k) eligibility When would you like employees to be eligible to participate in the plan? You can opt to have employees become eligible: Immediately – as soon as they begin working for your company After a specific length of service – for example, a period of hours, months, or years of service It’s also customary to have an age requirement (for example, employees must be 18 years or older to participate in the plan). You may also want to consider an “employee class exclusion” to prevent part-time, seasonal, or temporary employees from participating in the plan. Once employees become eligible, they can immediately enroll – or, you can restrict enrollment to a monthly, quarterly, or semi-annual basis. If you have immediate 401(k) eligibility and enrollment, in theory, more employees could participate in the plan. However, if your company has a higher rate of turnover, you may want to consider adding service length requirements to alleviate the unnecessary administrative burden of having to maintain many small accounts of employees who are no longer with your organization. Enrollment Enrollment is another important feature to consider as you structure your plan. You may simply allow employees to enroll on their own, or you can add an automatic enrollment feature. Automatic enrollment (otherwise known as auto-enrollment) allows employers to automatically deduct elective deferrals from employees’ wages unless they elect not to contribute. With automatic enrollment, all employees are enrolled in the plan at a specific contribution rate when they become eligible to participate in the plan. Employees have the freedom to opt out and change their contribution rate and investments at any time. As you can imagine, automatic enrollment can have a significant impact on plan participation. In fact, according to research by The Defined Contribution Institutional Investment Association (DCIIA), automatic enrollment 401(k) plans have participation rates greater than 90%! That’s in stark contrast to the roughly 50% participation rate for plans in which employees must actively opt in. With the passage of SECURE 2.0, auto-enrollment goes into effect on eligible plans on January 1, 2025. Deferrals must be between 3-10%, escalating to 10-15%. Newly auto-enrolled participants have a 90-day window to request their funds back. Many financial experts recommend a retirement savings rate of 10% to 15%, so using a higher automatic enrollment default rate would give employees even more of a head start. Auto-escalation Auto-escalation is an important feature to look out for as you design your plan. It enables employees to increase their contribution rate over time as a way to increase their savings. With auto-escalation, eligible employees will automatically have their contribution rate increased by 1% every year until they reach a maximum cap of 15%. Employees can also choose to set their own contribution rate at any time, at which point they will no longer be enrolled in the auto-escalation feature. For example, if an employee is auto-enrolled at 6% with a 1% auto-escalation rate, and they choose to change their contribution rate to 8%, they will no longer be subject to the 1% increase every year. Compensation You’re permitted to exclude certain types of compensation for plan purposes, including compensation earned prior to plan entry and fringe benefits for purposes of compliance testing and allocating employer contributions. You may choose to define your compensation as: W2 (box 1 wages) plus deferrals – Total taxable wages, tips, prizes, and other compensation 3401(a) wages – All wages taken into account for federal tax withholding purposes, plus the required additions to W-2 wages listed above Section 415 Safe Harbor – All compensation received from the employer which is includible in gross income Employer contributions Want to encourage employees to enroll in the plan? Free money is a great place to start! That’s why more employers are offering profit sharing or matching contributions. Some common employer contributions are: Safe harbor contributions – With the added bonus of being able to avoid certain time-consuming compliance tests, safe harbor contributions often follow one of these formulas: Basic safe harbor match—Employer matches 100% of employee contributions, up to 3% of their compensation, plus 50% of the next 2% of their compensation. Enhanced safe harbor match—The most common employer match formula is 100% of employee contributions, up to 4% of their compensation, but this could vary. Non-elective contribution—Employer contributes at least 3% of each employee’s compensation, regardless of whether they make their own contributions. Discretionary matching contributions – You decide what percentage of employee 401(k) deferrals to match and the maximum percentage of pay to match. For example, you could elect to match 50% of contributions on up to 6% of compensation. One advantage of having a discretionary matching contribution is that you retain the flexibility to adjust the matching rate as your business needs change. Non-elective contributions – Each pay period, you have the option of contributing to your employees’ 401(k) accounts, regardless of whether they contribute. For example, you could make a profit sharing contribution (one type of non-elective contribution) at the end of the year as a percentage of employees’ salaries or as a lump-sum amount. In addition to helping your employees build their retirement nest eggs, employer contributions are also tax deductible (up to 25% of total eligible compensation), so it may cost less than you think. Plus, we believe offering an employer contribution can play a key role in recruiting and retaining top employees. 401(k) vesting If you elect to make an employer contribution, you also need to decide on a vesting schedule (an employee’s own contributions are always 100% vested). Note that all employer contributions made as part of a safe harbor plan are immediately and 100% vested (although QACA plans can be subject to a 2-year cliff). The three main vesting schedules are: Immediate – Employees are immediately vested in (or own) 100% of employer contributions as soon as they receive them. Graded – Vesting takes place in a gradual manner. For example, a six-year graded schedule could have employees vest at a rate of 20% a year until they are fully vested. Cliff – The entire employer contribution becomes 100% vested all at once, after a specific period of time. For example, if you had a three-year cliff vesting schedule and an employee left after two years, they would not be able to take any of the employer contributions (only their own). Like your eligibility and enrollment decisions, vesting can also have an impact on employee participation. Immediate vesting may give employees an added incentive to participate in the plan. On the other hand, a longer vesting schedule could encourage employees to remain at your company for a longer time. Service counting method If you decide to use length of service to determine your eligibility and vesting schedules, you must also decide how to measure it. Typically, you may use: Elapsed time – Period of service as long as employee is employed at the end of period Actual hours – Actual hours worked. With this method, you’ll need to track and report employee hours Actual hours/equivalency – A formula that credits employees with set number of hours per pay period (for example, monthly = 190 hours) 401(k) withdrawals and loans Naturally, there will be times when your employees need to withdraw money from their retirement accounts. Your plan design will have rules outlining the withdrawal parameters for: Termination In-service withdrawals (at attainment of age 59 ½; rollovers at any time) Hardships Qualified Domestic Relations Orders (QDROs) Required Minimum Distributions (RMDs) Plus, you’ll have to decide whether to allow participants to take 401(k) plan loans (and the maximum amount of the loan). While loans have the potential to derail employees’ retirement dreams, having a loan provision means employees can access their money if they need it and employees can pay themselves back plus interest. If employees are reluctant to participate because they’re afraid their savings will be “locked up,” then a loan provision can help alleviate that fear. Investment options When it comes to investment methodology, there are many strategies to consider. Your plan provider can help guide you through the choices and associated fees. For example, at Betterment, we believe that our expert-built ETF portfolios offer investors significant diversification and flexibility at a low cost. Plus, we offer ETFs in conjunction with personalized advice to help today’s retirement savers pursue their goals. Get help from the experts Your 401(k) plan provider can walk you through your plan design choices and help you tailor a plan that works for your company and your employees. Once you’ve settled on your plan design, you will need to codify those features in the form of a formal plan document to govern your 401(k) plan. At Betterment, we draft the plan document for you and provide it to you for review and final approval. Your business is likely to evolve—and your plan design can evolve, too. Drastic increase in profits? Consider adding an employer match or profit sharing contribution to share the wealth. Plan participation stagnating? Consider adding an automatic enrollment feature to get more employees involved. Employees concerned about access to their money in an uncertain world? Consider adding a 401(k) loan feature. Need a little help figuring out your plan design? Talk to Betterment. Our experts make it easy for you to offer your employees a better 401(k) —at one of the lowest costs in the industry. -

![]()

All About Vesting of Employer Contributions

All About Vesting of Employer Contributions Employers have flexibility in defining their plan’s vesting schedule, which can be an important employee retention tool. Regardless of age, employees (as well as job seekers), are thinking about saving for their future. 401(k) plans, therefore, are a very attractive benefit and can be an important competitive tool in helping employers attract and retain talent. And when a company sweetens the 401(k) plan with a matching or profit sharing contribution, that’s like “free money” that can be hard for prospective and current employees to pass up. But with employer contributions comes the concept of “vesting,” which both employees and employers should understand. What is Vesting? With respect to retirement plans, “vesting” simply means ownership. In other words, each employee will vest, or own, a portion or all of their account in the plan based on the plan’s vesting schedule. All 401(k) contributions that an employee makes to the plan, including pre-tax and/or Roth contributions made through payroll deduction, are immediately 100% vested. Those contributions were money earned by the employee as compensation, and so they are owned by the employee immediately and completely. Employer contributions made to the plan, however, usually vest according to a plan-specific schedule (called a vesting schedule) which may require the employee to work a certain period of time to be fully vested or “own” those funds. Often ownership in employer contributions is made gradually over a number of years, which can be an effective retention tool by encouraging employees to stay long enough to vest in 100% of their employer contributions. What is a 401(k) Vesting Schedule? The 401(k) vesting schedule is the set of rules outlining how much and when employees are entitled to (some or all of) the employer contributions made to their accounts. Typically, the more years of service, the higher the vesting percentage. Different Types of 401(k) Vesting Schedules Employers have flexibility in determining the type and length of vesting schedule. The three types of vesting are: Immediate Vesting - This is very straight-forward in that the employee is immediately vested (or owns) 100% of employer contributions from the point of receipt. In this case, employees are not required to work a certain number of years to claim ownership of the employer contribution. An employee who was hired in the beginning of the month and received an employer matching contribution in his 401(k) account at the end of the month could leave the company the next day, along with the total amount in his account (employee plus employer contributions). Graded Vesting Schedule - Probably the most common schedule, vesting takes place in a gradual manner. At least 20% of the employer contributions must vest after two years of service and 100% vesting can be achieved after anywhere from two to six years to achieve 100% vesting. Popular graded vesting schedules include: 3-Year Graded 4-Year Graded 5-Year Graded 6-Year Graded Yrs of Service % Vested % Vested % Vested % Vested 0 - 1 33% 25% 20% 0% 1 - 2 66% 50% 40% 20% 2 - 3 100% 75% 60% 40% 3 - 4 100% 80% 60% 4 - 5 100% 80% 5 - 6 100% Cliff Vesting Schedule - With a cliff vesting schedule, the entire employer contribution becomes 100% vested all at once, after a specific period of time. For example, if the company has a 3 year cliff vesting schedule and an employee leaves for a new job after two years, the employee would only be able to take the contributions they made to their 401(k) account; they wouldn’t have any ownership rights to any employer contributions that had been made on their behalf. The maximum number of years for a cliff schedule is 3 years. Popular cliff vesting schedules include: 2-Year Cliff 3-Year Cliff Yrs of Service % Vested % Vested 0 - 1 0% 0% 1 - 2 100% 0% 2 - 3 100% Frequently Asked Questions about Vesting What is a typical vesting schedule? Vesting schedules can vary for every plan. However, the most common type of vesting schedule is the graded schedule, where the employee will gradually vest over time depending on the years of service required. Can we change our plan’s vesting schedule in the future? Yes, with a word of caution. In order to apply to all employees, the vesting schedule can change only to one that is equally or more generous than the existing vesting schedule. Known as the anti-cutback rule, this prevents plan sponsors from taking away benefits that have already accrued to employees. For example, if a plan has a 4-year graded vesting schedule, it could not be amended to a 5- or 6-year graded vesting schedule (unless the plan is willing to maintain separate vesting schedules for new hires versus existing employees). The same plan could, however, amend its vesting schedule to a 3-year graded one, since the new benefit would be more generous than the previous one. Since my plan doesn't currently offer employer contributions, I don't need to worry about defining a vesting schedule, right? Whether or not your organization plans on making 401(k) employer contributions, for maximum flexibility, we recommend that all plans include provisions for discretionary employer contributions and a more restrictive vesting formula. The discretionary provision in no way obligates the employer to make contributions (the employer could decide each year whether to contribute or not, and how much). In addition, having a restrictive vesting schedule means that the vesting schedule could be amended easily in the future. When does a vesting period begin? Usually, a vesting period begins when an employee is hired so that even if the 401(k) plan is established years after an employee has started working at the company, all of the year(s) of service prior to the plan’s establishment will be counted towards their vesting. However, this is not always the case. The plan document may have been written such that the vesting period starts only after the plan has been in effect. This means that if an employee was hired prior to a 401(k) plan being established, the year(s) of service prior to the plan’s effective date will not be counted. What are the methods of counting service for vesting? Service for vesting can be calculated in two ways: hours of service or elapsed time. With the hours of service method, an employer can define 1,000 hours of service as a year of service so that an employee can earn a year of vesting service in as little as five or six months (assuming 190 hours worked per month). The employer must be diligent in tracking the hours worked to make sure vesting is calculated correctly for each employee and to avoid over-forfeiting or over-distributing employer contributions. The challenges of tracking hours of service often lead employers to favor the elapsed time method. With this method, a year of vesting is calculated based on years from the employee’s date of hire. If an employee is still active 12 months from their date of hire, then they will be credited with one year of service toward vesting, regardless of the hours or days worked at the company. If there is an eligibility requirement to be a part of the plan, does vesting start after an employee becomes an eligible participant in the plan? Typically, no, but it is dependent on what has been written into the plan document. As stated previously, the vesting clock usually starts ticking when the employee is hired. An employee may not be able to join the plan because there’s a separate eligibility requirement that must be met (for example, 6 months of service), but the eligibility computation period is completely separate from the vesting period. The only instance where an ineligible participant may not start vesting from their date of hire is if the plan document excludes years of service of an employee who has not reached the age of 18. How long does an employer have to deposit employer contributions to the 401(k) plan? This is dependent on how the plan document is written. If the plan document is written for employer contributions to be made every pay period, then the plan sponsor must follow their fiduciary duty to make sure that the employer contribution is made on time. If the plan document is written so that the contribution can be made on an annual basis, then the employer can wait until the end of the year ( or even until the plan goes through their annual compliance testing) to wait for the contribution calculations to be received from their provider. What happens to an employer contribution that is not vested? If an employee leaves the company before they are fully vested, then the unvested portion (including associated earnings) will be “forfeited” and returned to the employer’s plan cash account, which can be used to fund future employer contributions or pay for plan expenses. For example, if a 401(k) plan has a 6-year graded vesting schedule and an employee terminates service after only 5 years, 80% of the employer contribution will belong to the employee, and the remaining 20% will be sent back to the employer when the employee initiates a distribution of their account. -

![]()

What Employers Should Know About Timing of 401(k) Contributions

What Employers Should Know About Timing of 401(k) Contributions One of the most important aspects of plan administration is making sure money is deposited in a timely manner—to ensure that employer contributions are tax-deductible and employee contributions are in compliance. Timing of employee 401(k) contributions (including loan repayments) When must employee contributions and loan repayments be withheld from payroll? This is a top audit issue for 401(k) plans, and requires a consistent approach by all team members handling payroll submission. If a plan is considered a ‘small plan filer’ (typically under 100 eligible employees), the Department of Labor is more lenient and provides a 7-business day ‘safe harbor’ allowing employee contributions and loan repayments to be submitted within 7 business days of the pay date for which they were deducted. If a plan is larger (>100 eligible employees), the safe harbor does not apply, and the timeliness is based on the earliest date a plan sponsor can reasonably segregate employee contributions from company assets. Historically, plans leaned on the outer bounds of the requirement (by the 15th business day of the month following the date of the deduction effective date), but today with online submissions and funding via ACH, a company would generally be hard-pressed to show that any deposit beyond a few days is considered reasonable. To ensure timely deposits, it’s imperative for plan sponsors to review their internal processes regularly. All relevant team members -- including those who may have to handle the process infrequently due to vacations or otherwise -- understand the 401(k) deposit process completely and have the necessary access. I am a self-employed business owner with income determined after year-end. When must my 401(k) contributions be submitted to be considered timely? If an owner or partner of a company does not receive a W-2 from the business, and determines their self-employment income after year-end, their 401(k) contribution should be made as soon as possible after their net income is determined, but certainly no later than the individual tax filing deadline. Their 401(k) election should be made (electronically or in writing) by the end of the year reflecting a percentage of their net income from self employment. Note that if they elect to make a flat dollar 401(k) contribution, and their net income is expected to exceed that amount, the deposit is due no later than the end of the year. Timing of employer 401(k) contributions We calculate and fund our match / safe harbor contributions every pay period. How quickly must those be deposited? Generally, there’s no timing requirement throughout the year for employer matching or safe harbor contributions. The employer may choose to pre-fund these amounts every pay period, enabling employees to see the value provided throughout the year and to benefit from compound interest. Note that plans that opt to allocate safe harbor matching contributions every pay period are required to fund this at least quarterly. When do we have to deposit employer contributions for year-end (e.g., true-up match or safe harbor deposits, employer profit sharing)? Employer contributions for the year are due in full by the company tax filing deadline, including any applicable extension. Safe harbor contributions have a mandatory funding deadline of 12 months after the end of the plan year for which they are due; typically for deductibility purposes, they are deposited even sooner.