The retirement readiness Annual report Level-up your benefits with 4 must-read insights

We surveyed 1,000 full-time employees to discover the most pressing concerns for today’s workforce. After years of navigating pandemic-era challenges and inflation, most employees are starting to feel more confident about saving for retirement (72%). And yet, anxiety about day-to-day finances is on the rise (89%). Now’s the time for employers to go back to basics, and offer strong financial benefits to support and build a loyal workforce. Read on to learn more.

Unlock all of the findings in our latest report

Insight #1 Employees are optimistic for tomorrow, but struggling today

The most concerning theme we found: Even though more employees are saving more money in their 401(k)s, they're dipping into retirement savings more often than before—especially younger workers.

-

6 in 10 experience significant anxiety over their daily finances.

6 in 10 experience significant anxiety over their daily finances. -

5 in 10 have dipped into retirement accounts for emergencies, showing a worrying trend toward using long-term savings for short-term needs.

5 in 10 have dipped into retirement accounts for emergencies, showing a worrying trend toward using long-term savings for short-term needs. -

4 in 10 are managing student debt, with 68% reporting moderate to severe anxiety because of it.

4 in 10 are managing student debt, with 68% reporting moderate to severe anxiety because of it. -

9 in 10 with student loans say resuming payments impacts their ability to save for retirement.

9 in 10 with student loans say resuming payments impacts their ability to save for retirement.

Insight #2 401(k) match is the new black

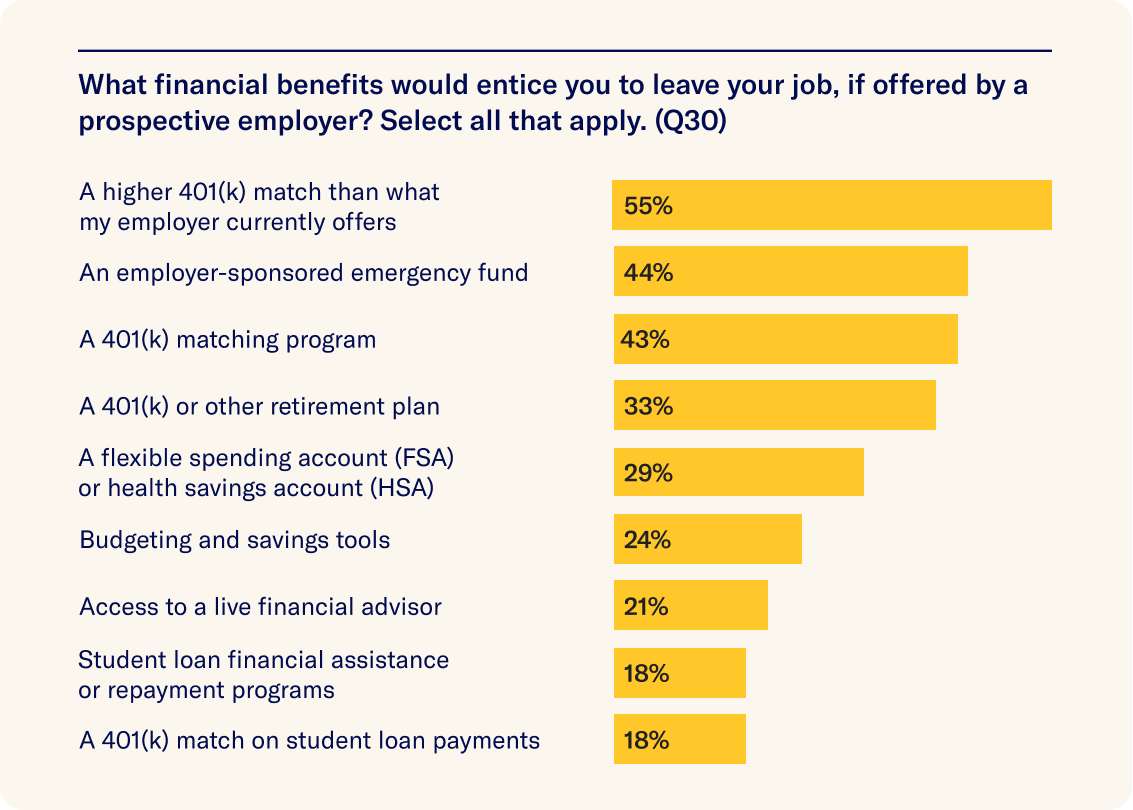

New SECURE 2.0 legislation has allowed more companies to offer financial benefits, making it harder for businesses to stand out in a competitive job market. It’s no surprise that a 401(k) match tops employee’ list of most-desired benefits.

75% of employees with a 401(k) receive an employer match, up from 68% in 2023 and 62% in 2022. Unsurprisingly, 401(k) has climbed to the top of employees' wish lists this year.

Insight #3 Small businesses have a big opportunity

Employees are increasingly looking to their employers for support, as they navigate a shifting economic landscape. While 79% of employers now offer a 401(k), that number drops to 67% for small businesses, highlighting a key opportunity for these employers.

-

46% of small business employees feel their employers are committed to supporting their financial wellbeing—compared to 55% of employees at midsize and large companies.

46% of small business employees feel their employers are committed to supporting their financial wellbeing—compared to 55% of employees at midsize and large companies. -

57% of employees said better benefits could entice them to switch jobs. This jumps to 61% among small business employees.

57% of employees said better benefits could entice them to switch jobs. This jumps to 61% among small business employees.

Small business employees want to see more commitment from their employers when it comes to financial wellness, and they would be most likely to jump ship to an employer with better financial benefits. These insights spotlight a crucial opportunity for small businesses to fortify the loyalty and focus of their teams by elevating their financial wellness packages, starting with the benefits workers want most.”

Edward Gottfried

Senior Director of Product Management Betterment at Work

Senior Director of Product Management Betterment at Work

Insight #4 It’s time to engage and educate

Even as the job market returns to normalcy following years of instability, financial anxiety persists. Employees have come to rely on employers for support, building emergency savings and navigating financial decisions.

-

63% of employees have an emergency fund—a significant increase rom 52% in 2023.

63% of employees have an emergency fund—a significant increase rom 52% in 2023. -

54% of employees tapped into their retirement accounts for emergencies, indicating a lack of emergency savings and/or education around the ramifications of 401(k) early withdrawals.

54% of employees tapped into their retirement accounts for emergencies, indicating a lack of emergency savings and/or education around the ramifications of 401(k) early withdrawals. -

37% of employees believe employers should provide education about emergency fund saving, as it is critical to financial wellness.

37% of employees believe employers should provide education about emergency fund saving, as it is critical to financial wellness.

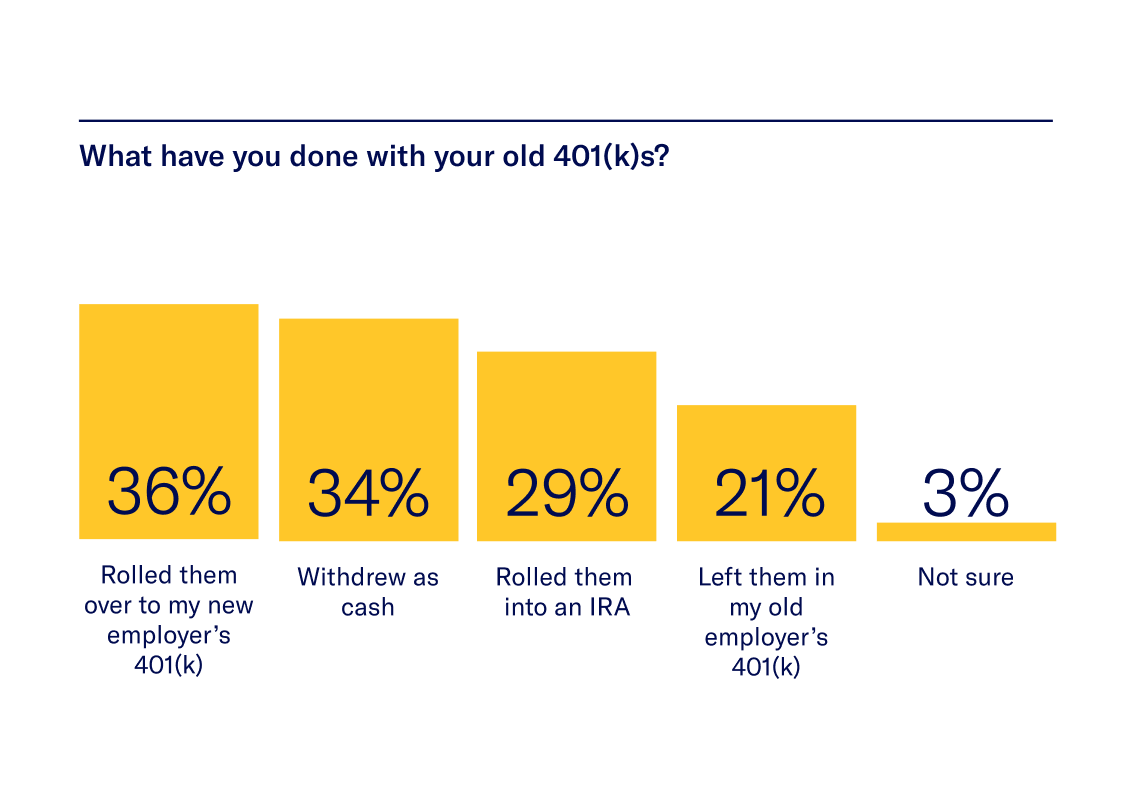

When it comes to retirement planning, one thing is clear: Knowledge gaps persist. Almost a third of employees (28%) cannot access their old 401(k)s, while 34% cashed out their retirement savings when changing jobs (instead of rolling them over into new plans). Unsurprisingly, a majority of employees (64%) want more proactive communication and education about their financial benefits.