Why Adding 529s to Your Financial Benefits Can Appeal to Working Parents

529s can help your employees maximize money put aside for education

Offering a better benefits package starts with a simple idea: your employees have diverse and ever-changing needs:

- Retirement may be their end goal, but there may be more pressing needs.

- Some of your staff might be striving to pay off their student loans.

- Others may need help saving for education.

With Betterment at Work, it’s possible to help them with all three goals in one place.

Let's take a closer look at 529 plans, an appealing benefit for working parents that helps them maximize money set aside for educational expenses.

529s help combat the steep cost of college

The average cost of 4-year college tuition and fees has more than tripled since 1980. So it’s no wonder paying for kids’ education is a top concern among parents.

529s are special investing accounts that can help, and they’re growing in popularity. The number of 529s opened has increased by 55% since 2009.

Funds in a 529 both grow and can be used tax-free for qualified expenses—things like tuition and fees, books and supplies, and even some room and board. You can even use them for up to $10,000 per year in K-12 tuition in all but a few states.

Other benefits include a high balance limit—between $235,000 and $550,000 depending on the state—and low-maintenance investment options that automatically adjust risk as the beneficiary nears college age.

Betterment at Work streamlines the 529 experience

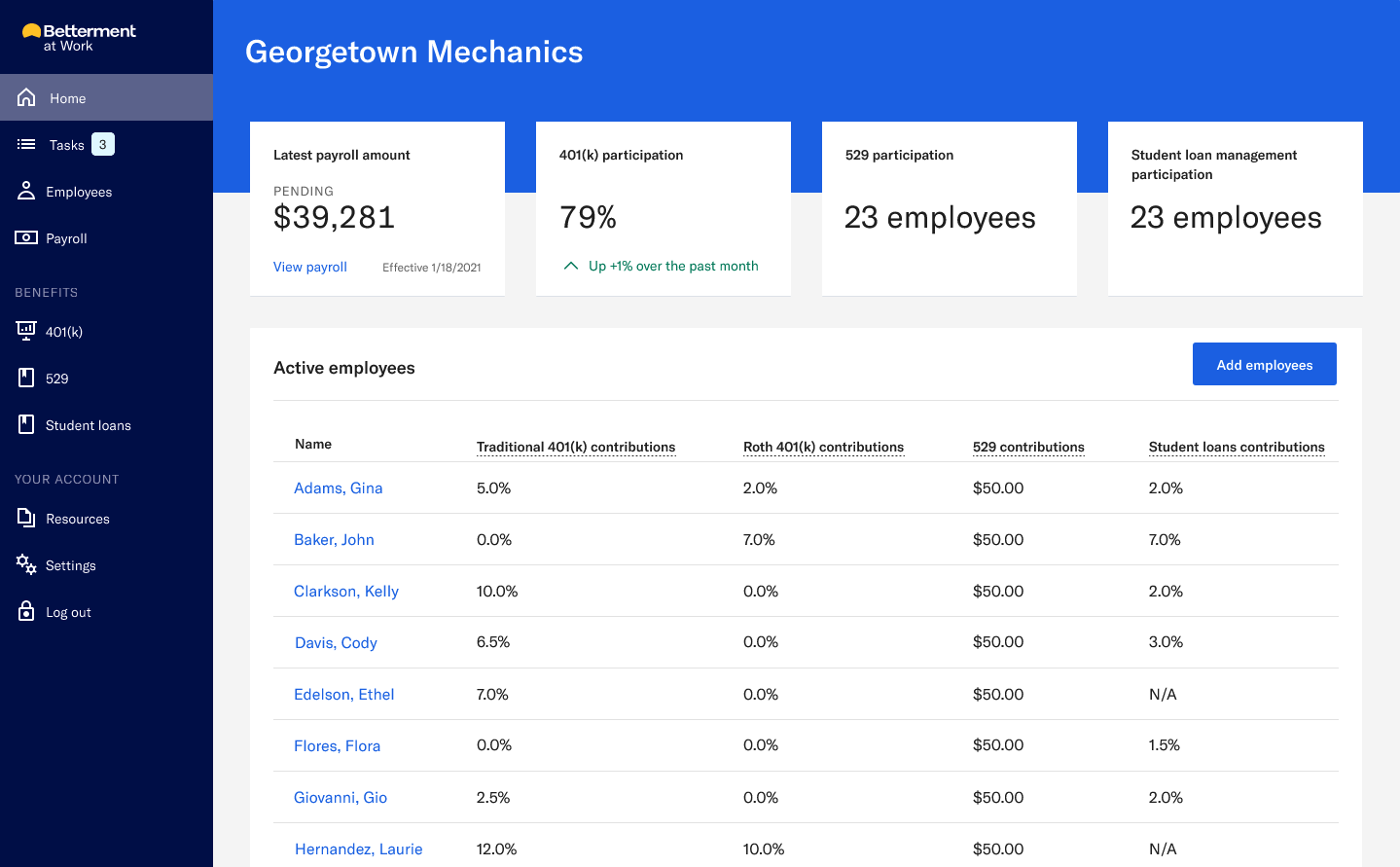

By offering your employees access to 529s through Betterment at Work, you add a unique benefit without adding another benefits provider.

Manage your 529 offering right alongside your 401(k) and you can even offer an employer match, just like a 401(k).

Just as importantly, your employees get a simple way to sign up for this savings tool. 529s can be a pain to shop for on your own, with nearly every state offering a plan open to anyone. The quality of those plans—everything from investment options and fees to website interfaces—can vary widely.

Betterment at Work simplifies things. Employees can compare and select plans all within the Betterment app, and with integrated plans, they can automatically fund their 529 through payroll deductions. They can also see their 529 savings right alongside their 401(k) and connected student loans.

529s are available through our Pro and Flagship plans. Learn more or get started today.